Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

Ethereum price today: $2,120

- Ethereum investors have booked more than $1.5 billion in losses over the past seven days.

- Retail investors and whales are distributing heavily as prices have plunged below their average cost basis.

- ETH could fall to $1,730 if it loses the $2,100 support level.

Ethereum (ETH) extended its decline on Wednesday, dropping more than 5% over the past 24 hours toward the $2,100 level, which is below the $2,310 average cost basis or realized price of investors, according to CryptoQuant's data.

Historically, the realized price serves as a support level during market downturns. However, a sustained move below it often leads to increased fear and capitulation, as evidenced by the more than $1.5 billion losses investors booked over the past week, per Santiment data.

A similar sentiment is visible across wallets of different sizes — from whales to retailers — with prices now also below their average cost basis. Retailers (100-1000 ETH and 1000-10000 ETH) intensified distribution, offloading more than 600K ETH over the past seven days.

-1770246416101-1770246416107.png)

The decline is heavily affecting whales with leveraged borrowed ETH positions, many of whom are ramping up selling to avoid liquidation. Trend Research, which held a levered ETH position worth over $1 billion, has deposited 316,185 ETH (worth about $738 million) into Binance over the past three days for potential sale, according to data cited by smart money tracker Lookonchain.

Ethereum treasury firm Bitmine Immersion (BMNR) is another key whale that has been underwater following the sustained decline in ETH's price. The firm is sitting on unrealized losses of about $7 billion on its 4.28 million ETH holdings as of Wednesday, per Lookonchain.

The huge losses have sparked debates across the crypto community, with one post claiming Bitmine will eventually sell its holdings, putting a future ceiling on ETH's price.

Bitmine Chairman Thomas Lee responded, claiming that such views "miss the point of an Ethereum treasury." He clarified that Bitmine is meant to track ETH's price and outperform it over the market cycle.

Lee added that "unrealized losses" are a feature, not a bug, citing index exchange-traded funds (ETFs) that suffer losses during market downturns.

With losses seen across the board for most investors, it's important to note that a crypto asset trading below its realized price is also considered an accumulation zone by smart money investors who often enter the market after sellers have been exhausted.

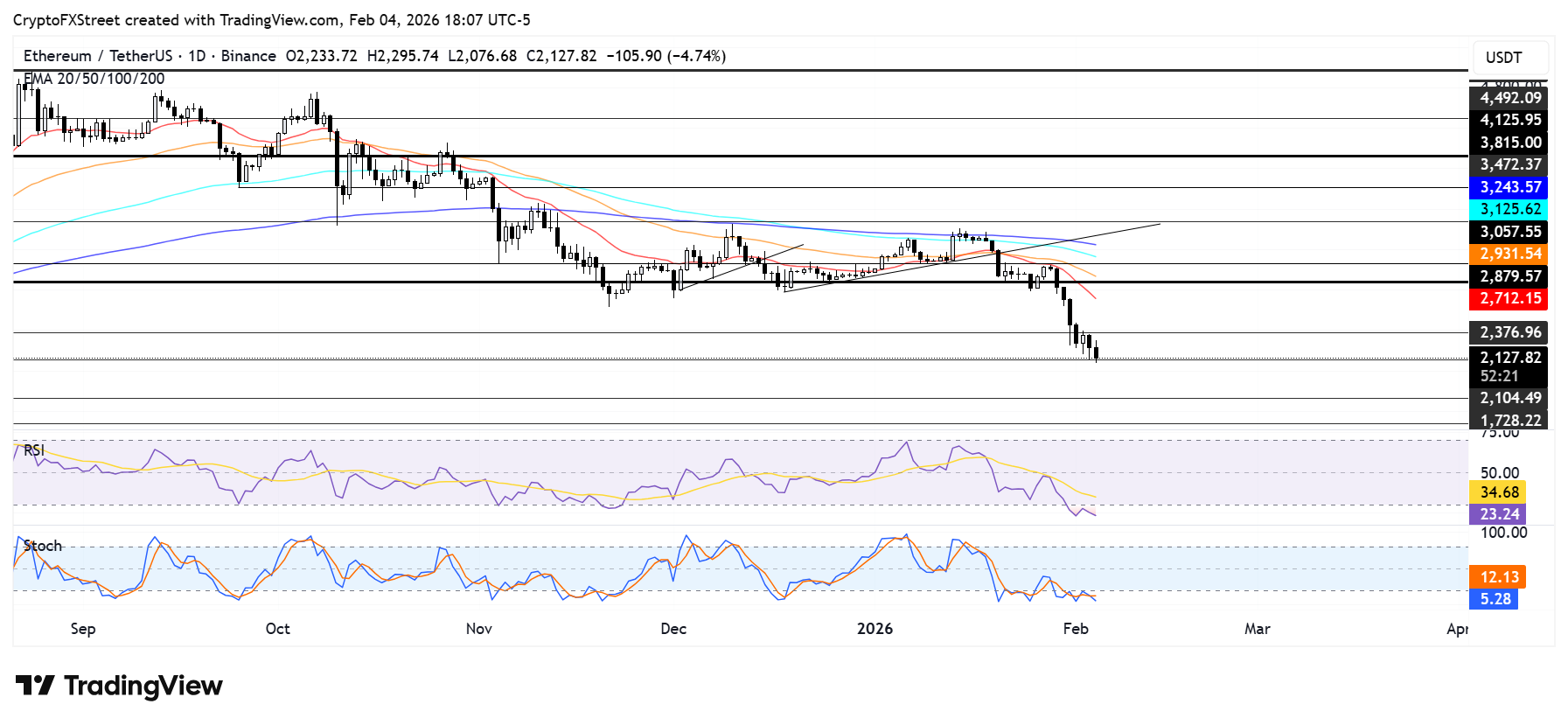

Ethereum Price Forecast: ETH retests $2,100 after rejection near $2,380

Ethereum has seen $228.5 million in futures liquidations over the past 24 hours, driven by $137.2 million in long liquidations, per Coinglass data.

ETH is testing the $2,100 support level for a second consecutive day after seeing a rejection at the resistance near $2,380. A decline below the support could push ETH toward $1,730.

On the upside, ETH must rise above the 20-, 50-, 100-, and 200-day Exponential Moving Averages (EMAs) to resume an uptrend.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are hovering in their oversold regions, indicating a strong bearish momentum.