Pi Core Team Moves Over 500 Million Pi in Early February as Token Falls More Than 94%

Nearly a full year has passed since Pi opened its network and was listed on exchanges. However, Pi’s price performance has disappointed many Pioneers, as the token has dropped around 94% from its all-time high. Recent activity suggests the Pi Core Team may be rolling out new plans to strengthen the ecosystem.

At the same time, heavy unlock pressure is raising concerns that the downtrend could worsen.

Pi Core Team Moves Over 500 Million Pi in Early February

Wallet addresses labeled by Piscan — a Pi Network data tracking platform — as belonging to the Pi Core Team recorded several large transactions in the first days of February. This activity came as Pi’s price fell about 25% year to date, trading near $0.16.

One major transaction involved the PI Foundation 1 wallet moving 500 million Pi, worth more than $80 million. The wallet did not transfer Pi to exchanges. Instead, the funds were sent to another internal wallet also labeled as PI Foundation 1.

The move followed an announcement from the Pi Core Team stating that more than 16 million Pioneers have completed Mainnet migration. Around 2.5 million Pioneers who were previously blocked due to security checks have now been unblocked and can migrate.

The team also announced that over the next few weeks, more than 700,000 Pioneers will gain access to apply for KYC. In addition, a reward distribution system for KYC validators is currently being tested. Deployment is expected by the end of March 2026.

Many Pioneers believe the team’s on-chain transfers are preparations for upcoming plans.

“These updates reflect ongoing efforts to expand access to KYC and Mainnet migration, enabling broader participation in Pi’s ecosystem,” Pi Network stated.

On the positive side, more Pioneers completing Mainnet migration could make the Pi ecosystem more active and boost demand. However, it may also test long-term investor confidence, pushing holders to decide whether to sell or continue holding.

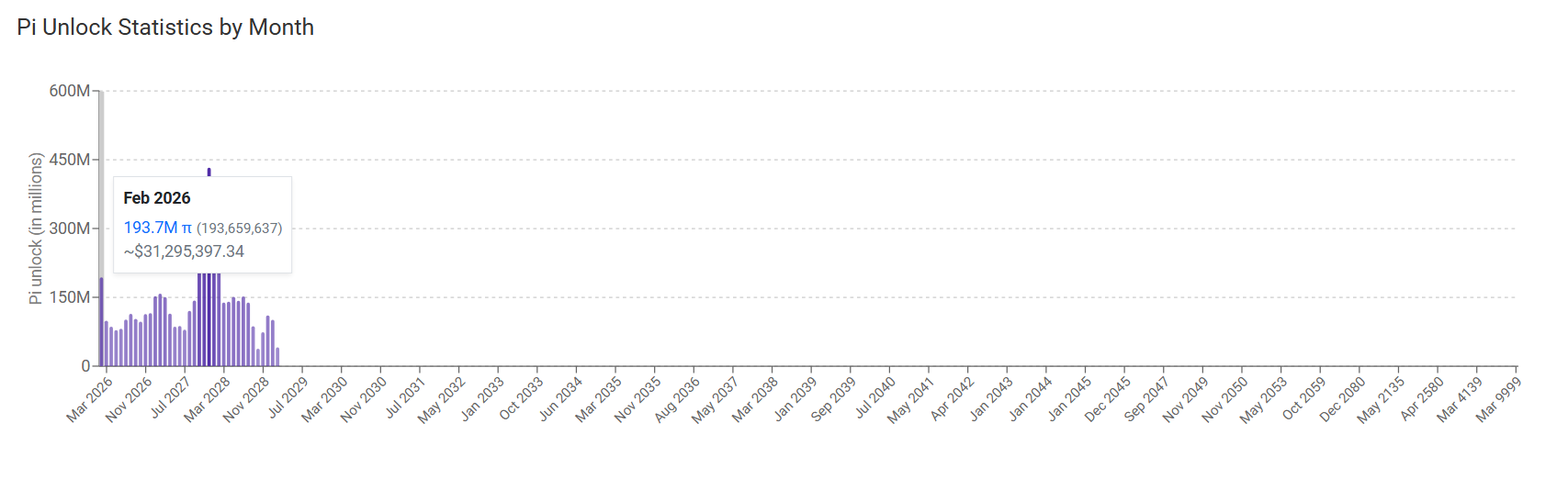

More Than 193 Million Pi to Unlock in February

Piscan data shows that more than 193 million Pi will unlock in February, worth over $31 million. This is the largest unlock amount scheduled for the period from now to October 2027.

Pi Unlock Statistics by Month. Source: Piscan

Pi Unlock Statistics by Month. Source: Piscan

On average, the next 30 days will see more than 7 million Pi unlocked per day, equivalent to around $1.1 million.

A recent BeInCrypto report noted that Pi’s trading volume on exchanges has dropped sharply. Daily volume remains weak, showing no improvement and staying below $20 million. Low volume combined with heavy unlock pressure creates a negative mix that continues to weigh on price.

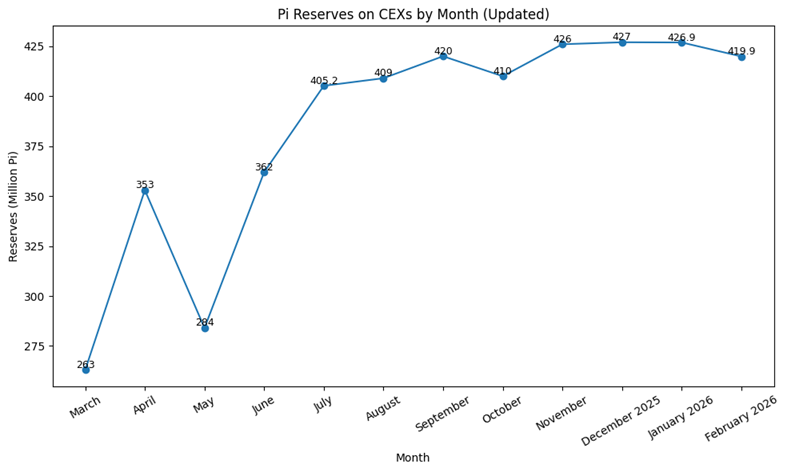

However, early February has shown some signs of demand returning. Exchange balance data compiled by Piscan indicates that Pi reserves on exchanges have started to decline after months of staying elevated.

Pi Reserves on CEXs by Month. Source: Pisan

Pi Reserves on CEXs by Month. Source: Pisan

Pi exchange balances currently stand at around 419.9 million Pi, down from 427 million Pi last month. While the decline is still modest, it suggests that early accumulation may be underway as prices remain low.

BeInCrypto’s latest analysis suggests positive sentiment could return. February is seen as the anniversary month of Pi Network’s exchange debut. Investors are also looking ahead to Pi Day in March.