Bitcoin Price Forecast: BTC steadies as bears shift focus toward $70,000

- Bitcoin trades above $76,000 on Wednesday, after hitting levels not seen since early November 2024 the previous day.

- Derivatives traders remain defensive, with the BTC futures premium holding steady around 6.3%, signaling reluctance to take on risk.

- Famous trader Michael Burry warned that BTC’s ongoing decline could destroy significant value, especially for companies holding large BTC reserves.

Bitcoin (BTC) price recovers slightly, trading above $76,000 at the time of writing on Wednesday, after reaching levels not seen since early November 2024 the previous day. The broader crypto market sentiment remains fragile, with derivatives traders staying defensive, signaling a hands-off approach amid a challenging environment of relative weakness. Traders should be cautious, despite a short-term recovery, as BTC’s long-term trend remains bearish, with bears targeting $70,000.

US-Iran tensions escalate as an Iranian drone is shot down

Bitcoin price remains under pressure so far this week, with the Crypto King slipping below $73,000 on Tuesday for the first time since November 2024. The price dip in BTC was fueled as the news came in late Tuesday that the US military shot down an Iranian drone that “aggressively” approached the USS Abraham Lincoln aircraft carrier in the Arabian Sea.

“The incident occurred as tensions in the Middle East are high, with President Donald Trump weighing potential military strikes against the Islamic Republic,” reported CNBC.

These developments have reduced investors’ risk appetite, despite President Trump’s special envoy, Steve Witkoff, is scheduled to meet with Iranian officials later this week.

Following Tuesday’s incident, Iran has insisted that the talks take place in Oman rather than Turkey and that the scope be limited to two-way conversations on the nuclear issue only, complicating an already delicate diplomatic effort.

Market participants are closely monitoring developments in the US–Iran negotiations, as any signs of rising geopolitical tensions could trigger deeper corrections toward the riskier assets such as BTC.

Derivatives traders remain defensive

The K33 Research reported on Tuesday that Bitcoin traders on the Chicago Mercantile Exchange (CME) have remained defensive for months.

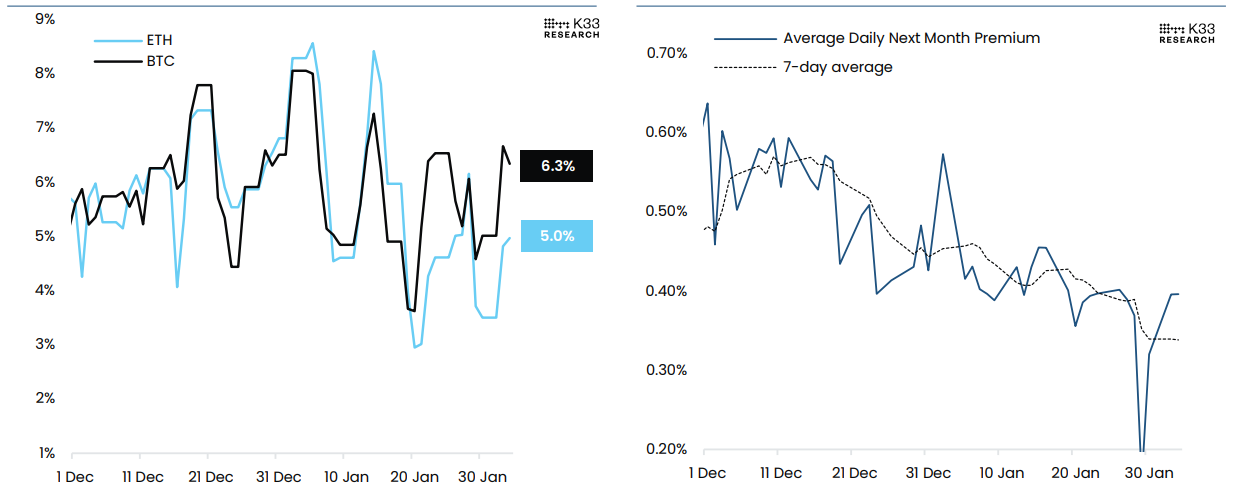

The chart (left) below shows that the annualized BTC futures premium was holding steady at 6.3% on Tuesday, consistent with premiums observed over the past three months, signaling that traders remain largely hands-off amid the dicey environment of relative weakness. In addition, while futures premiums have been stable, the term structure continues to trend lower, with CME’s 7-day (right chart) average next-month premium currently at lows not seen since the US banking crisis of March 2023, pointing toward considerable reluctance to add calendar risk.

Vetle Lunde, Head of Research at K33 Research, noted that, “BTC is currently trading at a crucial area, near the March 2024 all-time high and the April 2025 support zone. If prices fall below this range, we are prepared to trim risk, as we would then anticipate downside momentum to accelerate.”

Lunde further explained that Monday offered a few promising flashes in favor of a forming bottom. Trade volumes moved into the 90th percentile, and the perp regime flashed an even rarer extreme signal associated with past market lows, with leverage obliterated as yields turned deeply negative.

“Still, both metrics offer limited reliability in isolation and may represent false flags. However, with both flashing while BTC remains above support, a bottom may have formed,” Lunde concluded.

Michael Burry warns BTC’s ongoing sell-off could hurt the corporations holding BTC

Famous Wall Street trader Michael Burry, who bet on the 2008 housing market crash, warned that Bitcoin’s ongoing decline could destroy significant value, especially for companies holding large BTC reserves.

Burry said, “Bitcoin has failed as a safe haven like Gold and could push aggressive corporate holders into bankruptcy, triggering broader market fallout,” reports Walter Bloomberg X post on Wednesday.

As the largest corporate holder of Bitcoin, with 713,502 BTC in its reserves, Strategy (MSTR) stock price continued its correction, reaching a daily low of $126.74 on Tuesday, a decline of more than 70% from its 2025 high of $457.22.

With the upcoming earnings and revenue report on Thursday, investors remain on high alert, watching closely for any commentary on its Bitcoin strategy and balance-sheet exposure amid ongoing market volatility.

Meanwhile, the current NAV premium metric, which measures how much the market values the company relative to the net value of its Bitcoin holdings and other assets, excluding liabilities, reads -18.50% (0.81x), implying the market values MSTR at 81% of the value of its Bitcoin holdings per share (excluding other business value).

This suggests that investors are currently unwilling to pay a premium for Strategy’s leveraged Bitcoin exposure, as concerns over dilution, rising debt costs, and Bitcoin’s recent price drop weigh on sentiment – making it harder for MSTR to raise low-cost capital for further BTC accumulation without pressuring shareholders.

Bitcoin Price Forecast: BTC hits the lowest level since November 2024

Bitcoin recovers slightly to trade near $76,000 at the time of writing on Wednesday after hitting a low of $72,945, a level not seen since early November 2024, the previous day.

The current market situation suggests a falling knife scenario. Traders should be cautious, as attempting to buy the dip remains risky, as the downside may not be complete yet.

If BTC resumes its downward trend and closes below the daily support at $73,072 on a daily basis, it could extend the decline toward the key psychological level of $70,000.

The Relative Strength Index (RSI) reads 26 on the daily chart, an oversold condition, indicating strong bearish momentum. The Moving Average Convergence Divergence (MACD) also showed a bearish crossover on January 20, which remains intact with rising red histogram bars below the neutral level, further supporting the negative outlook.

Meanwhile, market participants should keep a watch as the primary trend for BTC remains bearish, so any short-term recovery has a high probability of a dead-cat bounce — a brief price increase within a broader downtrend.

If BTC recovers, it could extend the advance toward the 61.8% Fibonacci retracement level (from the August 2024 low of $49,000 to the October 2025 all-time high of $126,199) at $78,490.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.