Monero Price Forecast: XMR extends decline amid persistent bearish outlook

- Monero extends its decline on Tuesday, with losses exceeding 50% over the last three weeks.

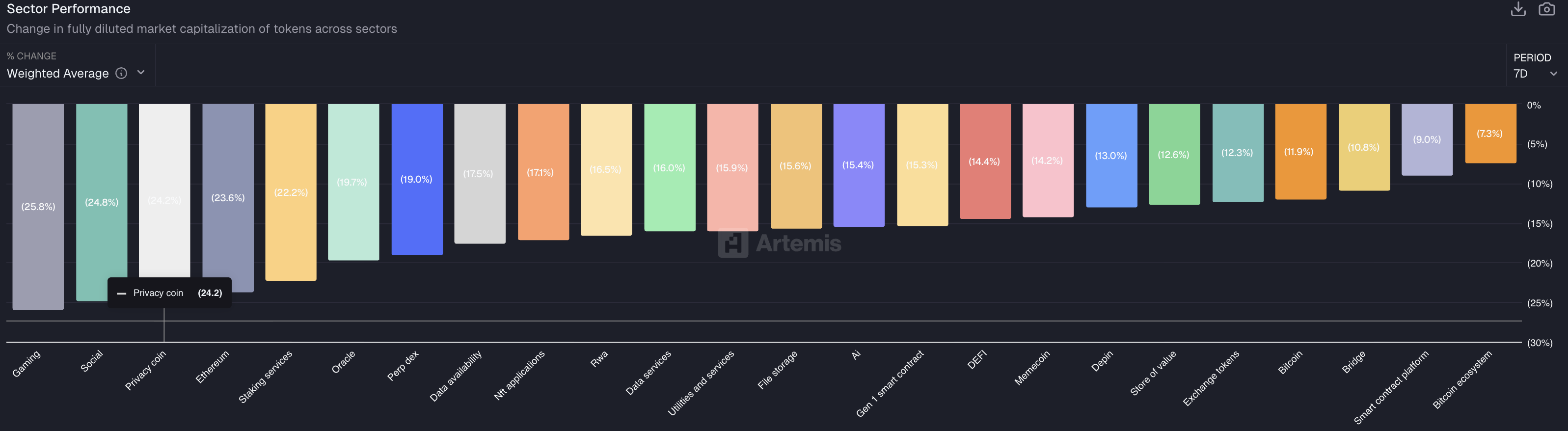

- Privacy coins were among the weakest-performing segments in the crypto market last week, with a roughly 25% drop.

- The technical outlook for Monero remains bearish, but decreasing trading volume suggests an easing in selling pressure.

Monero (XMR) remains under intense selling pressure for the third consecutive week, recording a 4% loss at press time on Tuesday. This is consistent with the declining retail interest in privacy coins, which was among the lowest-performing segments over the last week. The technical outlook indicates further downside risk below the 200-day Exponential Moving Average (EMA), but reduced trading volume suggests that sell-side intensity is waning.

Monero loses strength amid sectoral decline

Privacy coins remain under pressure so far this week, diverging from the minor relief seen in the broader cryptocurrency market as Bitcoin (BTC) resurfaces above $75,000. Artemis data show that the privacy segment has declined by 24% over the last week, making it one of the worst-performing sectors after gaming and social tokens.

On the derivatives side, the declining tone of retail strength remains consistent. CoinGlass data indicate that XMR futures Open Interest (OI) declined by 5.12% over the last 24 hours, to $135.18 million, reflecting a significant reduction in outstanding futures contracts.

Additionally, long liquidations of $518,340 over the last 24 hours are significantly higher than short liquidations of $65,270, indicating a bearish market bias. Meanwhile, the XMR funding rate of 0.0076% indicates that bullish interest persists, which in this case serves as an incentive for short-position holders.

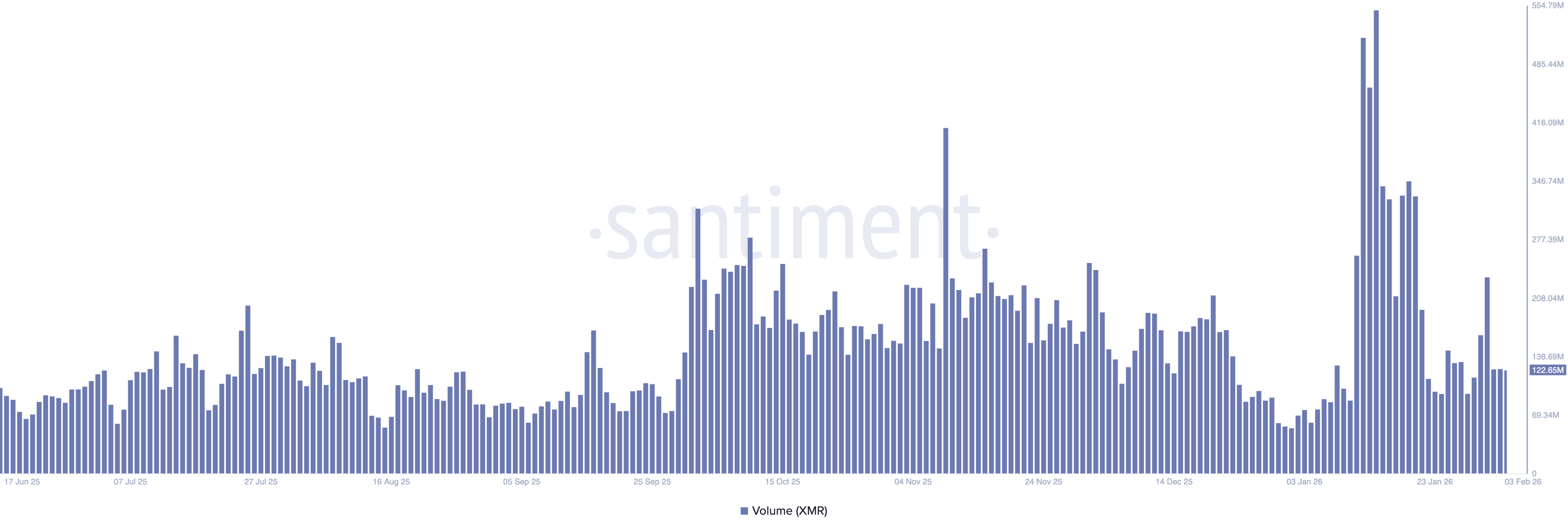

However, Santiment data indicate that Monero trading volume stands near $122 million on Tuesday, down from the $232 peak on January 31, suggesting an easing of selling pressure. Typically, spikes in trading volume during a downward trend signal a sell-off, as observed on January 14 and 31.

Technical outlook: Will XMR drop to $318?

Monero has fallen below the $400 mark from its $800 peak on January 14, representing more than a 50% decline. At the time of writing on Tuesday, XMR is down 4% on the day, trading below its 200-day EMA at $387, and amounting to a roughly 20% decline over the last three days.

Meanwhile, the downward slopes of the 50-day and 100-day EMAs highlight persistent selling pressure.

The technical indicators on the daily chart suggest that the privacy coin is gaining bearish momentum. The Moving Average Convergence Divergence (MACD) continues into negative territory as the histogram extends below zero, suggesting strengthening bearish momentum. At the same time, the Relative Strength Index (RSI) at 32 is approaching oversold conditions amid sustained selling pressure.

If Monero secures a daily close below the 200-day EMA at $387, the S1 Pivot Point at $318 could serve as the immediate support level.

Looking up, a daily close above $387 could ease the pressure on Monero and potentially extend a recovery to the 100-day EMA at $437.