Bitcoin Price Hits 9-Month Low Amid $2.6 Billion Liquidation: What’s Next?

Bitcoin price fell below the $80,000 support level, hitting a nine-month low and wiping out $2.6 billion in trader positions.

According to BeInCrypto data, the 6% slide sent the token to $77,082 before a minor rebound. This marked the first time prices have sat this low since April 2025.

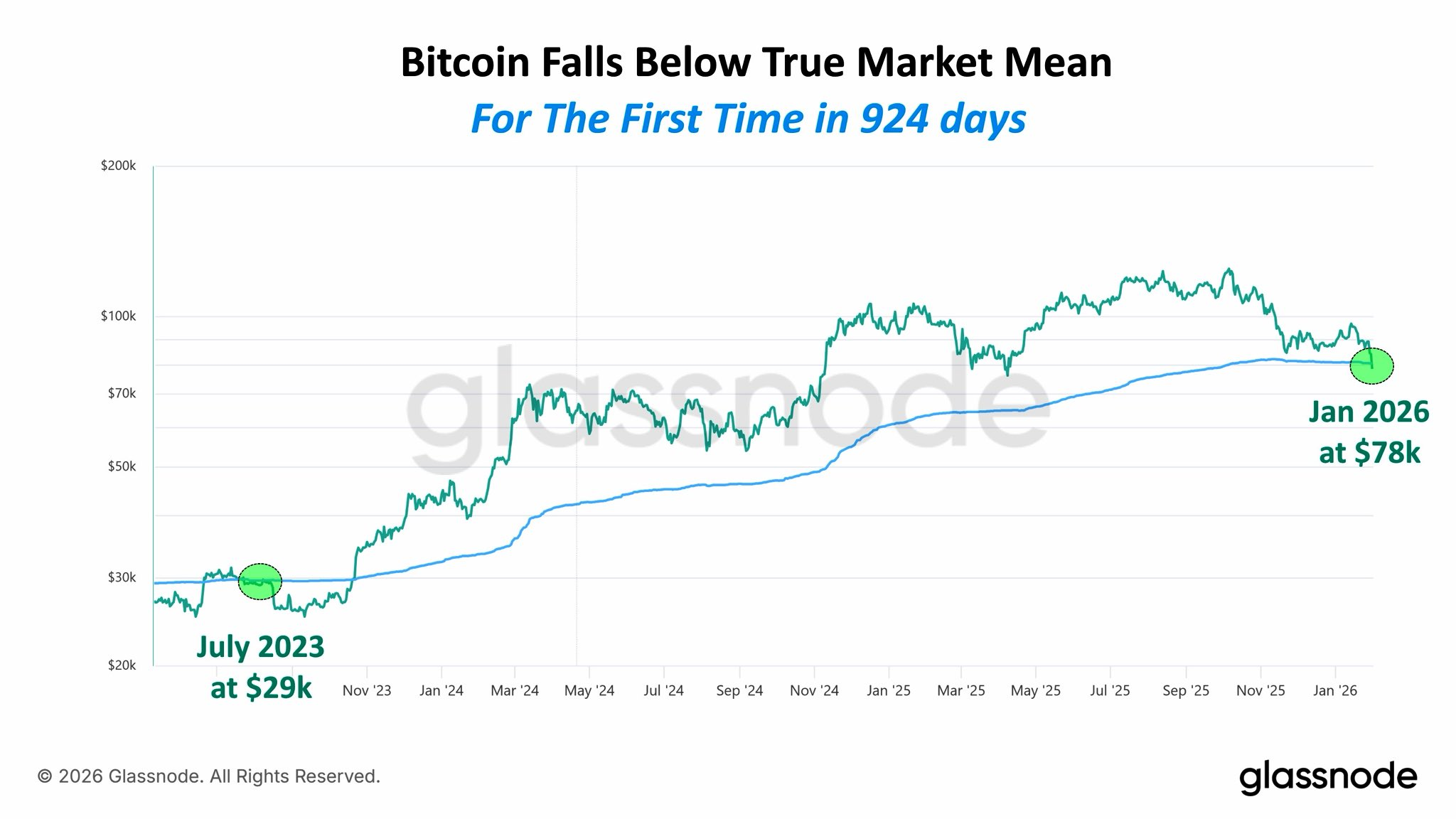

Bitcoin Sinks Below ‘Fair Value’ for First Time in Years

The price action pushed Bitcoin below critical on-chain benchmarks for the first time in years.

Glassnode data confirmed that Bitcoin fell below its True Market Mean—currently $80,500—for the first time in 30 months. The last breach occurred in late 2023, when the asset traded at just $29,000.

Bitcoin True Market Mean. Source: Glassnode

Bitcoin True Market Mean. Source: Glassnode

Historically, a breach of this level signals a transition from a bull cycle to a mid-term bear market.

As a result, BTC holders now face a grim reality as its Short-Term Holder Cost Basis has climbed to $95,400, while the Active Investor Mean stands at $87,300.

With the spot price significantly below these averages, the market now faces a substantial overhang of unrealized losses.

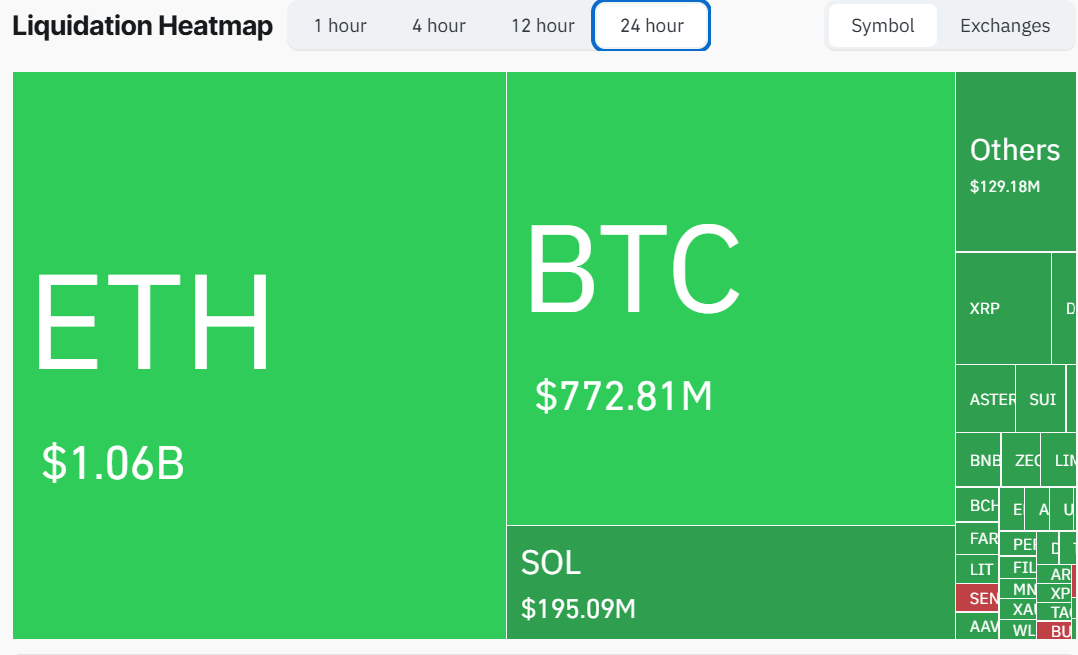

This technical breakdown triggered a violent deleveraging event across global derivatives exchanges.

Data from CoinGlass show that the collapse led to the liquidation of roughly $2.58 billion in trader positions.

Crypto Market Liquidation. Source: CoinGlass

Crypto Market Liquidation. Source: CoinGlass

Notably, the carnage hit one side of the market with extreme prejudice as “long” positions—bets on a price rebound—accounted for $2.42 billion of the total losses. This is the largest long liquidation event in the last three months.

Ethereum traders bore the heaviest burden, incurring $1.15 billion in liquidations, while Bitcoin-related wipes totaled more than $772 million.

This massive “long squeeze” shows that participants overleveraged their positions to defend the $80,000 floor, only to be crushed by accelerating downside momentum.

CryptoQuant CEO Ki Young Ju tied this substantial decline to an exhaustion in BTC’s buyer liquidity. He attributed this to a “flatlined” Realized Cap, which confirms that the fresh capital required to sustain a bull market has simply vanished.

According to Ju, while early investors continue to take profits on holdings acquired during the 2025 surge, no new institutional “blood” exists to absorb the supply.

“MSTR was a major driver of this rally. Unless Saylor significantly dumps his stack, we won’t see a -70% crash like previous cycles,” he added.

Considering this, he posited that the market would be forced into a “wide-ranging sideways consolidation” until a new floor emerges.