PENGU Price Surges Despite 95% Sentiment Drop — Is A Reversal Still In Play?

Pudgy Penguins (PENGU) is quietly outperforming much of the meme coin market as February approaches. The token is up about 7.7% over the past 24 hours, beating most big meme coins outside of extreme movers like PIPPIN. Over the past four days, PENGU has also rebounded nearly 18%, even as social attention takes a hit.

That disconnect is what makes this setup unusual. Price is rising. Whale interest is rising. But sentiment and positioning risks are telling a more cautious story. The question now is whether this move turns into a full trend reversal or stalls into a high-risk failure.

Bullish Divergence and a Falling Wedge Point to a Reversal Attempt

From a structure standpoint, PENGU is doing something technically constructive.

The token has been trading inside a falling wedge, a pattern that often forms during downtrends before a reversal. Inside that wedge, PENGU printed a lower low in price between December 1 and January 25, while the RSI formed a higher low.

RSI, or Relative Strength Index, measures momentum. When price makes a lower low but RSI does not, it signals that selling pressure is weakening. This is called bullish divergence, and it often appears near the end of downtrends. PENGU is in one, down almost 50% over the past three months.

That reversal signal has already played out partially. Since the January 25 low, PENGU has climbed about 18%, outperforming most meme coins over the same period. This rebound suggests the market is responding to the momentum shift. But the reversal is not in yet.

PENGU Price Structure: TradingView

PENGU Price Structure: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If PENGU can break above the upper trend line of the falling wedge, the pattern projects a potential move of up to 75%. That is the upside case traders could be watching. But structure alone does not guarantee follow-through.

Whales Are Accumulating Aggressively, Betting the PENGU Reversal Extends

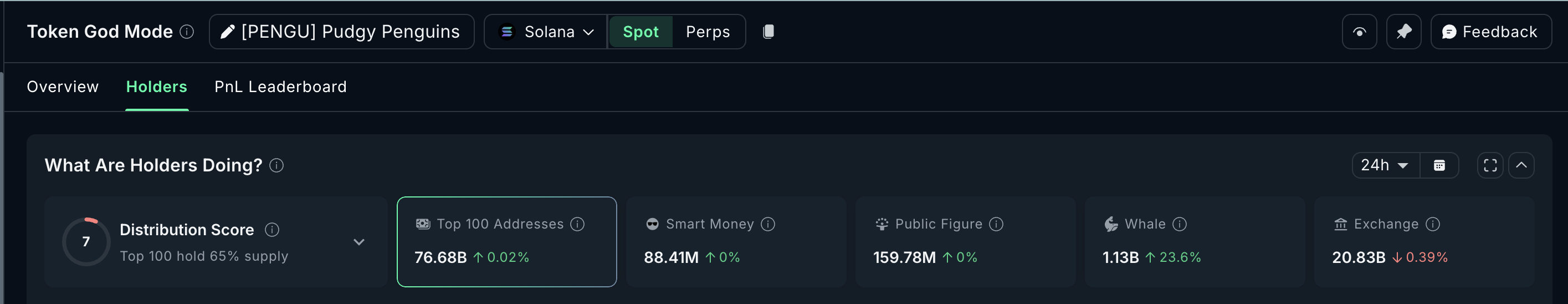

On-chain data shows why price has stabilized and pushed higher.

Over the past 24 hours, PENGU whales increased their holdings by 23.6%, lifting total whale-controlled supply to roughly 1.13 billion tokens. This is a large jump in a short time window and signals strong conviction from large holders.

What makes this notable is the contrast. While whales are buying aggressively, smart money and exchange balances remain largely flat, suggesting this move is being driven by a specific cohort rather than broad participation.

Pudgy Penguins Whales: Nansen

Pudgy Penguins Whales: Nansen

In simple terms, whales appear to be betting that the bullish divergence and falling wedge will take Pudgy Penguins higher. They are positioning early, before a confirmed breakout, rather than chasing strength later.

This kind of accumulation often happens near decision points. If the breakout materializes, whales benefit from early positioning. If it fails, they are also the first exposed. That exposure matters more because sentiment support is missing.

Fading Sentiment and Leverage Imbalances Raise Failure Risk

While price and whales point higher, positive social sentiment tells a different story.

In mid-January, PENGU’s price peaks closely matched spikes in positive sentiment, with scores reaching above 11. Since then, sentiment has collapsed to around 1.5, a drop of roughly 95%, even as the price begins to rebound.

Historically, PENGU’s local peaks in January 2026 alone have coincided with rising sentiment. The current move lacks that confirmation. This suggests the rebound is being driven by whale positioning and structure, not broader crowd excitement.

Weak Sentiment: Santiment

Weak Sentiment: Santiment

That creates the risk..

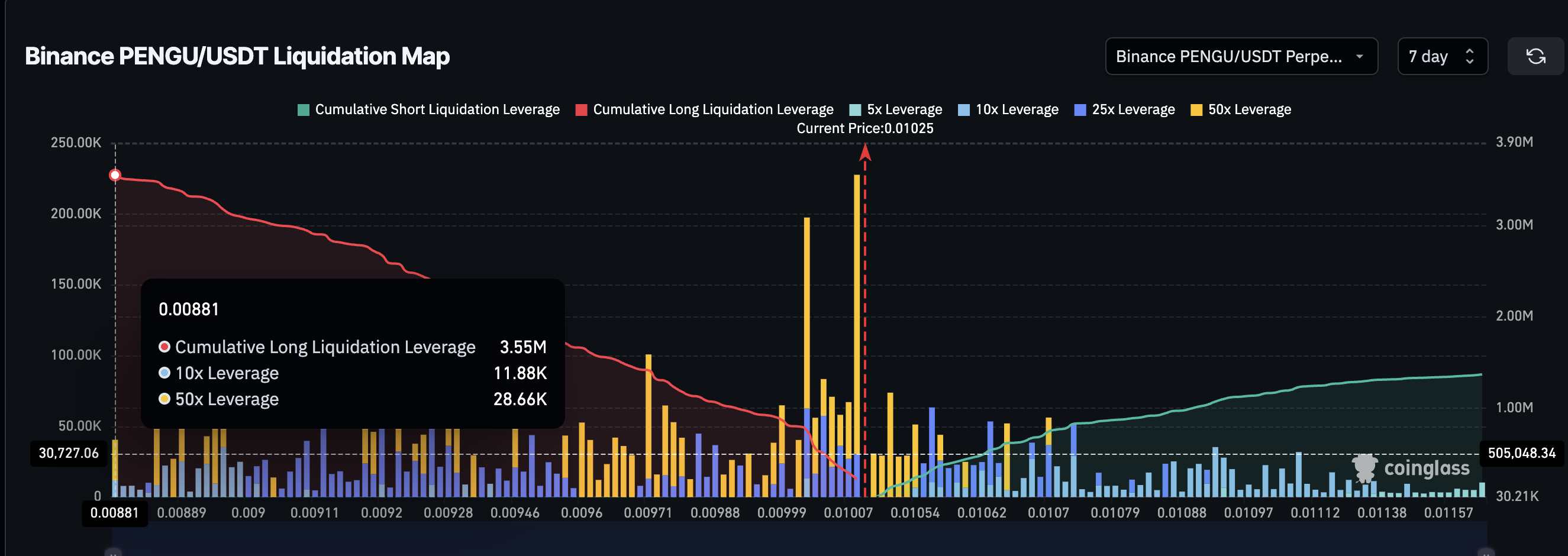

Derivatives data adds another layer of risk. On Binance’s PENGU perpetual pair, long positions total roughly $3.55 million in leverage, compared with about $1.37 million in shorts. This means bullish bets heavily outweigh bearish ones by roughly 160%.

If the PENGU price dips and loses key support, the longs risk being forced out, triggering a long squeeze.

Derivatives Risk: Coinglass

Derivatives Risk: Coinglass

Key levels now define the outcome. A sustained move above $0.0122 (critical Fib level) and $0.0131 would strengthen the breakout case and open the path toward the wedge target near $0.022. On the downside, losing $0.010 raises liquidation risk, with deeper danger near $0.0088–$0.0089, where long leverage clusters sit.

PENGU Price Analysis: TradingView

PENGU Price Analysis: TradingView

PENGU is setting up for a decisive move. The structure is bullish. Whales are confident. But fading sentiment and crowded longs mean this is not a low-risk trade. February will decide whether this quiet rebound becomes a true trend reversal or another failed breakout.