What Is Driving Internet Computer (ICP)’s Nearly 40% Rebound?

Internet Computer (ICP) surged more than 39% over the past week, outpacing major cryptocurrencies as investors responded to the newly released MISSION70 whitepaper.

The paper proposes comprehensive updates to reduce inflation by at least 70% by the end of 2026. This is to be achieved through a combination of demand-side acceleration and supply-side reductions

Internet Computer Tops Daily Gainers

ICP has emerged as a standout performer in the crypto market. Data from CoinGecko shows ICP posting gains of nearly 26% in the past 24 hours, placing the token at the top of the daily leaderboard among the top 100 cryptocurrencies.

The rally forms part of a broader upward momentum that began earlier this week. The altcoin entered 2026 largely in step with the wider crypto market, experiencing a modest initial rise before a brief pullback.

However, momentum reversed again this week. Major assets such as Bitcoin (BTC) and Ethereum (ETH) resumed their upward moves, restoring broader market optimism.

While this positive sentiment supported ICP’s price action, developments within the Internet Computer ecosystem may also be contributing to the rally, reinforcing investor confidence in the network’s native fundamentals.

“Internet Computer has led large cap assets over the past week by increasing its market cap by +39%,” Santiment wrote.

Internet Computer (ICP) Price Performance. Source: TradingView

Internet Computer (ICP) Price Performance. Source: TradingView

Mission 70 Whitepaper Outlines Dual Strategy to Reduce ICP Token Inflation

The DFINITY Team published the MISSION70 whitepaper on January 13, 2026. It details a dual approach to lowering ICP’s inflation rate. The strategy blends supply-side and demand-side actions, aiming for a 70% reduction in overall token inflation by year-end.

Supply-side reforms will provide 44% of the total reduction. These changes include lowering voting rewards, node provider rewards, capping reward pools, and introducing a simpler maturity modulation mechanism.

The whitepaper argues that current node provider rewards significantly exceed underlying infrastructure costs, creating room for reductions without compromising network security.

“We estimate that the supply-side measures reduce ICP minting from 9.72% (January 2026) to 5.42% (January 2027), a 44% reduction. DFINITY believes that the Mission 70 target of a 70% inflation reduction will be exceeded through a combination of these supply-side measures and demand acceleration,” the paper reads.

For the remaining 26%, increased network activity is essential. DFINITY intends to boost demand with AI-powered on-chain applications and new cloud engine products.

The paper projects that greater usage will burn more ICP through computational fees, which could create deflationary pressure.

“To achieve the overall Mission 70 target of a 70% inflation reduction (from 9.72% to 2.92%), an additional demand impact of 26% is required beyond the 44% reduction from supply-side measures. At current price levels, this requires increasing the cycle burn rate from the current 0.05 XDR per second to 0.77 XDR per second,” the team added.

Market Response and On-Chain Data Show Strong Confidence

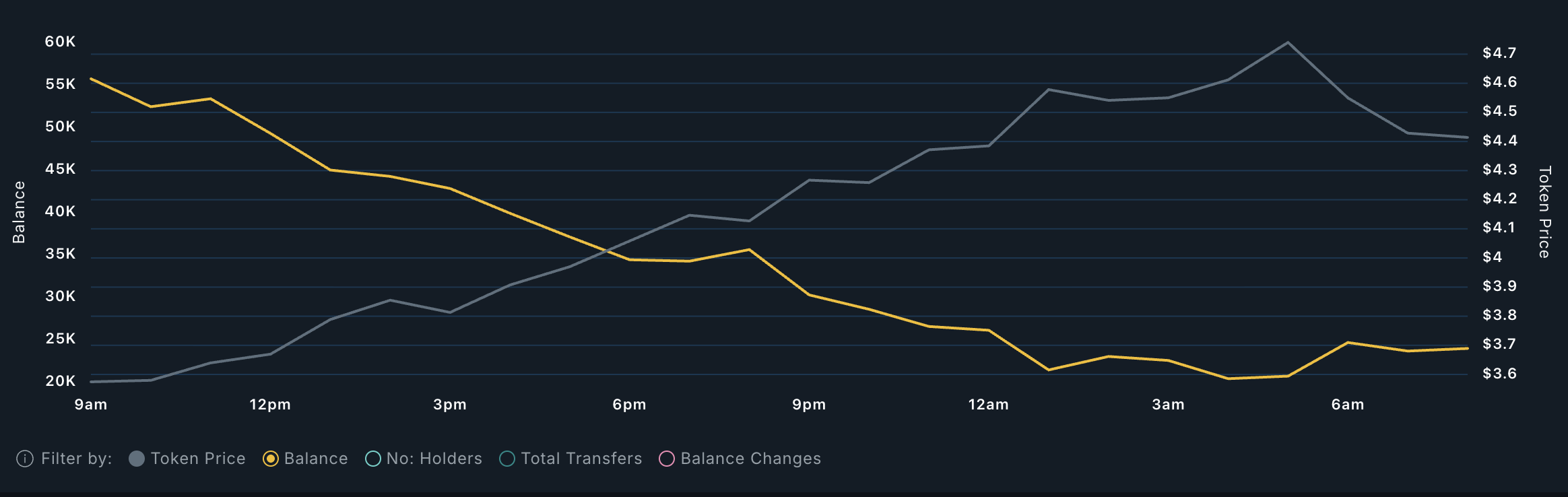

Meanwhile, ICP’s price gain was matched by notable on-chain activity. Data from Nansen shows that ICP exchange balances declined by more than 58% over the past 24 hours.

Such sharp outflows typically indicate that holders are moving tokens off exchanges, a trend commonly associated with reduced short-term selling pressure.

ICP Exchange Balance. Source: Nansen

ICP Exchange Balance. Source: Nansen

Network use is also rising. According to Chainspect, the Internet Computer processed approximately 90 million transactions in one day, marking the network’s highest daily activity in over a month.

From a technical perspective, analysts remain constructive on ICP’s outlook. Some point to similarities with its November 2025 price structure, suggesting that, if momentum holds, the asset could attempt a comparable upward move.

As the Internet Computer enters this critical period, the cryptocurrency market will watch to see whether DFINITY can deliver this economic overhaul. The coming time will show if the price rally signals lasting change or is a reaction to anticipated developments.