Cardano Price Prediction: When Will ADA Price Rise and Can It Reach $10 by 2030?

What is the current price of Cardano?

TradingKey - At the start of 2026, the cryptocurrency market got off to a strong start with bullish sentiment surging, and Cardano ( ADA) also joined the rally. In just seven days, the price of ADA has risen by over 24% , currently trading at $0.41, nearly recovering its losses from December 2025.

[Cardano Price Chart, Source: TradingView]

[Cardano Price Chart, Source: TradingView]

Compared to its price at the start of 2025, Cardano's price still faces a significant gap. In 2025, Cardano opened at $0.84 and rose to $1.18 on March 2, marking its yearly high. Subsequently, the price continued to retreat, hitting a low of $0.32 on December 31, resulting in a cumulative annual decline of 72%. As the new year begins, will Cardano's price continue to hit new lows, or will it reverse its losses and turn upward?

Will Cardano's Price Continue to Rise?

In December 2024, Cardano's price surged to $1.32, hitting its highest level since the fourth halving cycle. Notably, the rally was driven not only by the Bitcoin halving event boosting market bullishness, but also by Donald Trump's presidential victory, as the market highly recognized his campaign promises for cryptocurrency, such as creating a strategic crypto reserve and firing SEC Chair Gary Gensler. [Cardano Price Chart, Source: TradingView]

[Cardano Price Chart, Source: TradingView]

While Cardano's price has lost these supports, it may gain new momentum, boosting its price to further rebound. First, Cardano's primary shortcoming is its weak ecosystem; its TVL is at the lowest level among peer public chains. The Cardano team is pushing technical upgrades to drive ecological development, and founder Charles Hoskinson is collaborating with Solana to unlock cross-chain liquidity. Second, the U.S. CLARITY Act could classify ADA as a commodity, which would facilitate the approval of a spot ETF.

When will the price of Cardano rise?

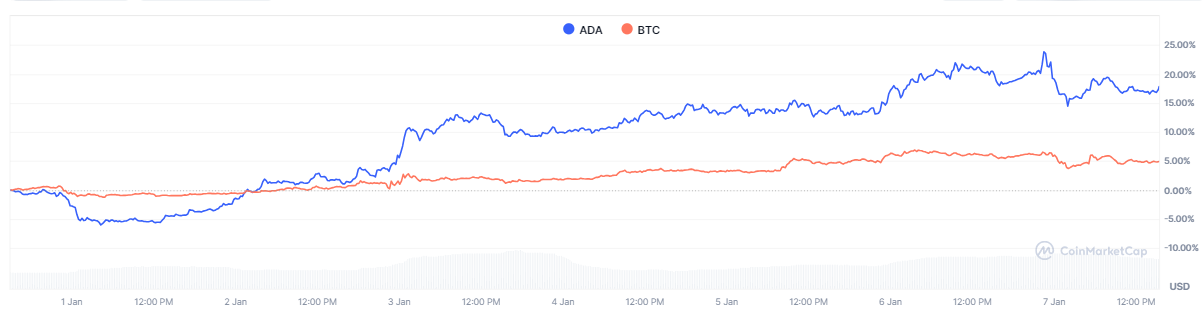

Since the start of 2026, Bitcoin ( BTC) prices have risen by only 5%, while Cardano at one point surged nearly 25%, significantly outperforming Bitcoin. It is evident that investors have already begun pricing in potential tailwinds for Cardano and are willing to pay a premium, which is a key driver behind Cardano's reversal from a downtrend to an uptrend.

[ADA and BTC Price Performance, Source: CoinMarketCap]

[ADA and BTC Price Performance, Source: CoinMarketCap]

From a technical analysis standpoint, Cardano's drop to $0.32 at the end of 2025 indicated that a rally was imminent for two reasons: first, Cardano entered oversold territory, and with bearish exhaustion, bulls are poised to take control; second, the return to the 2023-2024 bottoming range provides a robust support level.

How high will the Cardano price rise?

While it is essentially confirmed that ADA has initiated a rebound rally, how long can it be sustained and how high can it rise? Currently, Cardano's price primarily faces two key resistance levels: first, $1, which represents a round-number milestone and a relatively strong psychological resistance level; second is $1.30, the peak of the current cycle's rebound, where a significant volume of trapped positions is concentrated.

[ADA Price Chart, Source: TradingView]

[ADA Price Chart, Source: TradingView]

Compared to previous tailwinds, potential positive drivers in 2026—such as Federal Reserve interest rate cuts and Cardano addressing its ecosystem deficiencies—carry significant uncertainty and potentially limited impact. This implies the bullish sentiment they generate may not be as strong as in the past. Over the next year, Cardano may break the $1 mark, but the likelihood of it surpassing its 2024 high remains low, unless Bitcoin prices strengthen once again to reach new record highs.

However, other institutions and platforms are more conservative regarding Cardano's price performance in 2026. According to the crypto data platform CoinCodex, Cardano's price is expected to rise to at most $0.55, while TradingView and CryptoCompare are even more cautious, suggesting that Cardano lacks major catalysts and that ADA's price will peak at only $0.30.

Cardano Price Prediction: Can it reach $10 in five years?

Recently, the price of Cardano has been oscillating around $0.4. To reach the $10 target in the future, ADA would need to rise from current levels by approximately 2,400% . However, how realistic is this possibility?

On September 2, 2021, the price of ADA peaked above $3, setting an all-time high. However, during the current halving cycle, ADA has not only failed to break that record, but its peak has been less than half of it. This is a significant blow to Cardano, as it contradicts a characteristic seen in previous bull markets: that the peak of a new bull market is typically higher than the previous one. This also implies that ADA's price may be unable to break its all-time high before the new halving cycle in 2028, and the likelihood of its price reaching $10 within five years is very slim.

Most mainstream forecasting models suggest that Cardano's price is unlikely to reach this target in the next five years. Among them, Kraken and Finst expect it to fluctuate within the $0.50 to $0.60 range. However, some institutions such as CoinPedia and Cryptopolitan maintain a more optimistic outlook, believing that Cardano could potentially reach the target price by 2031.

Conclusion

In early 2026, Cardano prices rebounded from their lows, with ADA at approximately $0.41, rising over 24% in seven days. Short-term resistance for ADA stands at $1 and $1.3, and whether it can break through depends on ecosystem growth, macroeconomic factors, and Bitcoin's trajectory. For Cardano to reach $10 within five years, it would require a surge of approximately 2,400%, a scenario mainstream models consider highly unlikely; the market generally expects only a modest recovery over the next few years.