Venezuela Oil Exports Use USDT Heavily, Is Bitcoin Dominance at Risk?

TradingKey - Maduro's aggressive adoption of Tether for oil settlements drives USDT market cap surge; could this trend propel its market cap beyond Bitcoin?

According to The Wall Street Journal on January 10, reports indicate that Venezuelan President Nicolás Maduro, in an effort to circumvent external sanctions, is using Tether (USDT) to settle oil transactions, propelling USDT to become the world's leading stablecoin.

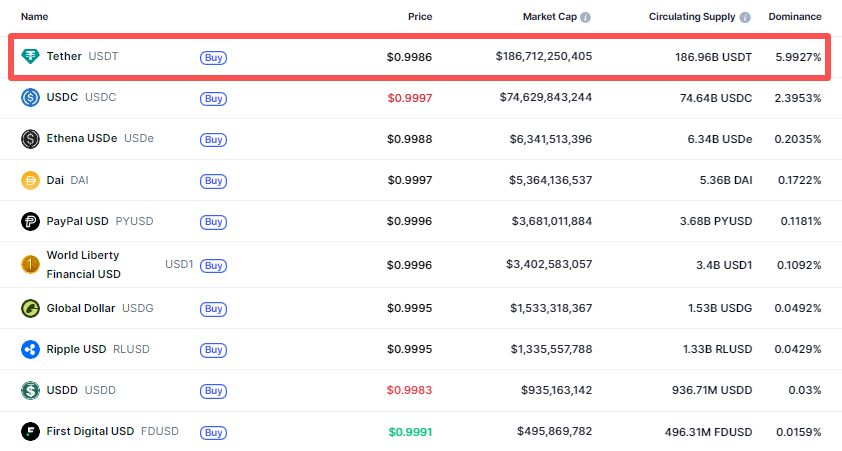

As of press time, USDT's market capitalization exceeds $180 billion, ranking first among all stablecoins with a total market dominance of nearly 6% , significantly surpassing the stablecoin issued by Circle, USDC, Ethena Labs' USDe, and others. Given USDT's strong momentum, could it eventually surpass Bitcoin (BTC)?

Top 10 Stablecoins by Market Capitalization, Source: CoinMarketCap.

Top 10 Stablecoins by Market Capitalization, Source: CoinMarketCap.

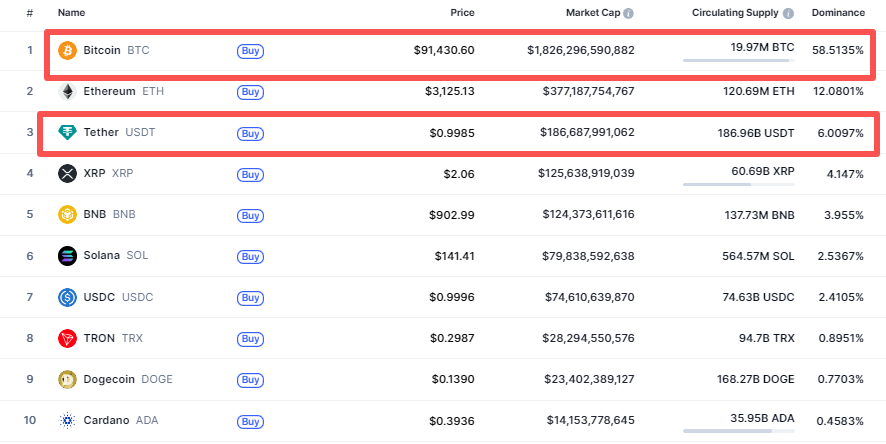

Given the current massive disparity, it is unlikely that Tether's market capitalization will surpass Bitcoin's in the short term. Although Tether ranks third in the crypto market — only two spots behind Bitcoin — Bitcoin's market cap exceeds $1.8 trillion, a level Tether is far from rivaling.

Top 10 Cryptocurrencies by Market Capitalization, Source: CoinMarketCap.

Top 10 Cryptocurrencies by Market Capitalization, Source: CoinMarketCap.

In the long run, Tether could theoretically overtake Bitcoin, but it remains unlikely in reality. In terms of utility, USDT primarily serves as a medium of exchange, whereas Bitcoin also functions as a store of value and an investment asset, making the demand and consensus for Bitcoin far stronger than for Tether.

From a regulatory perspective, it is even more difficult for Tether to surpass Bitcoin. Tether is a centralized token whose US dollar reserves have always been shrouded in mystery and subject to market skepticism. In contrast, Bitcoin is a decentralized token that has gained varying degrees of recognition globally; for instance, the U.S. has approved several spot Bitcoin ETFs and proposed a strategic Bitcoin reserve.

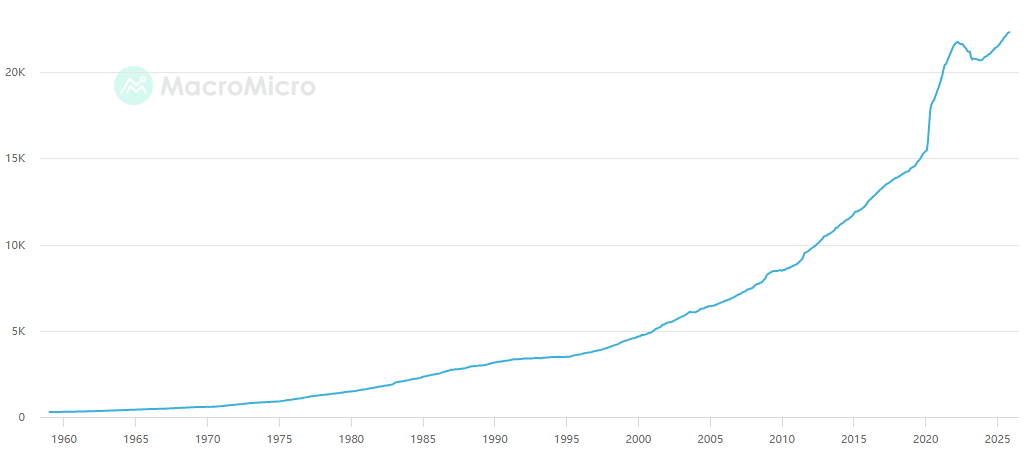

While it is nearly impossible for Tether to surpass Bitcoin in reality, it could potentially happen if the U.S. were to grant it official status for strategic crypto goals — giving it equal standing with the US dollar as an official national cryptocurrency. According to data released in December 2025, the U.S. M2 money supply reached $22.3 trillion, which is more than ten times the market capitalization of Bitcoin.

U.S. M2 Money Supply, Source: MacroMicro.

U.S. M2 Money Supply, Source: MacroMicro.

Will USDT transition from a commercial stablecoin to an official U.S. stablecoin? To achieve this, it would require Congressional legislation and a regulatory framework, for which there is currently no momentum. In practice, even as USDT's market share grows, regulators are more likely to favor central bank digital currencies (CBDCs), or compliant stablecoins issued by regulated financial institutions and subject to rigorous audits, rather than Tether, which carries numerous hard-to-assess risks, including technical, regulatory, and market risks.