Injective could extend gains with 99% approval on upgrade proposal to reduce inflation

- Injective tokenomics upgrade proposal receives 99% approval from voters, voting ends on April 23.

- The Injective 3.0 proposal aims to reduce the token’s inflation, the project claims it will be “one of the most deflationary assets to date.”

- INJ price added nearly 1% value on Monday, the token climbed nearly 10% in the past week.

Injective (INJ), a layer-one blockchain that hosts several decentralized finance (DeFi) applications on its chain is a step closer to a major tokenomics upgrade. The proposed upgrade is currently being voted on.

INJ price is up nearly 1% in the past day.

Injective proposal to reduce inflation receives 99% approval, voting is on

Injective’s tokenomics proposal aims to make INJ deflationary, and it proposes a plan to reduce the on-chain parameters for new token minting. Since its launch, Injective has introduced several measures to reduce INJ inflation, token burn auctions on mainnet launch, token burn auctions were then expanded to decentralized applications (DApps) in the network.

The expected outcomes of the proposal are to make INJ deflationary. The proposal reads, “Injective aims to emulate and eventually surpass the disinflationary characteristics of Bitcoin to become the most deflationary crypto asset.”

The proposal focuses on a controlled reduction in the inflation rate by balancing participation incentives and token scarcity, attracting new traders and early adopters to its blockchain network. The inflation rate change parameter, once increased to 0.5, will allow Injective to react swiftly to fluctuations in staking and ensure that the protocol is resilient.

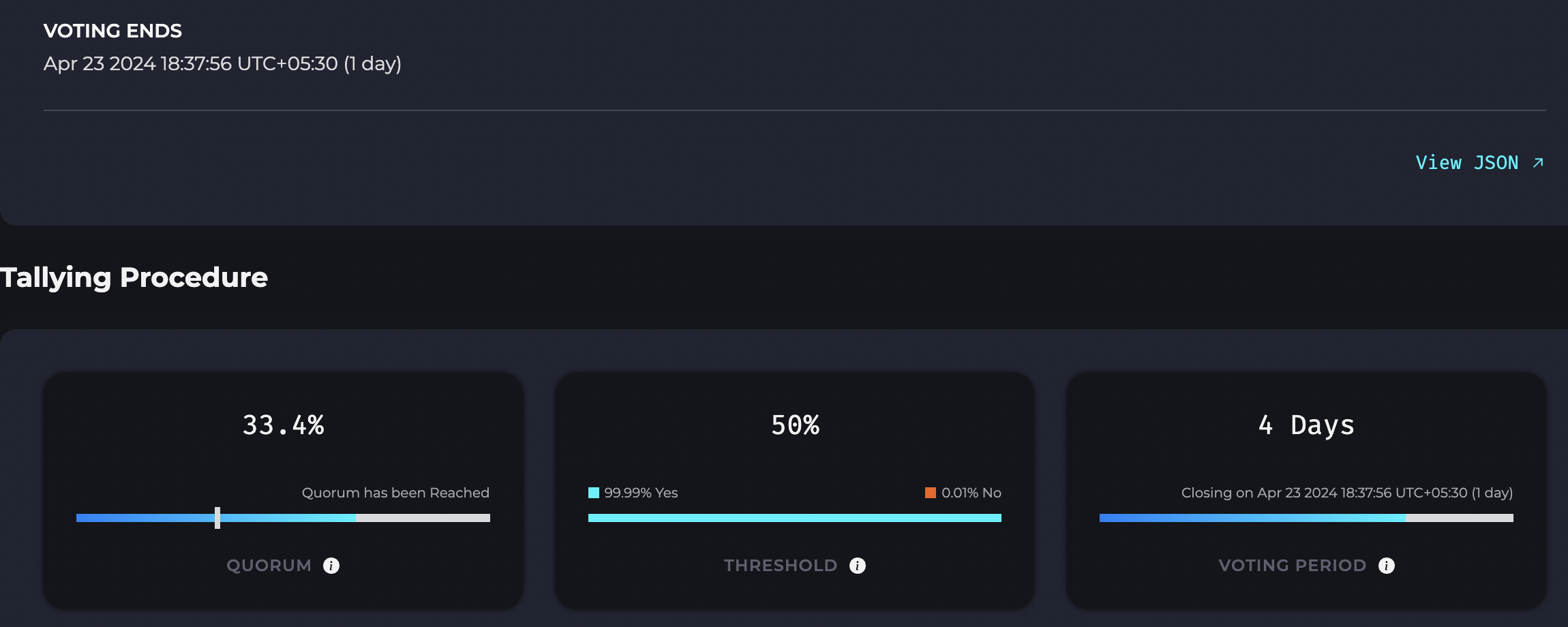

The new proposal is open to vote until April 23.

INJ voting

The portal shows that 99.99% voters have voted in favor of the proposal, according to the forum.

Reminder to all $INJ stakers and validators:

— Injective (@injective) April 22, 2024

The IIP-392 governance proposal which is set to make $INJ one of the most deflationary tokens ever is live!

Voting ends on April 23rd ️ https://t.co/VkECpBTjAz

INJ price climbed nearly 10% in the past week and the token is trading at $28.50 on Monday.