Ethereum ETF End 2025 With $67 Million Inflows, Price Stagnates Under $3,000

Ethereum price has moved sideways since late December 2025, struggling to establish a clear trend. ETH has repeatedly tested resistance without confirmation.

Despite muted price action, sentiment across several investor cohorts has improved, suggesting consolidation may be nearing an end as market confidence slowly rebuilds.

Ethereum Holders Smile As 2026 Rolls In

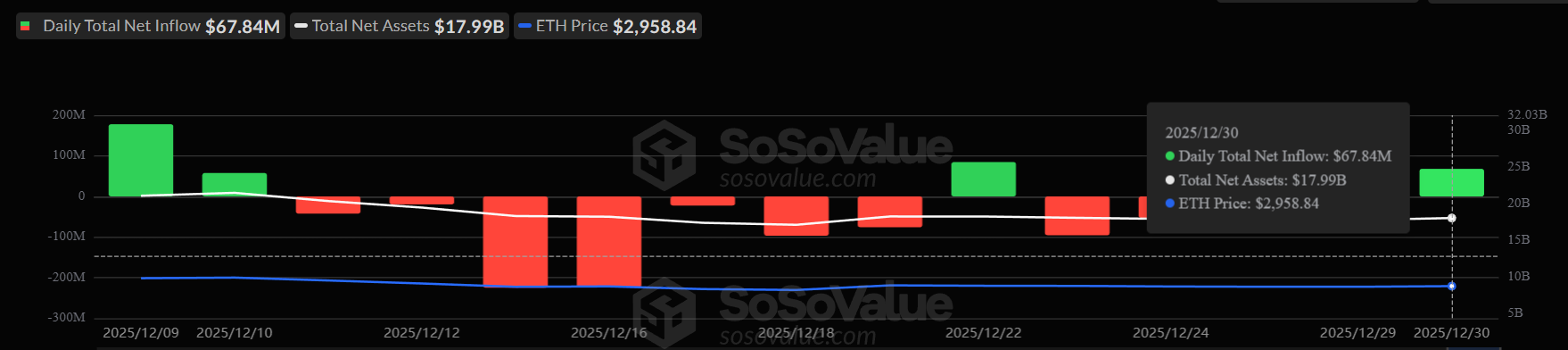

Ethereum ETFs closed 2025 on a constructive note after a volatile December. Spot ETH ETFs recorded combined inflows of $67 million, reversing nearly two weeks of steady outflows. This shift indicates renewed institutional interest following a period of risk aversion driven by macroeconomic uncertainty.

The inflows suggest macro investors may be repositioning for the new year. While December sentiment remained cautious, early 2026 flows imply improving expectations for Ethereum price performance. ETF activity often reflects longer-term conviction, reinforcing the view that downside pressure may be weakening across broader market participants.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum ETF Flows. Source: SoSoValue

Ethereum ETF Flows. Source: SoSoValue

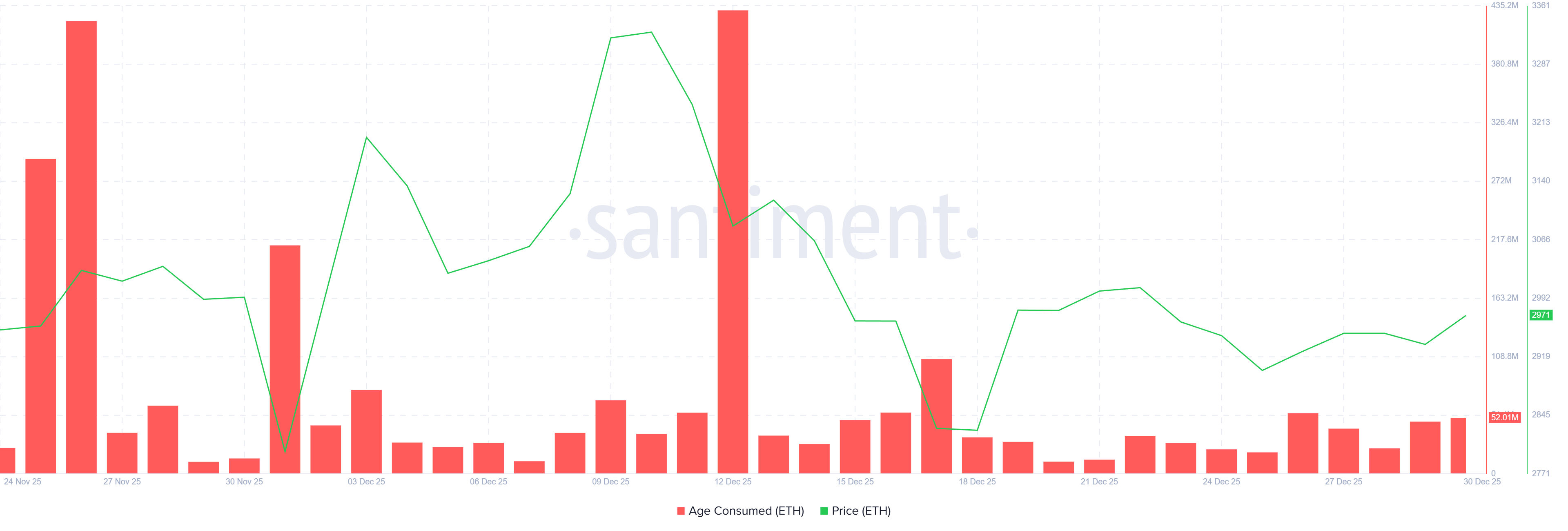

On-chain data support the improving sentiment narrative. Coin Days Destroyed, or CDD, showed only one notable spike throughout December. Outside of that event, the indicator remained subdued, signaling limited distribution activity among long-term holders.

CDD measures how long-held coins move on-chain, often highlighting selling by experienced investors. Ethereum LTHs appear unwilling to offload positions despite ETH failing to reclaim $3,000 for over two weeks. This behavior suggests confidence in higher future valuations and reduces near-term supply pressure.

Ethereum HODLer Position Change. Source: Glassnode

Ethereum HODLer Position Change. Source: Glassnode

ETH Price Continues Its Strained Relations From 2025

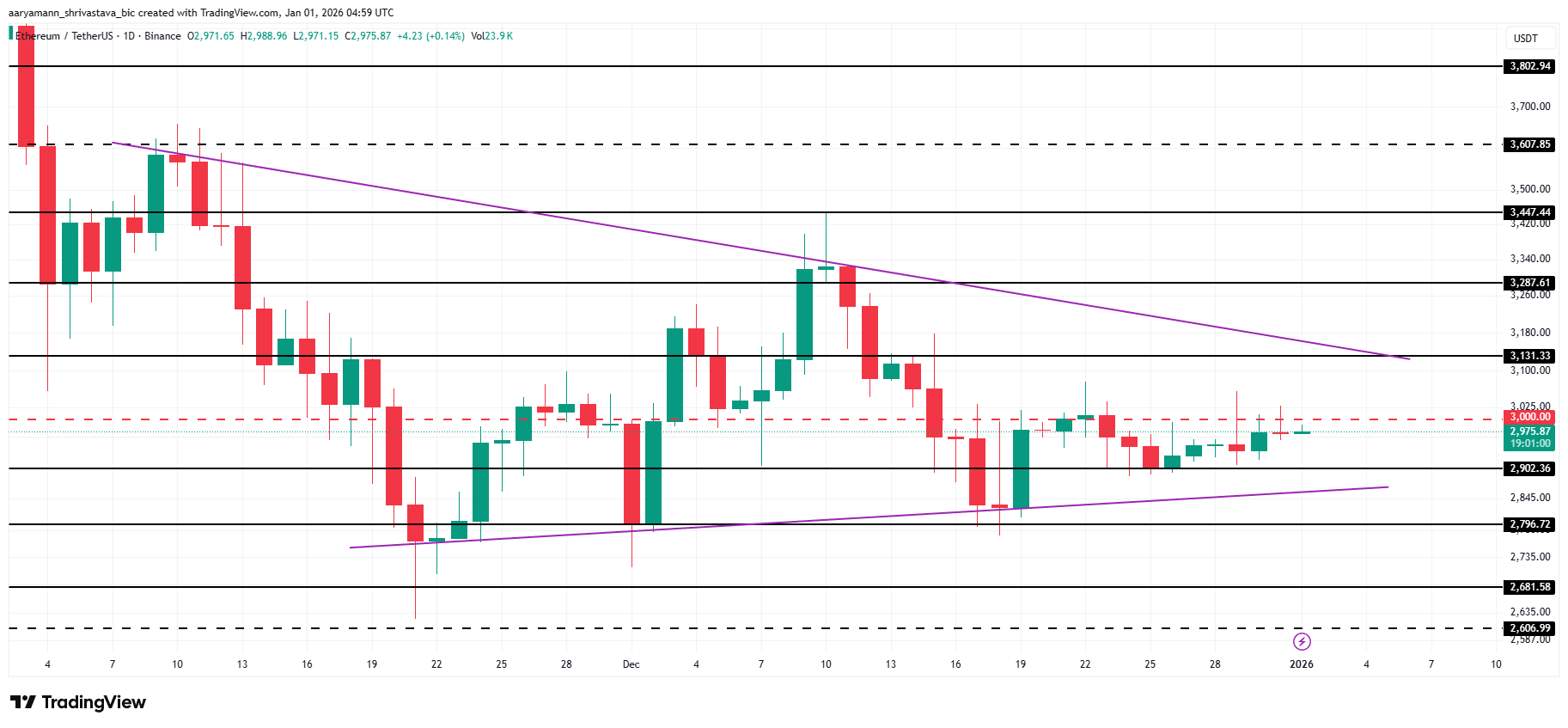

Ethereum trades near $2,975 at the time of writing, holding just below the $3,000 resistance. This level has capped price advances for most of December 2025. A sustained break above it remains critical for confirming a renewed bullish structure.

Positive holder sentiment could help Ethereum price push above $3,000 during the first week of 2026. Continued accumulation and stable ETF inflows may provide sufficient momentum. A confirmed breakout could allow the Ethereum price to target $3,131, aligning with previous resistance turned potential support.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

However, downside risks persist amid uncertain market conditions. A broader market pullback could trigger an ETH price correction toward $2,902. Increased selling pressure may extend losses to $2,796, which would invalidate the bullish outlook and shift focus back to defensive positioning.