XRP Price Looks Broken—but Investors Are Quietly Doing the Opposite

The XRP price remains within the constraints of a descending parallel channel, a bearish technical formation that started around mid-July.

However, this token, which powers the Ripple ecosystem, managed to buck the trend as crypto outflows hit $446 million last week.

XRP Bucks the Trend as Crypto Outflows Reach $446 Million

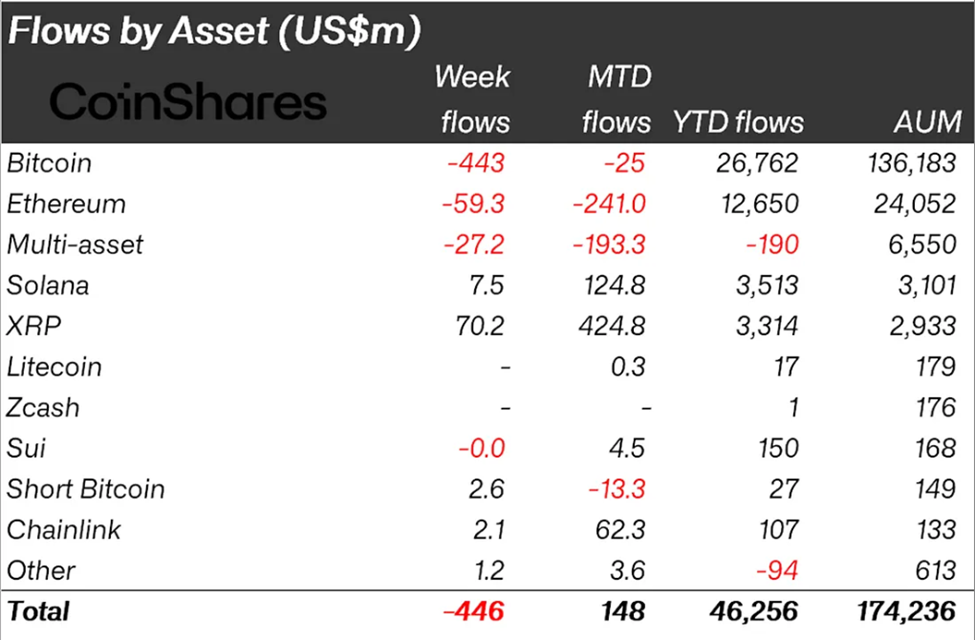

According to the latest CoinShares report, crypto outflows reached $446 million last week, slightly lower than the $952 million negative flows witnessed in the week ending December 20.

For both weeks, however, XRP managed to buck the trend, garnering positive fund flows as leading assets like Bitcoin and Ethereum experienced red flashes.

After recording $62.9 million in positive flows for the week before Christmas, positive flows into XRP reached $70.2 million last week. Meanwhile, Bitcoin and Ethereum recorded negative flows of $443 million and $59.3 million, respectively.

Crypto Fund Flows Last Week. Source: CoinShares

Crypto Fund Flows Last Week. Source: CoinShares

“This suggests investor sentiment has yet to fully recover… XRP and Solana recorded the largest inflows last week, totaling $70.2 million and $7.5 million, respectively,” read an excerpt in the latest CoinShares report.

James Butterfill, the head of research at CoinShares, ascribes the positive sentiment seen in XRP and Solana to their respective ETF launches in mid-October.

“Since the mid-October ETF launches in the US, they have seen $1.07 billion and $1.34 billion of inflows respectively, bucking the negative sentiment seen across other assets,” added Butterfill.

Indeed, and as BeInCrypto reported, XRP ETFs have sustained successive streaks of positive flows, likely contributing to the $70 million witnessed last week.

Technical Pressure Mounts as XRP Price Consolidates in Bearish Pattern

Despite positive flows into XRP-related funds, the Ripple price remains confined in a bearish technical formation, with bearish hands waiting to interact with the price upon any modest recovery. On-chain data and charts paint a different story.

As long as the XRP price remains within the confines of the channel, its value is likely to continue its downward trend. A break and close below $1.77 support could open the clog for a leg down to $1.50, almost 20% below current levels.

How can it avoid such a fate with more bearish than bullish hands waiting to interact with the price upon any slight recovery? The bearish volume profiles (red horizontal bars) show where sellers are positioned, while the green horizontal bars indicate buyer positioning.

The Relative Strength Index (RSI), a momentum indicator, indicates that sellers have the advantage, as it remains below 50. It accentuates the corrective phase, flattening after a prolonged decline, which usually signals momentum compression.

Ripple (XRP) Price Performance. Source: TradingView

Ripple (XRP) Price Performance. Source: TradingView

Meanwhile, the Awesome Oscillator is flashing green, but still in negative territory. It means the bears are losing aggression, but the bulls have not stepped in decisively.

Each minor RSI bounce has failed to break below the midline, respecting the upper boundary of the descending parallel channel, a sign that the trend remains intact.

So what would change the picture for the XRP price? A clean RSI break above 50, especially alongside a channel breakout to the upside, would be your first trend-shift confirmation.

Buyers should wait for a break and a successful retest of the price above the upper trendline of the channel. Until then, rallies are technically relief bounces.