3 Altcoins To Watch This Weekend | December 27 – 28

The crypto market is heading into the final weekend of 2025, and before the new year begins, there might be some room for altcoins to record growth still.

Led by Pippin (PIPPIN), these three altcoins are must-watch in the coming 48 hours as we near the year-end.

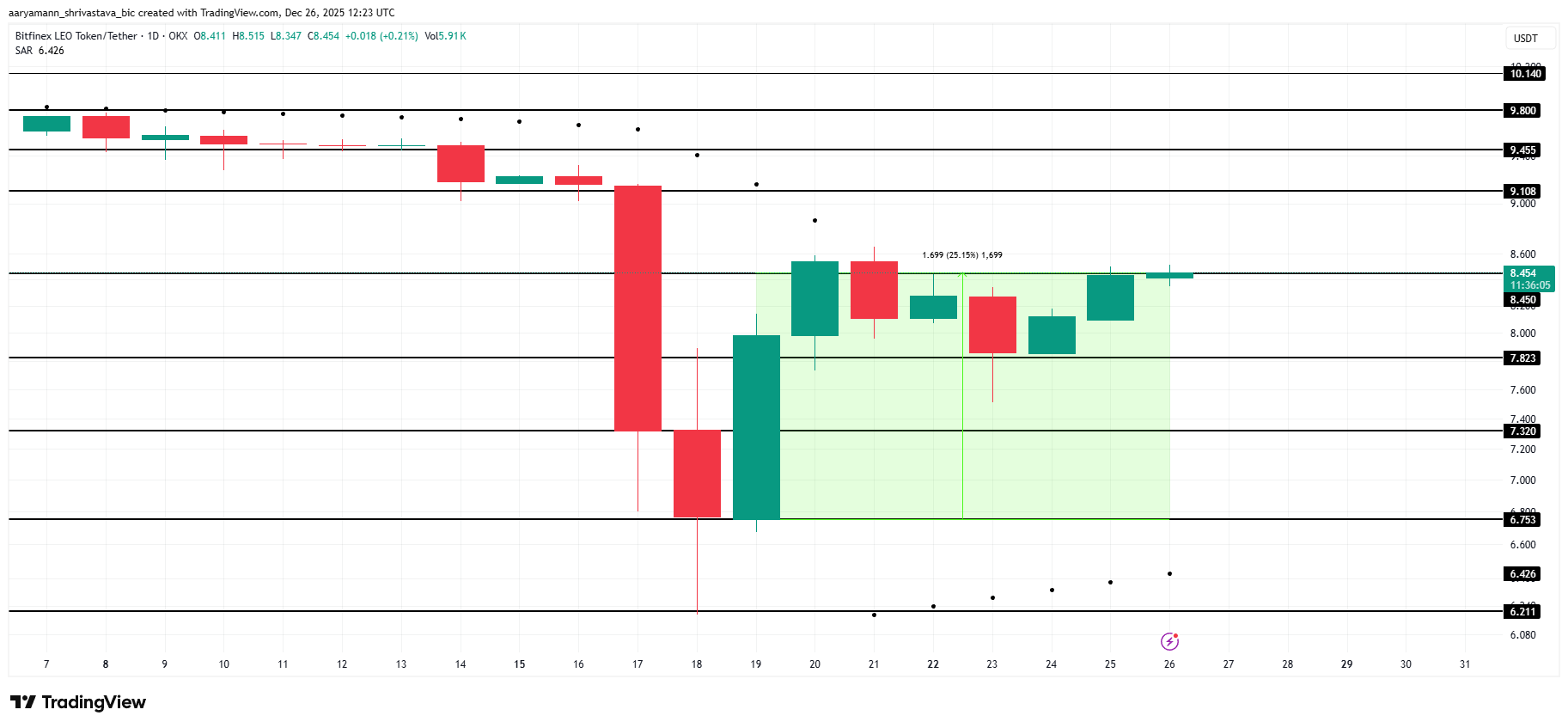

UNUS SED LEO (LEO)

LEO price surged 25% over the past week, trading near $8.45 at the time of writing. The technical structure shows strong support, with the Parabolic SAR confirming an active uptrend. This setup suggests buyers remain in control as momentum builds despite broader market uncertainty.

If bullish conditions persist, LEO could rebound toward $9.10, recovering losses recorded earlier this month. Sustained buying pressure may extend gains toward the $9.80 target. Achieving this level would reflect renewed confidence and reinforce the prevailing upward trend in the short term.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

LEO Price Analysis. Source: TradingView

LEO Price Analysis. Source: TradingView

Downside risks remain if investors move to lock in profits early. Selling pressure could push LEO below the $7.82 support. A further decline toward $7.32 would weaken technical structure, invalidate the bullish thesis, and signal a potential shift back to short-term bearish momentum.

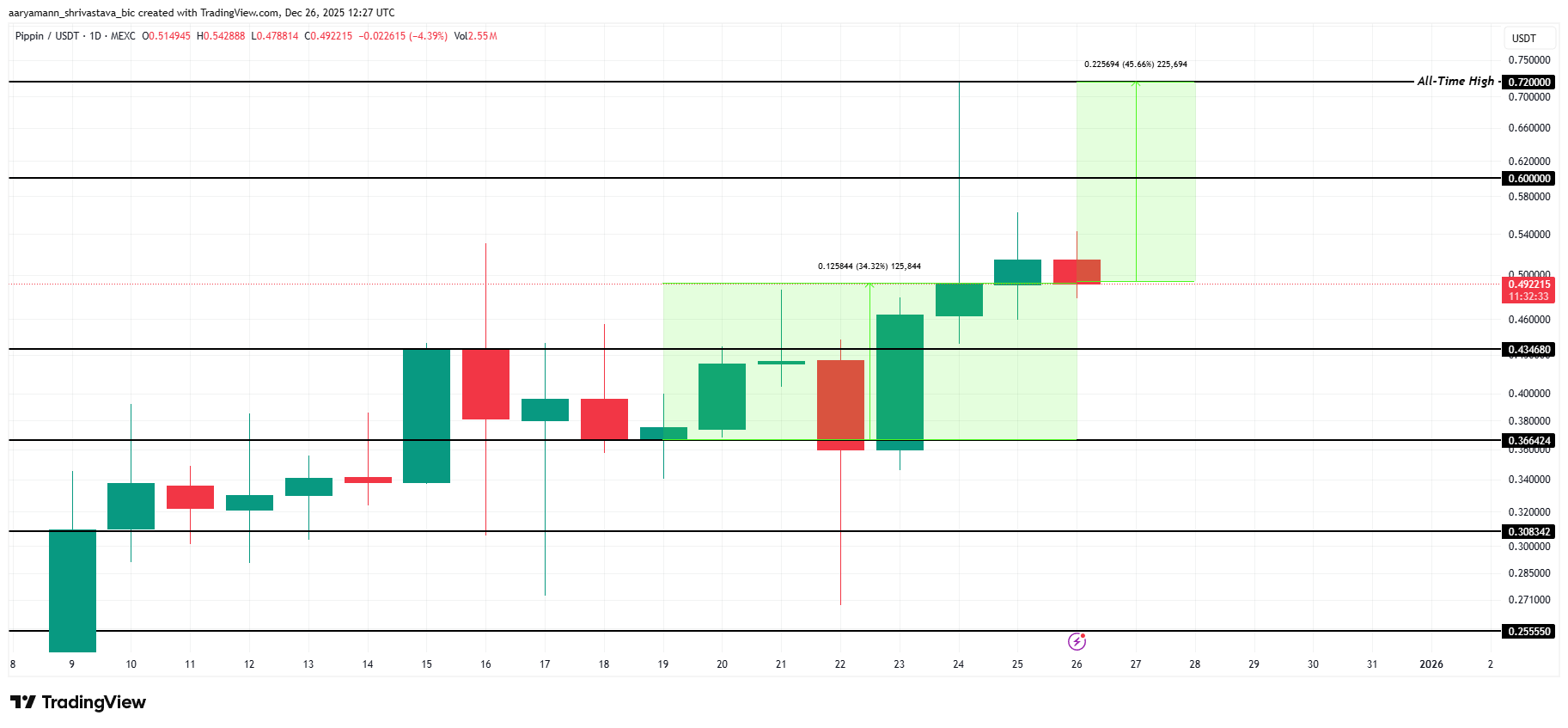

Pippin (PIPPIN)

PIPPIN has emerged as one of the strongest-performing altcoins this week, gaining 34% over the past seven days. The token continues to post fresh all-time highs on a weekly basis. Persistent buying interest and strong momentum have supported its sustained upward trajectory.

The latest all-time high stands at $0.720, with PIPPIN requiring a 45.6% move to revisit that level. Achieving this depends on flipping $0.600 into firm support. A successful hold above that zone would confirm strength and increase the probability of continued price discovery.

PIPPIN Price Analysis. Source: TradingView

PIPPIN Price Analysis. Source: TradingView

Downside risk remains if broader market sentiment turns bearish. Weakening risk appetite could push PIPPIN below the $0.434 support. A breakdown there may extend losses toward $0.366, erasing recent gains and invalidating the prevailing bullish outlook.

MYX Finance (MYX)

MYX price traded near $3.35 at the time of writing after rising 15.2% over the past seven days. The altcoin continues to hold above the $3.26 support. The current structure suggests buyers are targeting the $3.62 resistance as momentum gradually builds.

Technical indicators reinforce the bullish bias. The Relative Strength Index remains above the neutral 50.0 level, signaling sustained buying pressure. This strength could support further recovery. A confirmed breakout above $3.62 may open the path toward $3.80 in the short term.

MYX Price Analysis. Source: TradingView

MYX Price Analysis. Source: TradingView

Downside risks persist if broader market conditions weaken. Increased selling pressure could push MYX below the $3.26 support. A breakdown there would expose the $2.88 level, invalidating the bullish outlook and signaling a shift back toward short-term bearish momentum.