XRP Mildly Undervalued On MVRV: What About Bitcoin, Ethereum?

XRP is in a mild undervalued zone according to the 30-day MVRV Ratio. Here’s how other cryptocurrencies like Bitcoin and Ethereum compare.

XRP 30-Day MVRV Ratio Shows Negative Returns

In a new post on X, on-chain analytics firm Santiment has talked about how the 30-day Market Value to Realized Value (MVRV) Ratio is currently looking for the different top coins in the cryptocurrency sector like Bitcoin and XRP.

The “MVRV Ratio” is a popular indicator that keeps track of the ratio between an asset’s market cap and its Realized Cap. The latter capitalization model calculates the cryptocurrency’s total value by assuming the value of each individual token is equal to the spot price at which it was last transacted on the blockchain.

The Realized Cap can be thought of as an estimate of the capital that the investors as a whole used to purchase their tokens. In contrast, the market cap is the value that they are carrying in the present. As the MVRV Ratio takes the ratio between the two, it essentially contains information about the profit-loss balance of the investors.

In the context of the current topic, a very specific form of the MVRV Ratio is of interest: the 30-day version. This metric only tracks the profit-loss balance for the traders who got into the market during the past month.

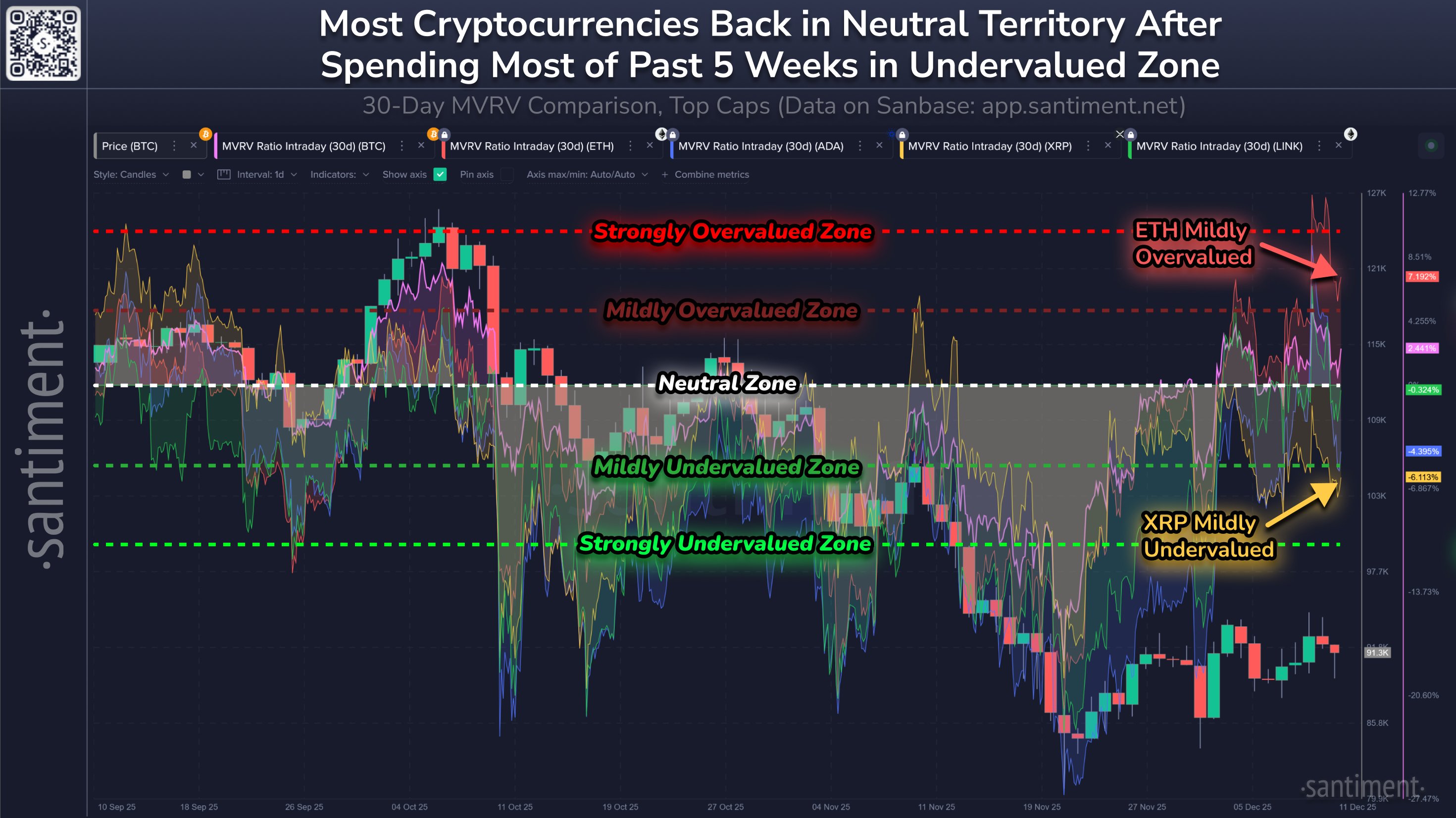

Now, here is the chart shared by Santiment that shows the trend in the 30-day MVRV Ratio for six assets: Bitcoin, Ethereum, Cardano, XRP, and Chainlink.

As is visible in the above graph, the 30-day MVRV Ratio hasn’t displayed a uniform behavior across the top cryptocurrencies, indicating that the situation of the 30-day buyers is different for the various assets.

Ethereum currently has the metric at a positive value of 7.2%. This means that market entrants from the past month are sitting on a gain of 7.2% on the network. Bitcoin also has a positive value, but at just a level of 2.4%, the 30-day traders are more-or-less breaking even.

Chainlink also has a very neutral trend with the 30-day MVRV Ratio at a value of -0.3%. Cardano 30-day traders are also in the red, but in its case, the losses are more notable at -4.4%.

Finally, new XRP investors are down 6.1%, implying that the network currently hosts the worst trader profitability. This fact, however, may not actually be negative for the cryptocurrency.

Generally, the higher investor gains get, the more likely they become to participate in a selloff with the aim of profit realization. This can make a top more probable for the asset when its MVRV Ratio is at a high level. Similarly, a deep negative value can be bullish instead, as it suggests profit-takers have probably become depleted.

In the chart, the analytics firm has defined overvalued and undervalued zones based on the 30-day MVRV Ratio. XRP is currently the only one in an undervalued zone, while Ethereum is inside a mild overbought region.

XRP Price

At the time of writing, XRP is floating around $2.04, up 1.5% over the last 24 hours.