4 Reasons December Could Be the Best Time to Start DCA Into Altcoins

The Dollar-Cost Averaging (DCA) strategy can generate losses when the market enters a downtrend. However, in certain phases, it can become highly effective when investors choose the right moment to begin.

Several factors suggest that December may be an ideal period to start this strategy. The following sections provide a detailed explanation of these factors.

4 Reasons to Start DCA Into Altcoins From December

Starting a DCA strategy does not guarantee that prices will rise after the first purchase. This approach requires proper capital allocation so investors avoid missing opportunities and secure optimal entry prices.

Altcoin Volume Decline Creates a Golden Period for DCA

The first reason comes from declining altcoin trading volume, which reflects a quiet market phase similar to previous market bottoms.

According to Darkfost’s analysis, a comparison between 30-day altcoin volume (against stablecoin pairs) and the yearly average shows that altcoins have entered a “buy zone.”

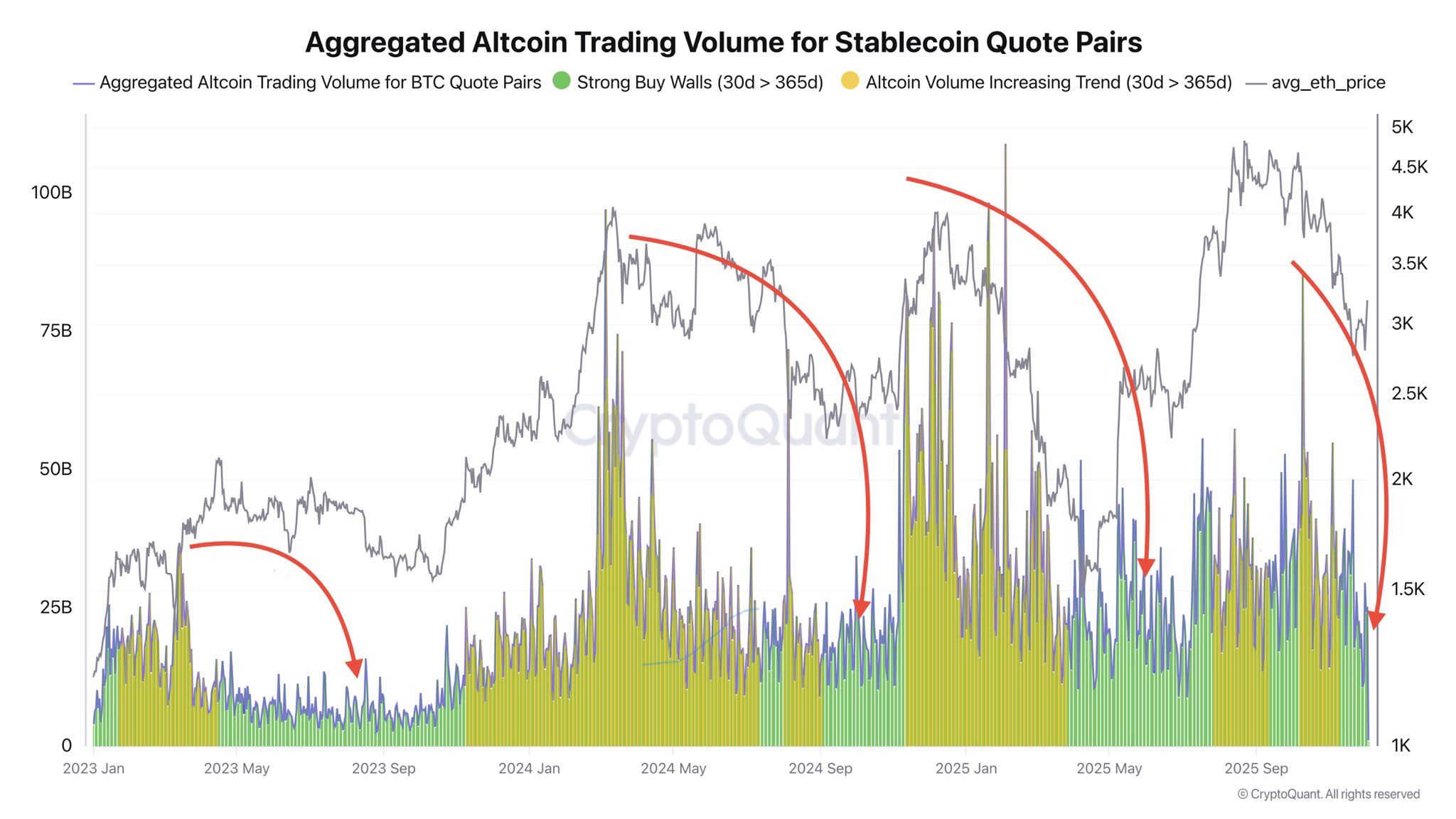

Aggregated Altcoin Trading Volume for Stablecoin Quote Pairs. Source: CryptoQuant.

Aggregated Altcoin Trading Volume for Stablecoin Quote Pairs. Source: CryptoQuant.

The chart illustrates that historical periods when 30-day altcoin volume dropped below the yearly average often marked market bottoms. These phases can persist and test investor patience.

“This is a period that encourages DCA if you’re betting on a continuation of the bullish trend. It’s a phase that can last for weeks or even months, giving enough time to optimize a DCA strategy with well-targeted entry points,” Darkfost commented.

Falling volume suggests that many sellers have already completed their selling activities, but market sentiment remains too weak for a recovery. As a result, DCA can perform well in such conditions.

Declining Social Interest Aligns With Market Bottom Conditions

The second reason stems from declining social interest, as reflected in Google Trends – a counterintuitive signal that often indicates potential speculation opportunities.

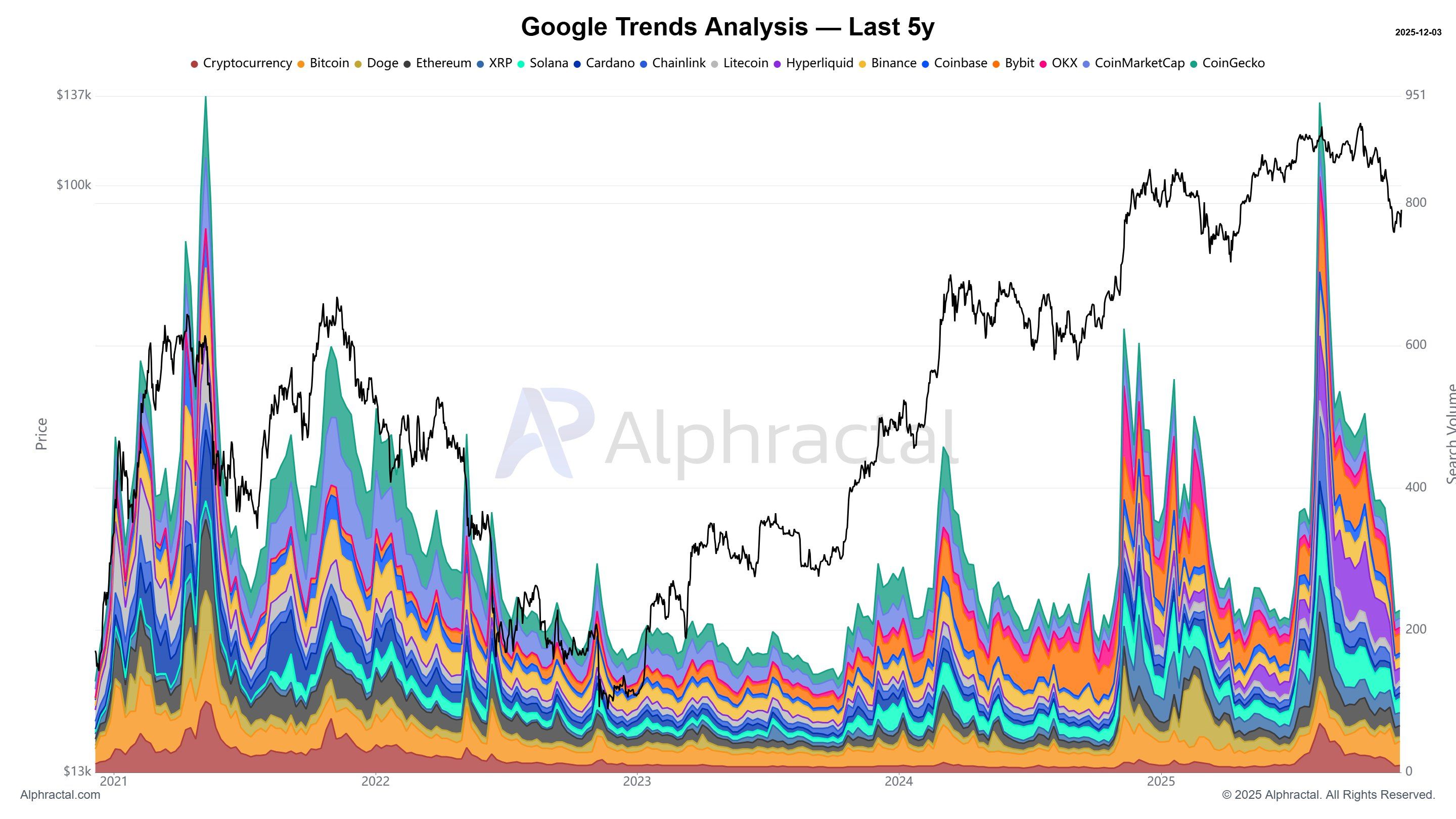

Data from Joao Wedson, CEO of Alphractal, shows that searches for crypto-related topics, major exchanges like Binance or OKX, and market trackers such as CoinMarketCap or CoinGecko have dropped 70% from the September 2025 peak.

Crypto Market Interest According to Google Trends. Source: Alphractal.

Crypto Market Interest According to Google Trends. Source: Alphractal.

“Historically, low social interest has been associated with bear markets — but ironically, these periods have also been the best times to speculate while everyone else is disengaged,” Joao Wedson said.

His reasoning aligns with the classic mindset of being greedy when others are fearful. Historical data show that declining interest typically appears near market bottoms. This behavior seems to be characteristic of the cryptocurrency market.

Santiment also notes that negative discussions across various platforms, including X, Reddit, Telegram, 4Chan, BitcoinTalk, and Farcaster, often align with market bottoms. This pattern has resurfaced recently.

95% of Altcoins Are Trading Below the 200-Day SMA

The third reason comes from technical indicators. Roughly 95% of altcoins are trading below the 200-day Simple Moving Average (SMA), a historically significant buy signal.

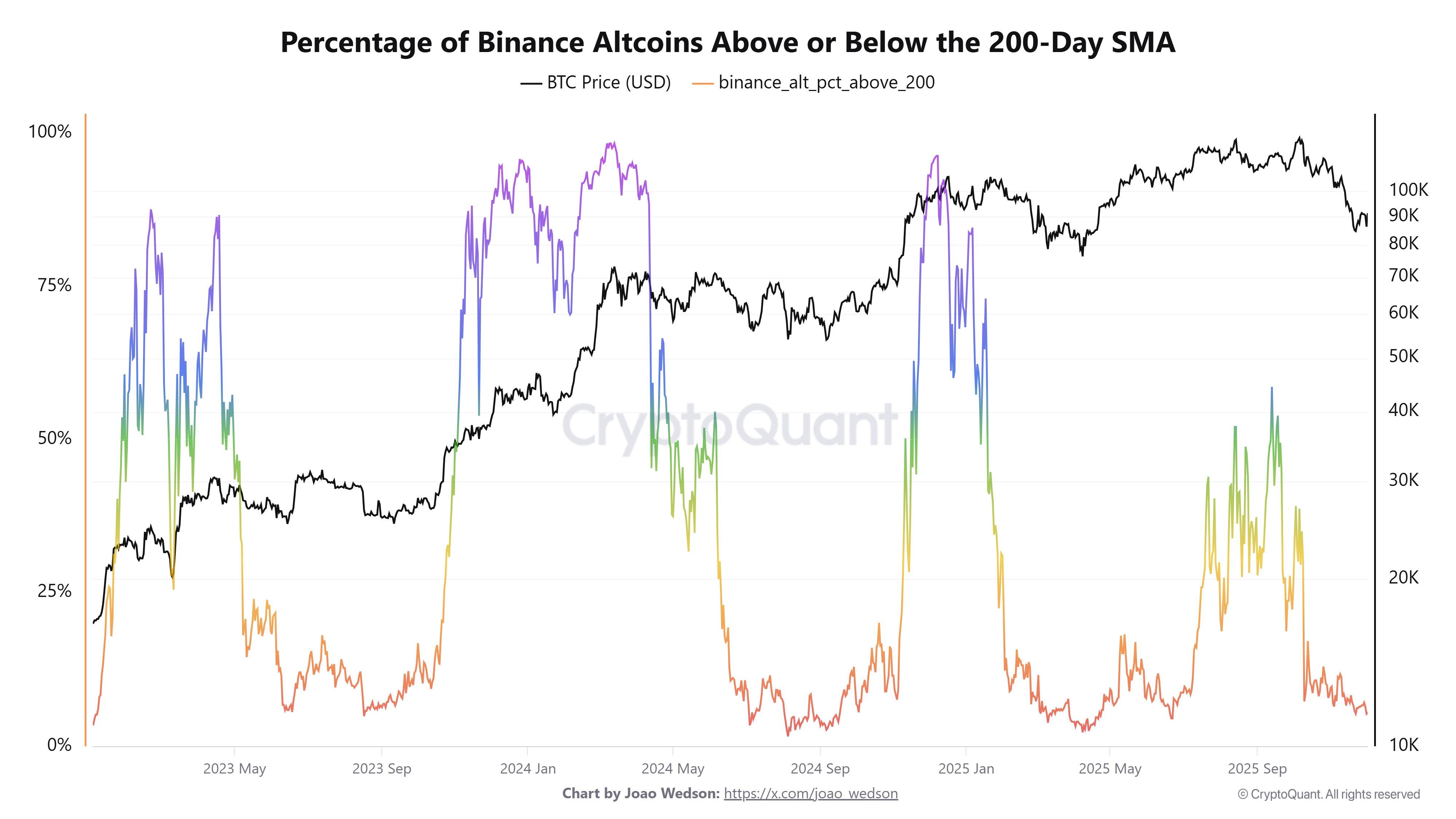

Percentage of Binance Altcoins Above or Below the 200-day SMA. Source: CryptoQuant.

Percentage of Binance Altcoins Above or Below the 200-day SMA. Source: CryptoQuant.

CryptoQuant data shows that only 5% of altcoins currently trade above the 200-day SMA. This figure reflects harsh conditions for altcoin holders, many of whom are likely experiencing losses.

Historically, when this metric drops below 5%, the market often forms a bottom and later stages strong recoveries.

From this perspective, investors who allocate capital gradually and begin DCA during such phases may generate profits after several months.

USDT Dominance Shows Signs of Correcting in December

The final reason comes from USDT Dominance (USDT.D), which reflects USDT’s share of the total market capitalization. When USDT.D decreases, it indicates that investors are using USDT to purchase altcoins.

This shift appears to be occurring in December as USDT.D pulls back from the 6% resistance zone.

CrypFlow’s observation also indicates that the weekly stochastic RSI of USDT.D confirms a bearish cross.

A recent report from BeInCrypto notes that total stablecoin market capitalization began rising again in early December after declining throughout November. This trend reflects increasing stablecoin accumulation in preparation for buying opportunities.

These four factors indicate that December presents multiple key conditions for a DCA strategy. However, choosing which altcoins to accumulate presents a separate challenge. Many experts believe the market has changed, and not all altcoins will deliver strong gains as seen in previous altcoin seasons.