BitMine Adds $60M In Ethereum as Market Recovers while $SUBBD Presale Heats Up

What to Know:

- BitMine has bought 21,537 more $ETH for about $60M, now holding over 3% of supply despite roughly $4B in unrealized losses.

- The company plans a US-based MAVAN validator network to generate staking revenue and turn its massive Ethereum stack into active infrastructure.

- SUBBD is building an AI-powered creator content platform on Ethereum, using $SUBBD for payments, rewards, and access to automated content tools.

- The $SUBBD presale combines fixed 20% staking rewards with multi-x upside forecasts, but remains a high-risk early-stage Ethereum ecosystem play.

BitMine has just grabbed another 21,537 Ethereum tokens for around $60M, even though it is already sitting on roughly $4B in unrealized losses on its $ETH stack. The company now controls more than 3% of the entire Ethereum supply, making it one of the most important non-foundation players anchoring the network.

That is not what capitulation looks like.

This fresh buy comes after Ethereum slid more than 25% in a month, putting digital asset treasuries under heavy scrutiny. $ETH is currently below $3K – hovering around $2.8K.

Yet BitMine keeps saying the drawdown is a liquidity shock, not a signal that Ethereum’s fundamentals are breaking. Instead of trimming risk, it is doubling down and preparing to turn its holdings into an active business line.

The firm has outlined plans for a US-based validator network called MAVAN (Made in America Validator Network), expected to go live next year and focused on staking Ethereum in a fully regulated model. The idea is simple: if you already own billions in $ETH, you might as well earn yield and become part of the network’s security backbone, rather than just watching price candles.

For smaller investors who cannot spin up an industrial validator farm, this kind of move still matters. If a major treasury is willing to absorb eye-watering paper losses while building out Ethereum infrastructure, it is a strong vote of confidence in the chain that underpins most of DeFi, NFTs and, increasingly, AI-focused tokens.

That is where SUBBD Token ($SUBBD) comes in, positioning itself as an AI creator platform native to Ethereum at the very moment large players are reinforcing the base layer.

That is where SUBBD Token ($SUBBD) comes in, positioning itself as an AI creator platform native to Ethereum at the very moment large players are reinforcing the base layer.

SUBBD Token Powers AI Creator Utilities on Ethereum

SUBBD is built around a straightforward idea: creators spend far too much time on admin work and not enough time actually creating. Plus they are charged management fees that eat away at any profit they make.

That’s why this project uses AI agents and automation to handle tasks like scheduling, tier management, personalized responses and analytics so that creators can focus on content while fans get a smoother experience.

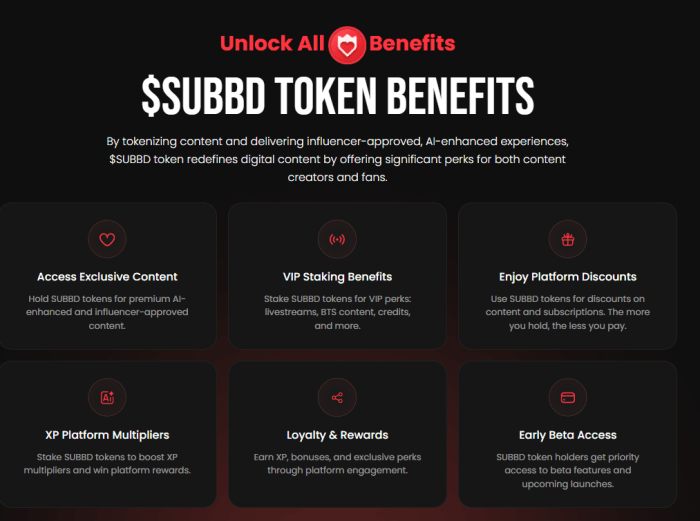

The $SUBBD token sits at the center of this ecosystem. It is used for subscription payments, tips, access to exclusive content and early access to new AI features.

The $SUBBD token sits at the center of this ecosystem. It is used for subscription payments, tips, access to exclusive content and early access to new AI features.

Holders also tap into perks such as loyalty rewards and platform benefits that are designed to keep the most engaged fans inside the ecosystem instead of bouncing between centralized platforms with high fees and opaque rules.

The project’s ecosystem potentially reaches millions of followers across roughly 2K top influencers plugged into the broader SUBBD brand.

That scale matters. If even a small percentage of those fans migrate to on-chain subscriptions and rewards, on-chain activity can build up quickly, especially on an Layer-1 like Ethereum, where BitMine and other big treasuries are reinforcing security via staking.

The project whitepaper frames SUBBD as part of the wider creator economy, which already sits around the tens of billions of dollars in annual value. By moving fan payments, perks and AI tools on-chain, the project is trying to turn a Web2-style subscription model into a tokenized system where value accrues not just to a platform, but also to token holders and active participants.

In other words, while BitMine is building ‘physical’ Ethereum infrastructure through MAVAN, SUBBD is aiming to build the application layer where human and AI ‘digital labor’ actually earns revenue.

In other words, while BitMine is building ‘physical’ Ethereum infrastructure through MAVAN, SUBBD is aiming to build the application layer where human and AI ‘digital labor’ actually earns revenue.

If Ethereum’s long-term story plays out the way BitMine is betting, creator platforms that live directly on the network are positioned to benefit from that same recovery.

SUBBD Presale, Staking Rewards And Upside Potential

The SUBBD presale is still live, with more than $1.36M already committed and the current token price at $0.057025.

The sale uses incremental price steps, with a final presale rate above current levels, so early buyers effectively lock in a small discount before any exchange listings. Learn how to buy $SUBBD now to get in early.

On top of that, the team is offering a fixed 20% staking reward during the presale phase. The goal here is not only to give holders passive income in $SUBBD, but also to reduce immediate sell pressure by rewarding those who lock their tokens rather than flipping them at the first listing.

Our $SUBBD price prediction maps a potential high of around $0.668 by the end of 2026. From the current presale level of $0.057025, that implies roughly a 12x upside.

Our $SUBBD price prediction maps a potential high of around $0.668 by the end of 2026. From the current presale level of $0.057025, that implies roughly a 12x upside.

Compared with BitMine’s strategy of squeezing mid-single digit staking yields from a massive Ethereum position, smaller investors are clearly hunting for higher-gear exposure.

A focused application token like $SUBBD links directly to a specific use case in the AI creator economy, while still inheriting the macro thesis that Ethereum remains the settlement layer of choice.

Join the SUBBD Token presale before the next price hike.

Disclaimer: This article is informational only, not financial advice; presales are speculative, illiquid, and you should be prepared for total capital loss.

Authored by Aaron Walker for NewsBTC – https://www.newsbtc.com/news/bitmine-60m-ethereum-buy-subbd-token-ai-creator-presale