Ripple Price Forecast: XRP could drop below $2.00 as the crypto market weakens

- XRP struggles to recover from support at $2.10 amid risk-off sentiment.

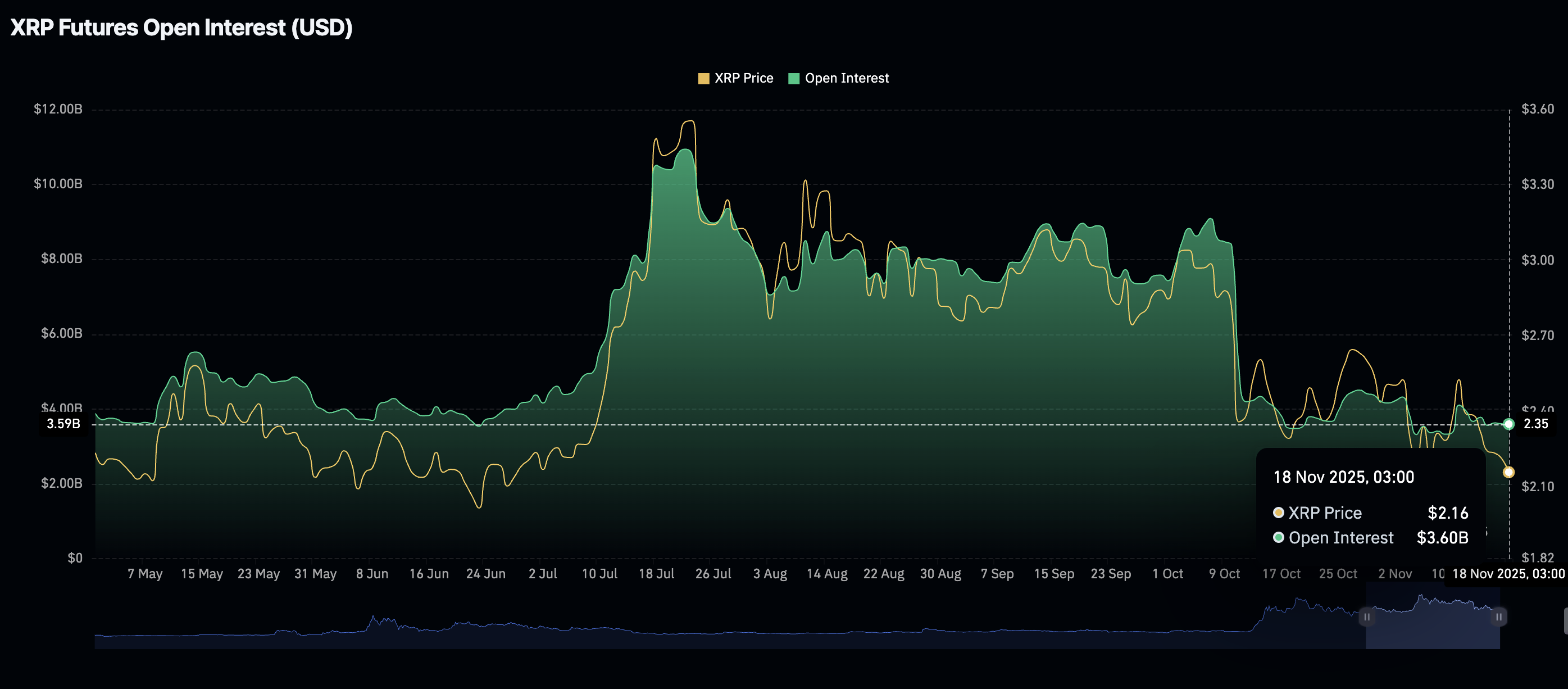

- Retail demand for XRO remains significantly low with futures Open Interest at $3.78 billion.

- A downward trending RSI and a MACD sell signal underscore the weak technical structure.

Ripple (XRP) is trading above its short-term support at $2.10 at the time of writing on Tuesday as uncertainty takes root in the broader cryptocurrency market.

Low retail and institutional demand, the lack of strong price catalysts, and sticky risk-off sentiment are among the factors weighing on the cross-border remittance token.

Since October’s interest rate cut, sentiment has dimmed, as investors in riskier assets price in the possibility of a pause on monetary policy easing in the next Federal Reserve (Fed) meeting on December 10.

Fed Chair Jerome Powell said during the policy meeting in November, which saw a 25-basis-point rate cut to a range of 3.75% to 4.00%, that further easing this year was not a guarantee.

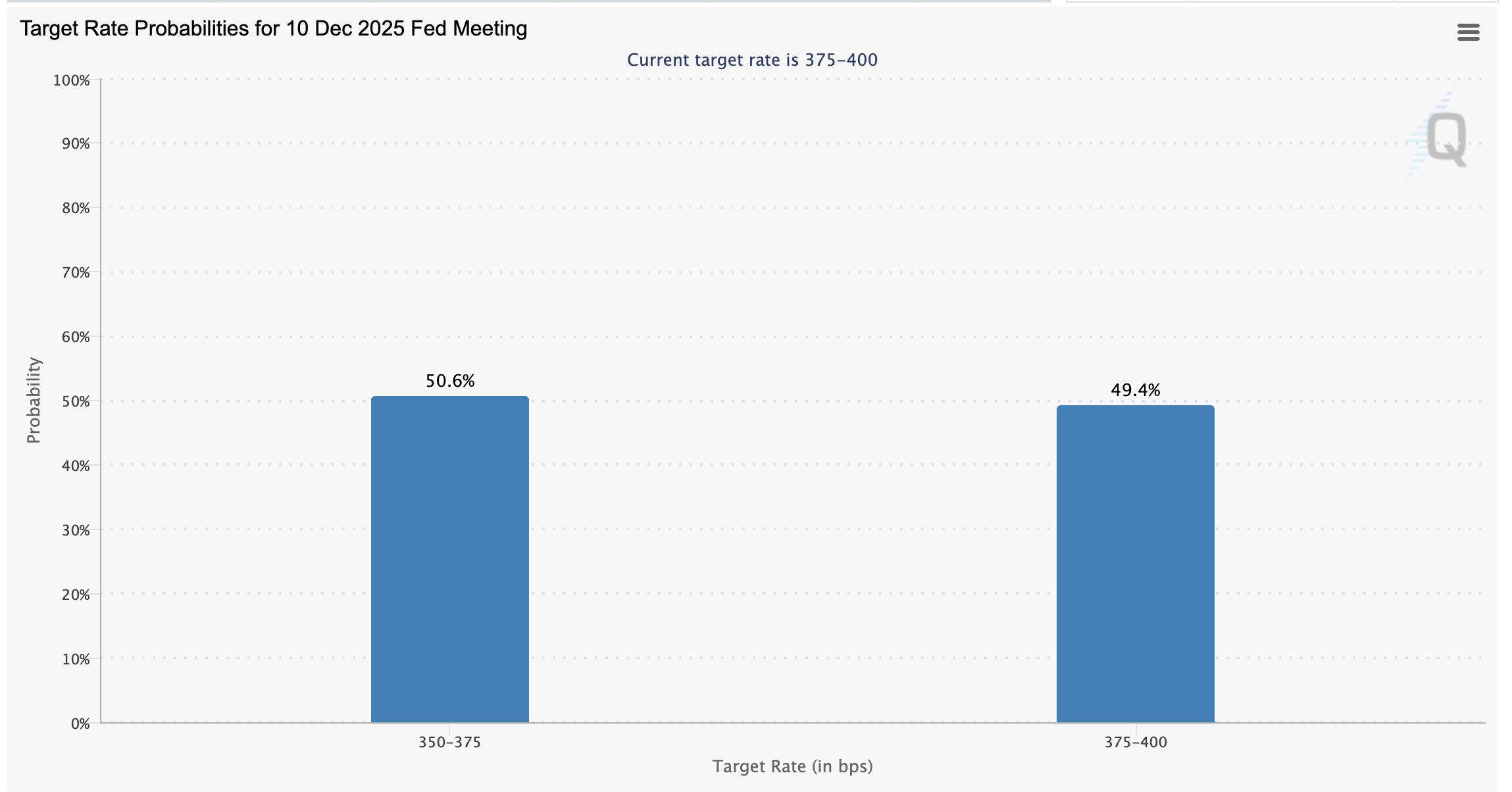

According to CME Group’s FedWatch Tool, the market is split between expecting another 25-basis-point cut or a pause. Approximately 50.6% of market participants expect the Fed to go ahead with the rate cut, while 49.4% anticipate a pause, leaving the rate unchanged in the range of 3.75% to 4.00%.

XRP weakens as retail demand shrinks

XRP futures Open Interest (OI) highlights a weak derivatives market averaging $3.6 billion on Tuesday. Since OI represents the notional value of outstanding futures contracts, sideways movement suggests muted interest. Traders are less convinced that XRP can sustain recovery in the short term. They are reducing their exposure to risk or staying on the sidelines, which contributes to selling pressure and risk-off sentiment.

Technical outlook: XRP recovery could stall further

XRP hovers above support at $2.10 at the time of writing on Tuesday as bulls struggle to gain control. The Relative Strength Index (RSI) at 38 on the daily chart is showing early signs of stability. If the RSI rebounds toward the bullish zone, it could help strengthen XRP’s short-term bullish outlook.

However, traders should be cautiously optimistic, considering the Moving Average Convergence Divergence (MACD) indicator has maintained a sell signal since Sunday, which may continue to call for risk-averse action among investors.

XRP also sits below key moving averages, including the 50-day Exponential Moving Average (EMA) at $2.49, the 200-day EMA at $2.55, and the 100-day EMA at $2.59, which emphasize the bearish sentiment. Key areas of interest for traders are $2.07, which was tested on November 4, and $1.90, tested in June.

Still, if investors identify key entry zones and increase exposure in upcoming sessions, XRP could steady its recovery toward the 50-day EMA at $2.49.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.