Best Crypto Under $1 to Watch as Whales Buy Bitcoin ETF Dip

What to Know:

- Bitcoin ETFs have seen significant outflows, yet whales are purchasing, signaling long-term demand.

- Projects like Bitcoin Hyper and Maxi Doge show strong presale activity and innovative features.

- TRON continues to stand out with real-world utility and a well-established market presence.

- The market is ripe for undervalued cryptos, with many positioned for potential gains post-selloff.

The crypto market is currently in a state of flux, with major shifts in investor sentiment as Bitcoin ETFs experience notable outflows.

In conversation with MarketWatch, Julio Moreno, CryptoQuant’s head of research, discussed how holdings in Bitcoin ETFs have seen a drastic drop, from 441K $BTC in October to 271K $BTC in November.

And data now shows four consecutive days of outflows. Retail investors seem to be avoiding this downturn; however, whales are stepping in with significant purchases.

For example, a recent $31.16M Ethereum purchase in a single day has captured the market’s attention. Meanwhile, CryptoQuant posted about the ‘Biggest $BTC Accumulation… in the Middle of a Selloff,’ signaling long-term demand for the asset.

This shift in market dynamics presents a unique opportunity for investors to keep an eye on undervalued cryptos, especially the best crypto under $1, which may offer substantial growth potential once the market recovers.

With whale activity and strong long-term demand driving the market, certain crypto projects are poised to deliver impressive gains. Bitcoin Hyper ($HYPER), Maxi Doge ($MAXI), and TRON ($TRX) are three promising cryptocurrencies under $1 that could benefit from the upcoming market rebound.1. Bitcoin Hyper ($HYPER): Hyper-Speed Bitcoin is Here

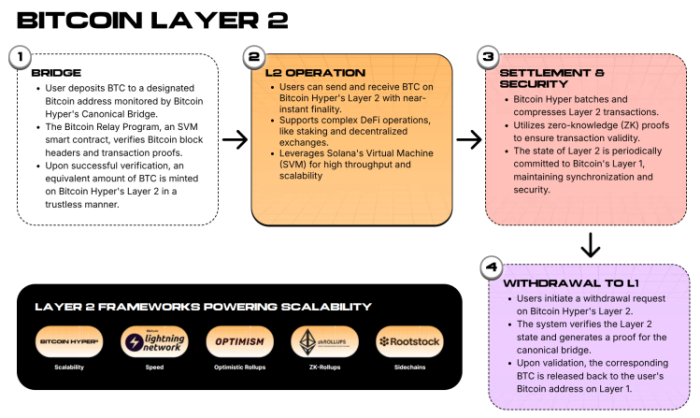

Tired of Bitcoin’s slow speeds and high fees? Bitcoin Hyper ($HYPER) is the next-generation Layer-2 solution designed to transform the world’s most secure asset from a static store of value into a dynamic, programmable ecosystem.

By integrating the high-throughput Solana Virtual Machine (SVM), $HYPER unleashes Bitcoin’s true potential, enabling near-instant transactions and minimal fees.

This breakthrough paves the way for a fully functional Bitcoin DeFi world, supporting smart contracts, staking, and dApps without sacrificing Bitcoin’s legendary security.

With over $27M raised in a wildly successful presale, the market has clearly signaled its demand for faster, cheaper $BTC utility. $HYPER is not competing with Bitcoin; it’s upgrading it, offering the speed of a modern blockchain while settling securely on the original L1.

Position yourself at the forefront of the new Bitcoin economy; the future is hyper-fast. Still want more info though, check out our ‘What is Bitcoin Hyper’ guide for a full project run down.

With Bitcoin ETFs in the news, Bitcoin Hyper stands to benefit from the growing interest in Bitcoin-related investments. The project’s alignment with the ongoing market trends makes it a prime candidate for those looking to invest in a project with both short-term potential and long-term growth.

Invest in Bitcoin Hyper now for $0.013295 and don’t miss the 41% staking rewards.2. Maxi Doge ($MAXI): The 1000X Leverage Lifestyle Token

Forget the quiet, wholesome meme coins, Maxi Doge ($MAXI) is the crypto market’s new gym-bro degen mascot, embodying the relentless hustle and high-leverage energy of the bull market. $MAXI is not just a token; it’s a lifestyle rooted in green candles, gym reps, and the pursuit of maximal gains.

This meme-powered coin provides more than hype. It features a live staking mechanism offering attractive APYs (currently 76%) to early investors, locking up supply and rewarding long-term conviction.

Furthermore, the roadmap includes integration into futures trading platforms and weekly trading competitions, giving $MAXI a utility edge that elevates it above traditional meme coins. Sounds good and want in? Check out our ‘How to Buy Maxi Doge’ guide for all the details on getting started.

With its presale raising over $4M, Maxi Doge is rallying a community ready to dominate the charts. It’s a high-octane blend of viral appeal and practical utility, built for traders who embrace the ‘never skip leg-day, never skip a pump’ mentality. Get your reps in $MAXI is set to pump!

Buy $MAXI today for $0.0002685.3. TRON ($TRX): The High-Speed Engine for Global Web3 Adoption

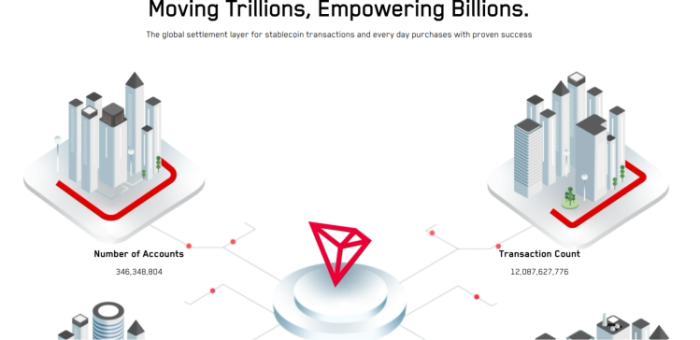

TRON ($TRX) is the powerhouse layer-1 blockchain dedicated to building a truly decentralized internet. Born from the vision of empowering content creators and challenging centralized web monopolies, TRON has evolved into a global settlement layer known for its blazing speed and near-zero transaction fees.

Leveraging a Delegated Proof-of-Stake (DPoS) consensus, the TRON network handles thousands of transactions per second, making it significantly faster and cheaper than many legacy blockchains.

This performance has fueled its dominance in the global stablecoin market, hosting the largest circulating supply of $USDT, and making it the top choice for daily payments and remittances worldwide.

$TRX is the fuel for this massive ecosystem, used for governance, staking, and interacting with thousands of dApps spanning DeFi, GameFi, and NFTs.

By prioritizing accessibility and high throughput, TRON is actively bridging the gap between traditional finance and the decentralized web, welcoming the next billion users into the crypto space.

Buy $TRX on major exchanges like Binance.Recap: As Bitcoin ETFs experience a dip, whales are stepping in, and now is the time to look for undervalued cryptos with high potential. Projects like Bitcoin Hyper, Maxi Doge, and TRON are well-positioned to capitalize on the market’s recovery, each offering unique opportunities for long-term growth.

Remember, this isn’t intended as financial advice, and you should always do your own research before investing.

Authored by Aaron Walker, NewsBTC — https://www.newsbtc.com/news/dogecoin-might-rise-to-1-as-best-meme-coins-like-maxi-soar-2