This Bitcoin Sell Signal Flashes For The First Time Since 2021 — What’s Happening?

The sentiment around Bitcoin and the general crypto market appears to be worsening, with most large-cap assets on a decline in recent days. On Friday, September 14, the flagship cryptocurrency fell below the $95,000 mark for the first time in over six months.

Interestingly, the price of Bitcoin seems set for an even longer period of negative action, as a rare bearish signal has gone off for the first time in four years. Here’s how much the BTC price dropped the last time this happened.

BTC Price At Risk Of 70% Decline If Sell Signal Holds

In a recent post on the social media platform X, Chartered Market Technician Tony Severino shared an alarming outlook for the Bitcoin price in the long term. According to the crypto expert, the rare sell signal on the BTC weekly supertrend has gone off again.

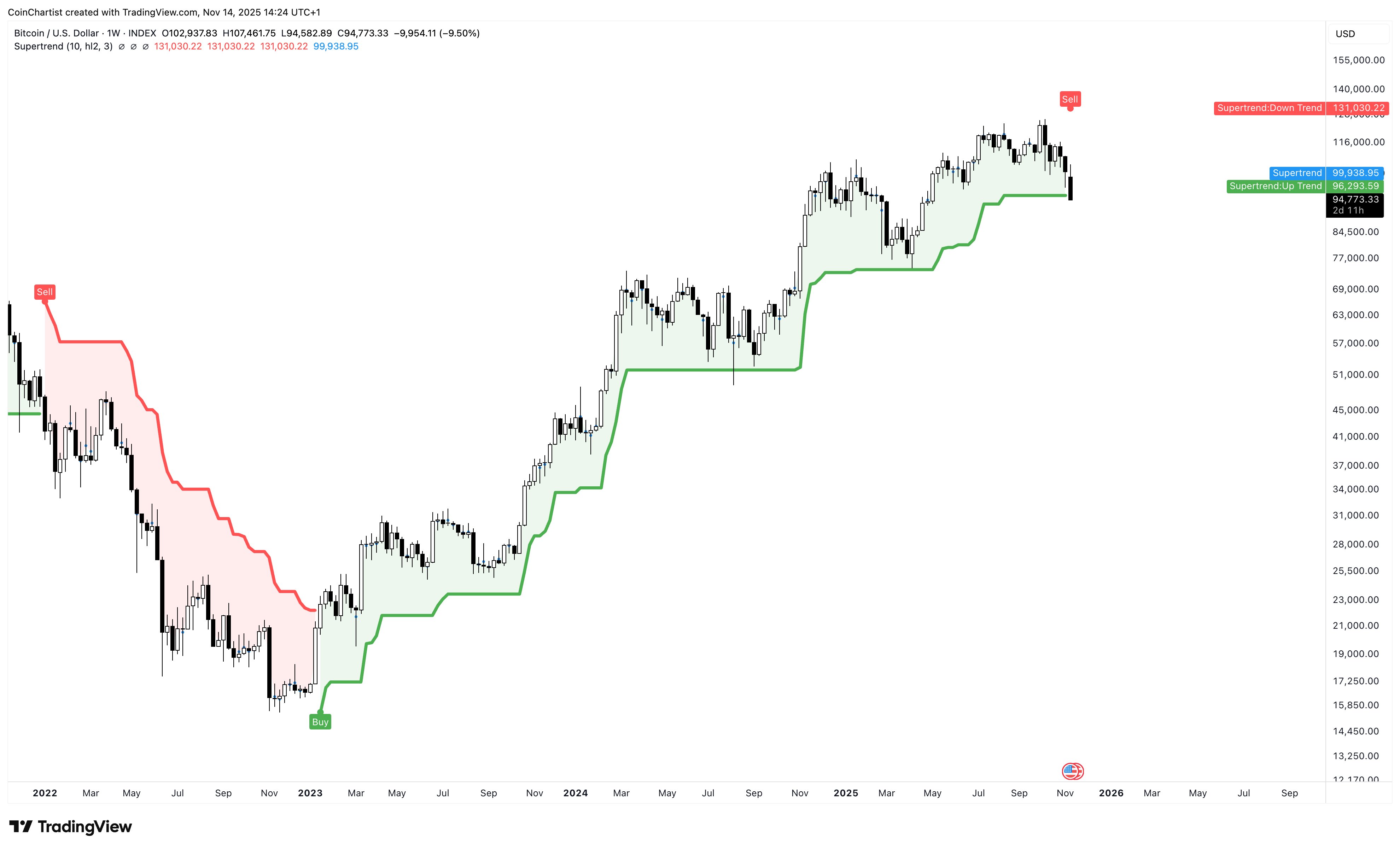

The “weekly supertrend” is a technical indicator that uses the Average True Range (ATR) and a multiplier to pinpoint the direction of an asset’s price trend over a weekly timeframe. As observed in the chart below, the indicator turns green for an upward trend and red for a downward trend, offering potential buy and sell signals.

In his Friday post on X (formerly Twitter), Severino highlighted that Bitcoin just triggered a sell signal on the Supertrend indicator on the weekly timeframe. According to the prominent crypto pundit, this represents the first time this signal will be going off for the premier cryptocurrency since December 2021.

At the time, the sell signal marked the abrupt end of the previous Bitcoin bull cycle, preceding an extended period of downward price movement. The price of Bitcoin fell by more than 70% after this signal was triggered, coinciding with significant sell-offs following the Terra LUNA and FTX collapses in 2022.

If history is anything to go by, this sell signal foretells a story of a potential 60 – 70% decline for the Bitcoin price. A downturn of that magnitude could see the market leader return to around $30,000 from the current price point.

However, it is worth noting that the weekly supertrend sell signal is currently still unconfirmed. While the indicator has been in a buy signal since January 2023, a weekly price close below $96,300 could spell the start of a bear market for Bitcoin.

Bitcoin Price At A Glance

As of this writing, the price of BTC sits just above $94,400, representing an over 6% decline in the past 24 hours.