Ethereum Price Forecast: Whales accelerate buying pressure amid price weakness

Ethereum price today: $3,410

- A key whale has accumulated $1.38 billion in ETH over the past ten days.

- Holders with a balance of 10K-100K ETH also increased their collective balance by 180K ETH over the past week.

- ETH faces resistance at the 200-day EMA.

Ethereum (ETH) trades around $3,400 on Wednesday as a key whale continues to use leverage to accelerate its accumulation of the top altcoin.

Whales stack up Ethereum as price fails to rise

A key Ethereum whale has accumulated over $1.38 billion in ETH over the past 10 days, according to data from Arkham Intelligence.

After adding another $105 million in ETH to its holdings, the whale is also borrowing $270 million from the decentralized lending platform Aave to potentially expand its ETH position.

The entity holds 228.39K ETH in loaned positions worth about $818.6 million and 157.32K ETH in direct spot holdings worth $563.8 million, at the time of publication on Wednesday.

Other onchain platforms and smart money trackers also reveal a similar sentiment among large holders.

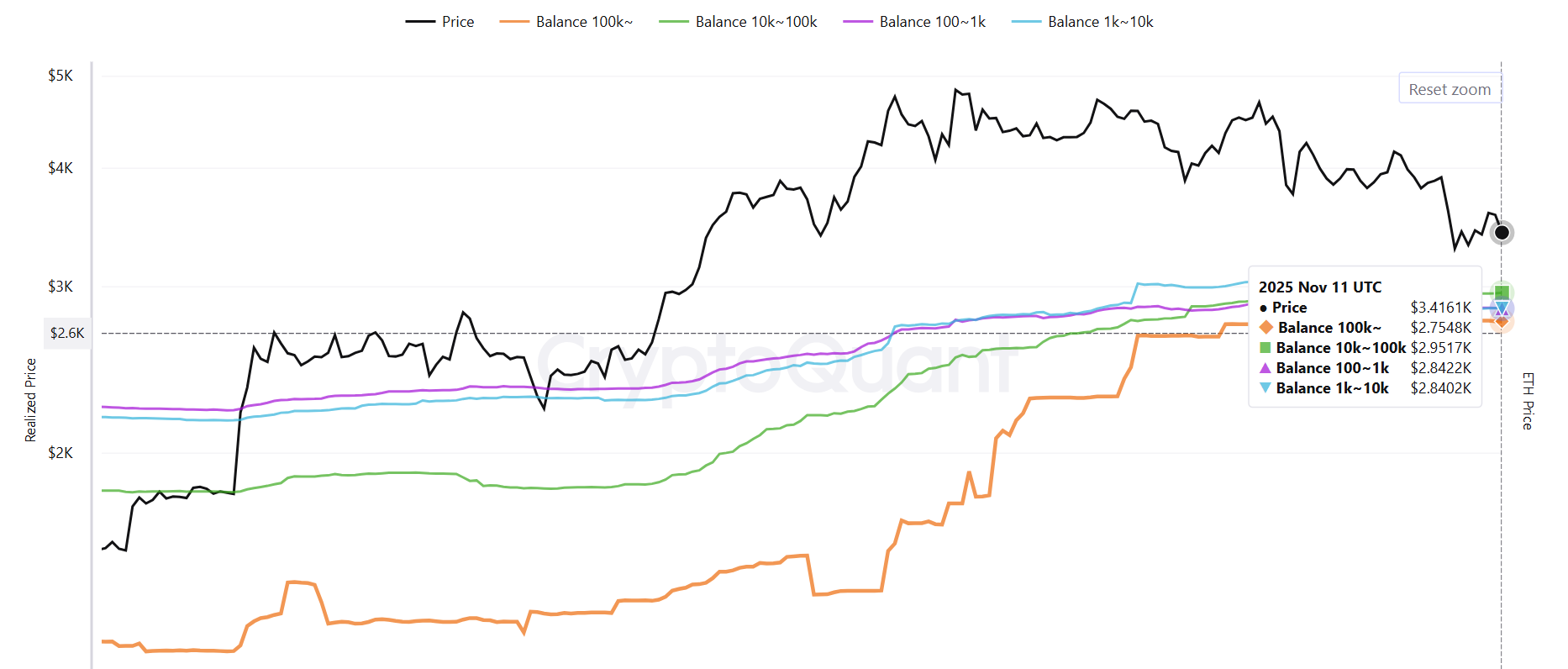

Ethereum whales with a balance of 10K-100K ETH continued accumulation over the past week, CryptoQuant data shows. Despite the general weakness in the top altcoin's price, this cohort added 180K ETH in the past week, sending their collective holdings to 22.34 million ETH.

However, with uncertainty and cautious sentiment lingering over the crypto market, it's important to watch their cost basis at $2,950, just below the $3,000 key level. Historically, selling pressure often accelerates if this cohort is unable to defend prices from falling below their average purchase price.

Meanwhile, US spot Ethereum exchange-traded funds (ETFs) have failed to gain momentum, recording net outflows of $107.1 million on Tuesday, per SoSoValue data. On the other hand, BTC ETFs saw inflows of $523.9 million, their largest since October 7. The flows indicate institutional investors could be rotating to Bitcoin.

Ethereum Price Forecast: ETH faces 200-day EMA resistance

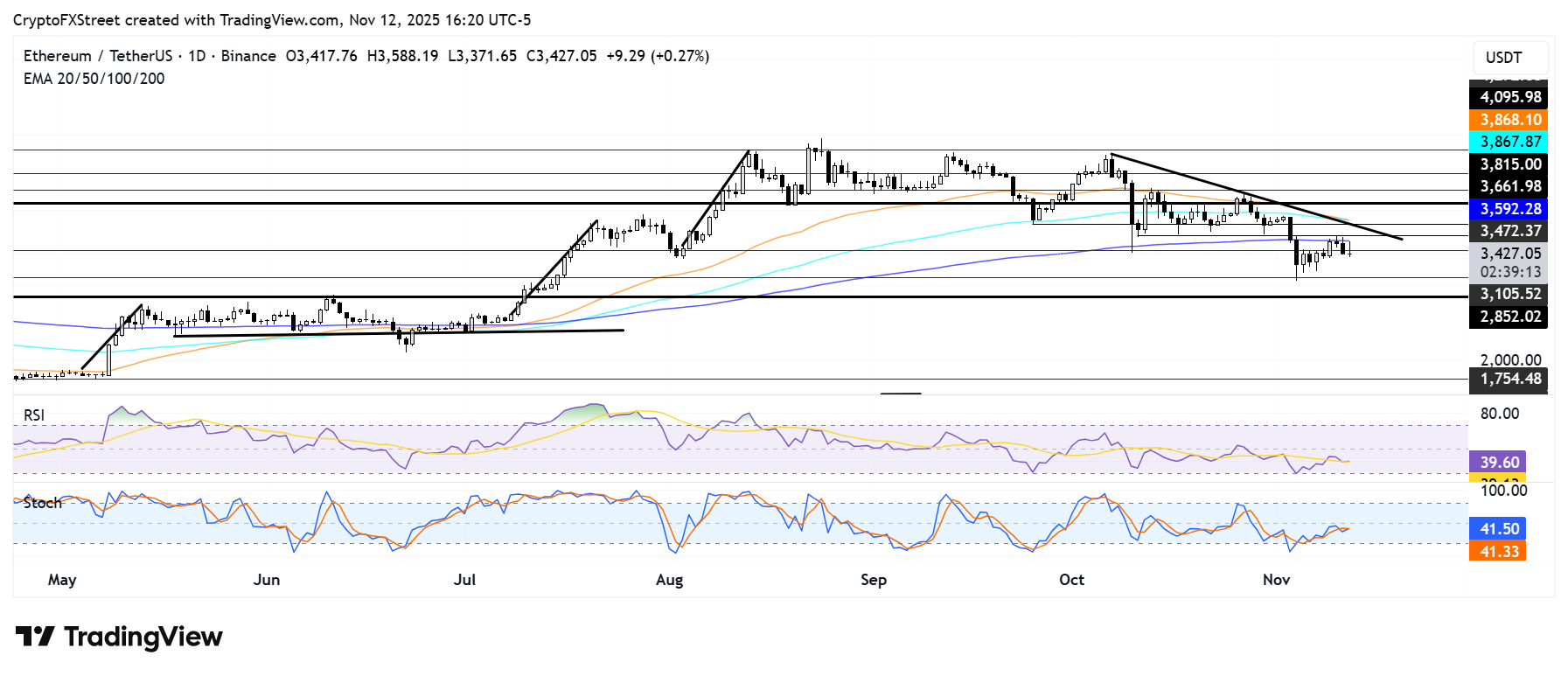

Ethereum has seen $153.1 million in liquidations over the past 24 hours, led by $122.8 million in long liquidations, according to Coinglass data.

ETH saw a rejection at the 200-day Exponential Moving Average (EMA) — just below the $3,660 resistance — on Wednesday. The top altcoin has now declined below the $3,470 key level. If ETH fails to recover $3,470, it could fall further toward $3,100. A decline below $3,100 could send prices toward the $2,850 key support.

On the upside, if ETH rises above $3,660, it faces a descending trendline resistance near the confluence of the 50-day and 100-day EMAs.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, indicating a dominant bearish momentum. A cross above their neutral levels indicates a switch toward bullish dominance.