Monero Price Forecast: XMR recovers midweek amid lower retail interest

- Monero recovers over 4% so far on Wednesday, aiming for its first bullish candle of the week.

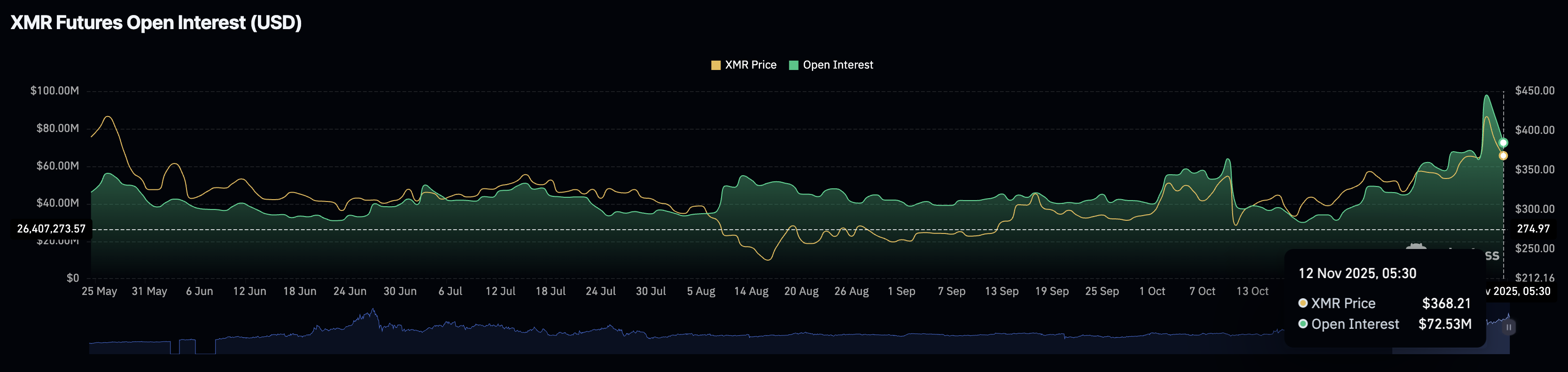

- A pullback in XMR futures Open Interest indicates lower retail interest.

- The technical outlook remains mixed, as the MACD risks a bearish crossover, while the RSI holds above the midline.

Monero (XMR) price surges by more than 4% at press time on Wednesday, breaking the streak of two consecutive days of losses. The privacy coin rebound lacks the support of retail interest, which is still low after the rough start to the week. The technical outlook for XMR remains mixed as buying pressure softens.

Trading volume holds steady as retail interest wobbles

Monero has experienced a pullback in retail interest so far this week, following last week’s surge in demand for privacy coins. CoinGlass data shows the XMR futures Open Interest (OI) is at $72.53 million, down from $97.98 million on Monday. The downward slope in XMR futures OI indicates a loss of risk appetite among traders, who are adopting a wait-and-see approach.

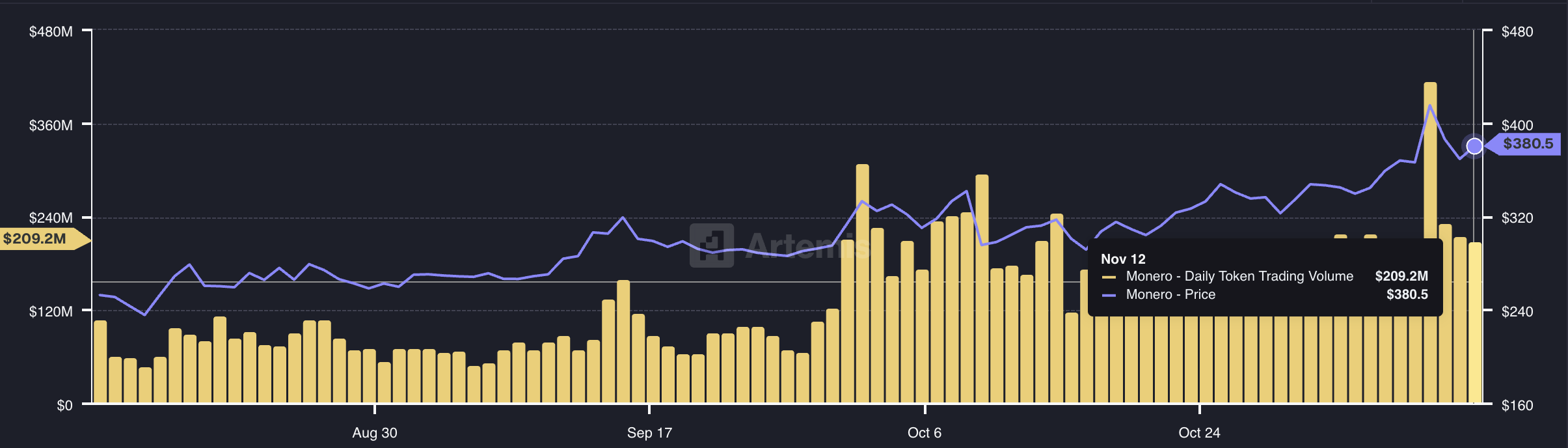

Despite the declining demand in the derivatives market, the spot trading volume of Monero has held above $200 million since Sunday. This indicates a steady interest in the spot market as the riskier derivatives segment suffers capital withdrawal.

Monero rebounds from crucial crossroads

Monero holds ground above $350 with a bounce back of over 4% by press time on Wednesday, with bulls aiming to reclaim the $400 mark. The privacy coin rally from last week failed to sustain a daily close above the $419 peak from May 26, resulting in this week’s rough start.

If the XMR recovery surfaces above $400 for a successful close above $419, it could face opposition from the $471 high from Sunday, followed by the all-time high of $518, recorded on May 7, 2021.

However, the momentum indicators on the daily chart flash mixed signals as the Relative Strength Index (RSI) at 60 hovers above the midline, maintaining a neutral to bullish level.

Still, the Moving Average Convergence Divergence (MACD) struggles to keep an uptrend above the signal line, risking a crossover. If the MACD blue line crosses below the red, it would signal a renewed bearish momentum.

If Monero slips below $350, the rising 50-day Exponential Moving Average at $332 would serve as the immediate line of defense.