Bitcoin Treasuries Face Capital Shock as Falling Prices Erase Gains

Crypto-focused treasury companies are facing renewed strain as the latest market downturn erodes asset values and erases equity cushions that once appeared durable.

In a November 7 post on X, crypto analysis platform CryptoQuant reported that falling token prices have narrowed financial buffers across the sector. That contraction has weakened company valuations, pushing several treasuries to adopt defensive balance-sheet moves in an effort to reassure shareholders.

Bitcoin Treasuries Lean Into Caution as Losses Deepen

According to the report, Bitcoin-heavy firms are absorbing the sharpest losses. BTC has fallen more than 16% this month and briefly slipped under the $100,000 mark, and that pressure has rippled directly into corporate portfolios.

For context, Strategy, the largest corporate holder of Bitcoin with more than 675,000 BTC, has seen its purchases slow sharply in recent months. The company has shifted from buying thousands of coins to only a few hundred.

Market analysts say the softer buying pace reflects the combined weight of Bitcoin’s slide and Strategy’s weaker equity performance.

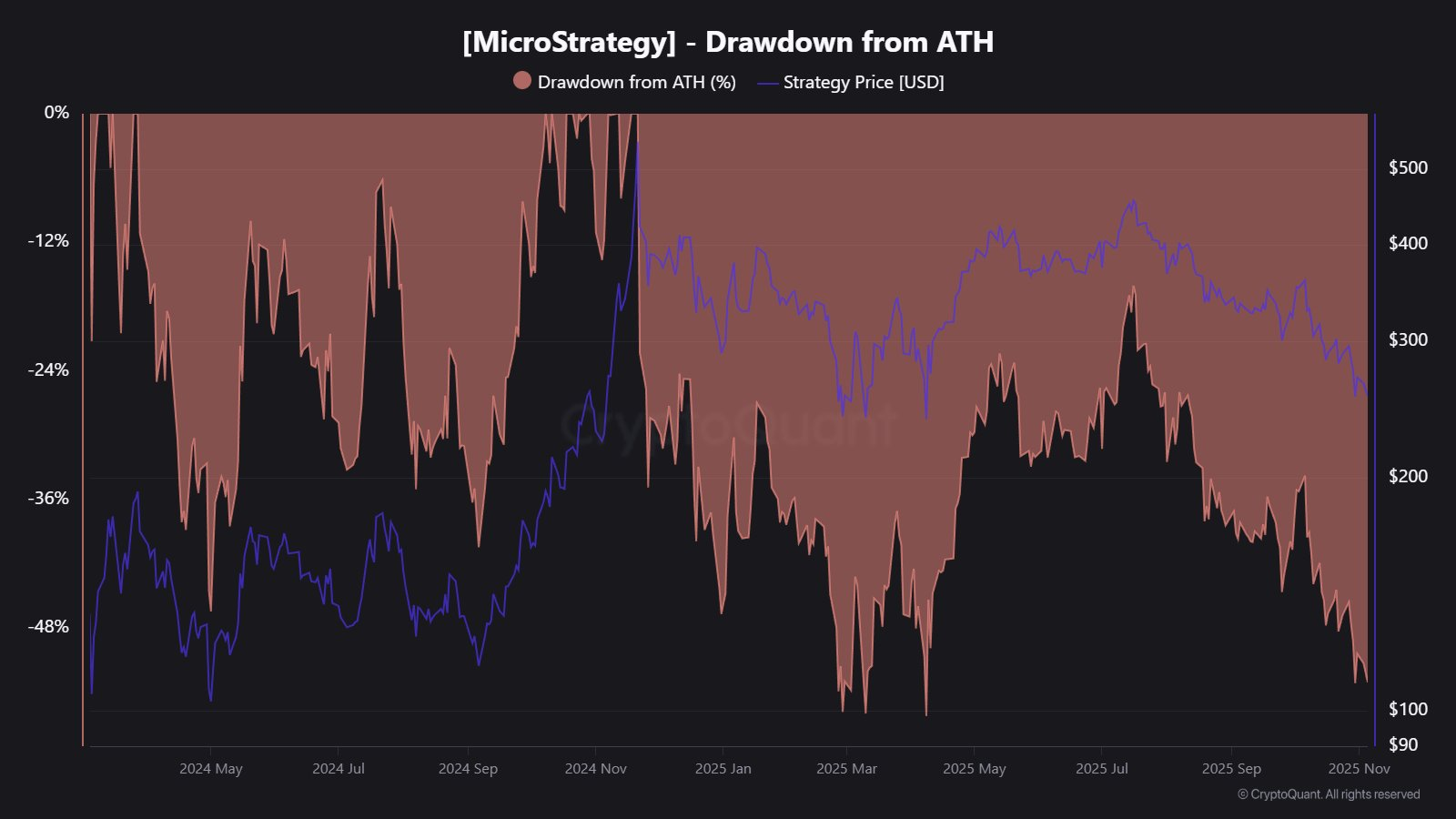

As a result, the shift has coincided with a reversal in its MSTR stock price, which has dropped roughly 53% from its all-time high to about $241.93.

MicroStrategy’s MSTR Price Performance. Source: CryptoQuant

MicroStrategy’s MSTR Price Performance. Source: CryptoQuant

At the same time, Metaplanet, listed on the Tokyo Stock Exchange, finds itself in a similar position.

The company holds 30,823 BTC at an average cost basis of $106,000, leaving it with more than $120 million in unrealized losses at current prices

As a result, its stock has dropped by more than 80% from its peak, compressing market net asset value and prompting a share buyback program designed to restore confidence.

Altcoin Treasuries Absorb Steep Markdowns

Altcoin-focused treasury companies are also feeling the pressure, as the broader market downturn drives steep markdowns across their portfolios.

Their positions have weakened alongside sector-wide declines, adding another layer of strain to an already stressed treasury landscape.

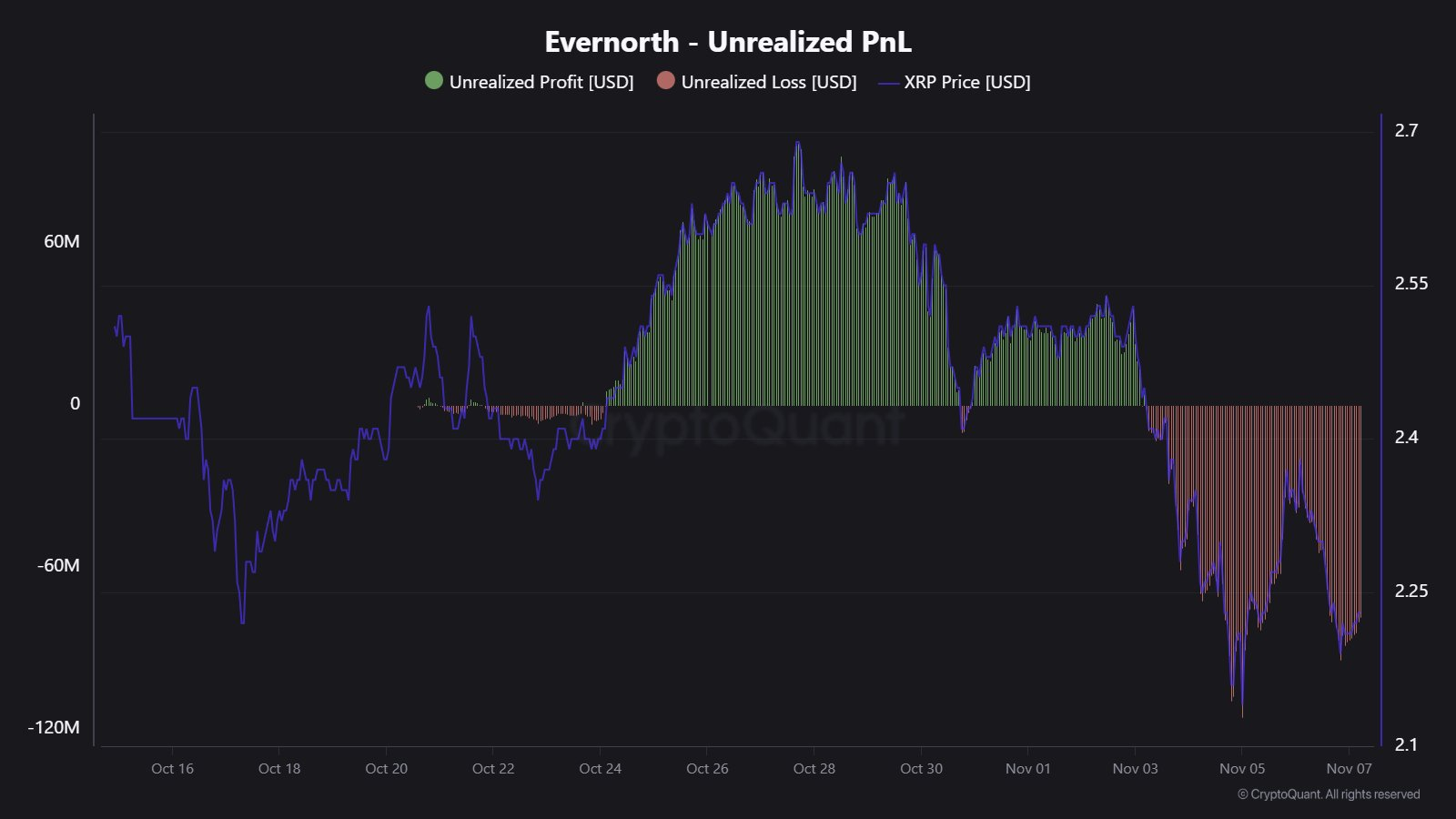

Evernorth, the largest corporate holder of XRP, began accumulating the token in mid-October. However, its 388.7 million XRP tokens are now in an unrealized loss of approximately $79 million.

Evernorth’s Profit and Losses. Source: CryptoQuant

Evernorth’s Profit and Losses. Source: CryptoQuant

On the other hand, BitMine, the largest Ethereum treasury with more than 3.4 million ETH, is facing even deeper losses.

Ethereum’s recent decline of over 22% in the past month has pushed the company’s unrealized deficit to roughly $2.1 billion.

BitMine’s Ethereum Holdings. Source; CryptoQuant

BitMine’s Ethereum Holdings. Source; CryptoQuant

Analysts say the scale of these drawdowns underscores a recurring structural risk where companies that build positions during periods of strength often experience the fastest erosion of capital when sentiment reverses.

This is in congruence with previous warnings that digital-asset accumulation carries risks that not every firm can absorb.

Considering this, firms now face a sharper test of resilience as they work to maintain long-term conviction in digital assets while absorbing near-term financial pressure. That tension is likely to shape treasury decisions well into next year.