Is Palantir Stock Still a Buy? Wall Street Is Telegraphing a Clear Answer

Key Points

Palantir's third-quarter earnings were a masterpiece from a business performance standpoint.

Despite the stellar report, the stock is selling off.

This could be the beginning of a lesson about the weight of expectations when valuations run too hot.

- 10 stocks we like better than Palantir Technologies ›

Palantir Technologies (NASDAQ: PLTR) has arguably been the hottest stock in the artificial intelligence (AI) boom.

Shares traded at just $6 a few years ago but changed hands above $200 at the beginning of November. That is enough to be a life-changing investment return for those who held onto the stock through the volatility.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The stock's remarkable ascent reflects an underlying business that has continually raised the bar with one impressive earnings report after another. However, shares are selling off following the company's third-quarter earnings report.

Is Palantir still a buy, or has the music stopped for this AI stock? Wall Street could be trying to send a message, and here's why.

Image source: Getty Images.

Palantir just delivered a remarkable third-quarter earnings report

To be clear, Palantir Technologies just delivered an elite quarter by almost any measure.

From a headline standpoint, Palantir cleared virtually every bar (all estimates compiled by LSEG):

- Third-quarter revenue came in at $1.18 billion versus estimates of $1.09 billion.

- Non-GAAP (adjusted) third-quarter earnings per share of $0.21 topped estimates of $0.17.

- Fourth-quarter revenue guidance was $1.33 billion versus estimates of $1.19 billion.

- Full-year 2025 revenue guidance was $4.40 billion versus estimates of $4.17 billion.

It's clear that Palantir's technology platforms, used to create custom artificial intelligence software applications for government and corporate customers, are a raging success.

Palantir's third-quarter revenue grew 63% year over year and 18% from the prior quarter. Revenue growth has continually accelerated since the company launched its AIP platform in the middle of 2023. The company generated a Rule of 40 score of 114% in the third quarter -- that's spectacular, and it signals that Palantir is growing in a very profitable manner.

Meanwhile, the company's commercial business is exploding. Palantir's remaining deal value among U.S. commercial clients increased by 199% year over year to $3.63 billion, up 30% from just the prior quarter.

These are growth numbers one usually sees from companies building on a small base, but Palantir is poised to generate $4.4 billion in sales this year, making it all the more impressive.

Yet the market is selling the stock anyway

Despite the blowout quarter, Palantir stock has trended downward since the report.

The headlines calling out Palantir's valuation have piled up over the past year. For as much as Palantir has delivered on the business side of things, the stock's gains have been equally breathtaking, perhaps even more so. Prior to the latest earnings release, the stock was up over 300% in the past year and over 2,200% in the past three years.

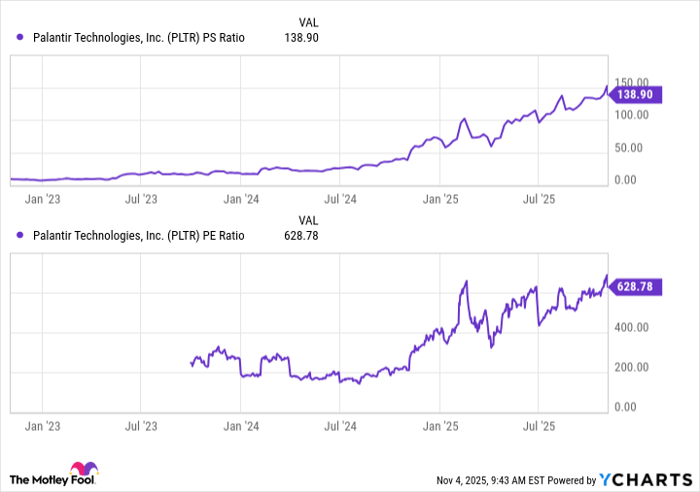

As a result, its valuation expansion has outrun its actual growth. Whether you evaluate Palantir's valuation based on its price-to-sales (P/S) ratio or its price-to-earnings (P/E) ratio, this is one of the most expensive stocks across the entire market.

Data by YCharts.

For context, the S&P 500 index trades at around 28 times earnings. Yes, Palantir is growing faster than the broader market but not enough to justify a valuation more than 20 times higher. Assuming no further price appreciation for the stock, Palantir's bottom line would need to double annually for four to five years for its valuation to come down to typical market levels, and the S&P 500's current valuation is near a historical high to begin with.

Wall Street's message is clear

It can help to think of stock valuations as expectations. The higher the valuation, the more investors expect from a company.

Sometimes, expectations can get so high that it's impossible to meet them. That becomes a possibility when you have stock trading at levels like those Palantir has reached. Even though Palantir just delivered what appears to be its best quarter as a public company with obvious growth momentum, the stock is dropping.

Based on that response from Wall Street, Palantir stock may finally be buckling under the weight of its valuations. With that in mind, it's probably best to avoid any impulse to buy the dip here.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $595,194!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,153,334!*

Now, it’s worth noting Stock Advisor’s total average return is 1,036% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.