Which Altcoins Could Crash if Bitcoin Closes Below $100,000?

Bitcoin briefly slipped below the $100,000 mark a few hours back, shaking market confidence and sparking fresh volatility. As traders assess the next move, attention is turning to the altcoins that could crash if Bitcoin falls further, given their tight price link with BTC.

With Bitcoin’s dominance climbing again, several highly correlated tokens are already flashing signs of weakness. These three coins often move in lockstep with Bitcoin — and if BTC slides deeper, their declines could quickly intensify.

Bitcoin Cash (BCH)

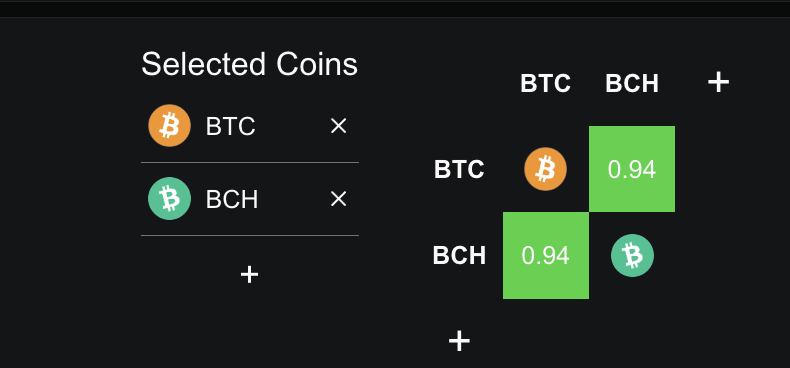

Bitcoin Cash could be one of the altcoins to crash if Bitcoin falls, given its strong price link with BTC. Its 7-day Pearson correlation coefficient is 0.94, showing that BCH moves almost exactly in step with Bitcoin. The Pearson coefficient measures how closely two assets move together, with +1 meaning they move the same way and -1 meaning the opposite.

BCH-BTC 7-day Correlation: Defillama

BCH-BTC 7-day Correlation: Defillama

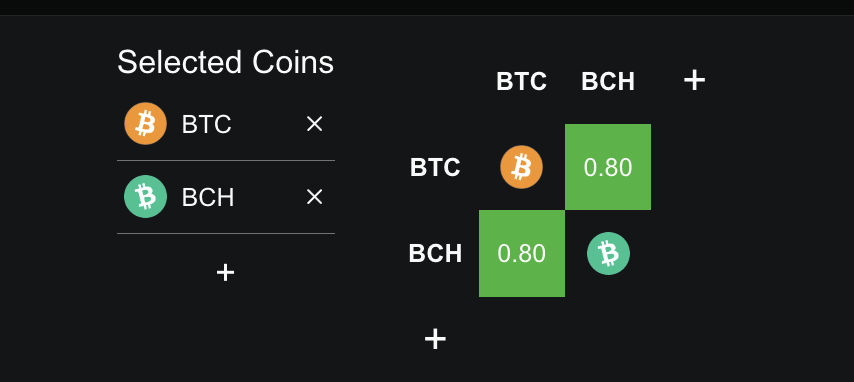

Even over the past year, BCH has maintained a high 0.80 correlation, making it one of the most consistently linked assets to Bitcoin’s movements.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BCH-BTC Yearly Correlation: Defillama

BCH-BTC Yearly Correlation: Defillama

That connection is already visible in recent price action. Over the past month, Bitcoin Cash has dropped 18.9%, while Bitcoin has fallen 18.1% — showing both are still moving in tandem. As Bitcoin dominance climbs above 60%, this tight correlation makes BCH especially vulnerable to any deeper Bitcoin decline.

Large holders — the 100,000 to 1 million BCH cohort, often considered whales — have been reducing positions since November 1, cutting their stash from 4.39 million to 4.34 million BCH, or roughly 50,000 coins (about $25 million).

BCH Whales: Santiment

BCH Whales: Santiment

On the charts, BCH trades near $484. If Bitcoin weakens further, $439 is the next key support, below which a larger breakdown could begin. However, if BTC rebounds, BCH is likely to follow quickly.

Bitcoin Cash Price Analysis: TradingView

Bitcoin Cash Price Analysis: TradingView

A move above $491 would be the first recovery signal, while reclaiming $523 would invalidate the bearish setup, indicating that Bitcoin’s strength is also returning.

BNB (BNB)

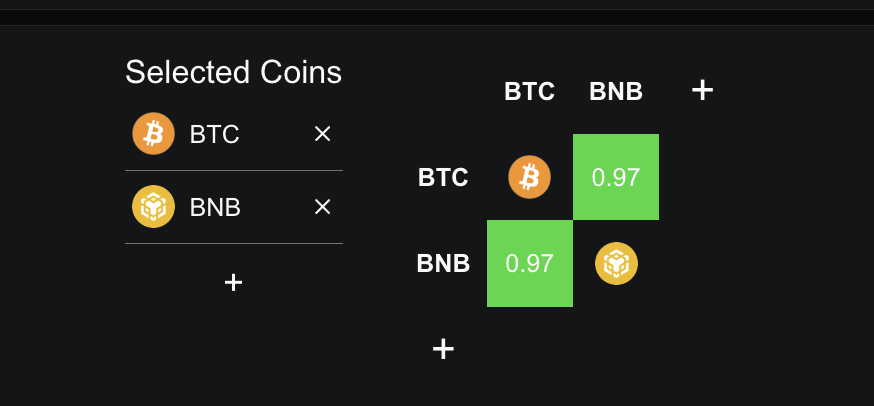

BNB is another major altcoin to crash if Bitcoin falls, given its consistently strong correlation with BTC. The 7-day correlation between the two stands at 0.97, showing they move almost together.

BNB-BTC 7-day Correlation: Defillama

BNB-BTC 7-day Correlation: Defillama

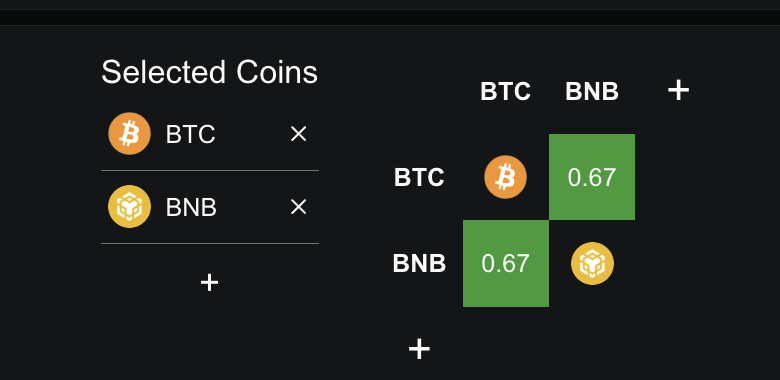

Over the longer term, the one-year coefficient sits at 0.67, which still signals a strong positive link. That correlation is already visible in recent price data. BNB and Bitcoin have both corrected by over 4% in the past 24 hours.

BNB-BTC Yearly Correlation: Defillama

BNB-BTC Yearly Correlation: Defillama

The coin has followed BTC closely through this correction phase. However, despite the weakness, BNB remains one of the strongest performers of this cycle, still up 23.5% over the past three months.

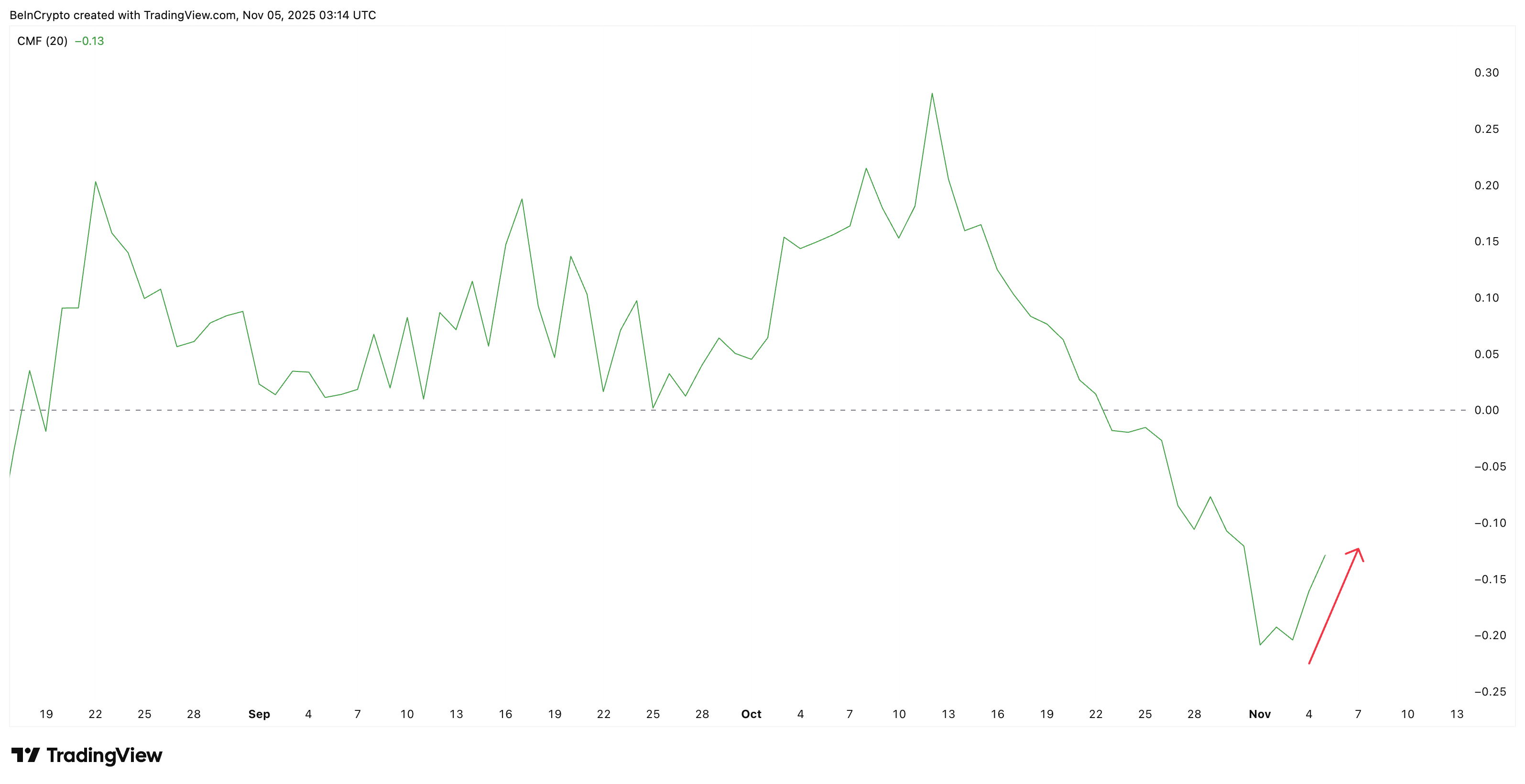

On the Chaikin Money Flow (CMF) chart, large-wallet inflows have dropped sharply since October 22 but are now trending upward as Bitcoin rebounds above $101,600, suggesting early signs of renewed buying interest. The CMF tracks money inflows and outflows based on price and volume, mostly from large wallets.

BNB Whales Start Adding After A Drop: TradingView

BNB Whales Start Adding After A Drop: TradingView

If Bitcoin manages to recover further, BNB could be one of the first coins to benefit. For that to happen, the price must hold above $946 to confirm a rebound setup.

Between October 10 and November 4, the price made a higher low while the Relative Strength Index (RSI) made a lower low — a hidden bullish divergence that hints at an ongoing uptrend beneath the correction. This pattern lends weight to the rebound setup, but only if BTC keeps strong.

The RSI measures price momentum to show if an asset is overbought or oversold.

BNB Price Analysis: TradingView

BNB Price Analysis: TradingView

A daily close above $1,084 would invalidate the bearish structure and point to recovery. However, if Bitcoin fails again and breaks below $100,000, the BNB price could test key supports at $859 and $817.

Litecoin (LTC)

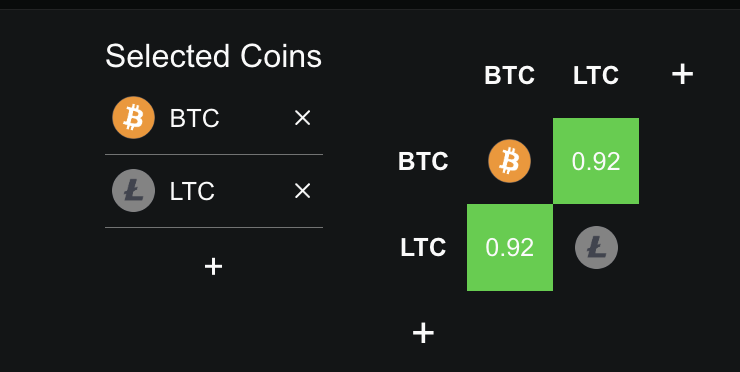

Litecoin (LTC) is another altcoin to crash if Bitcoin falls, given its strong and consistent correlation with BTC across both short and medium time frames. The monthly Pearson correlation coefficient for Litecoin and Bitcoin stands at 0.92, showing they move almost perfectly in sync.

LTC-BTC Correlation: Defillama

LTC-BTC Correlation: Defillama

That connection shows in recent performance. While Bitcoin has fallen over 18% this month, Litecoin has dropped even more — about 28%, reflecting its tighter sensitivity to BTC price swings. Even in the past 24 hours, LTC has slipped 3%, only slightly less than Bitcoin.

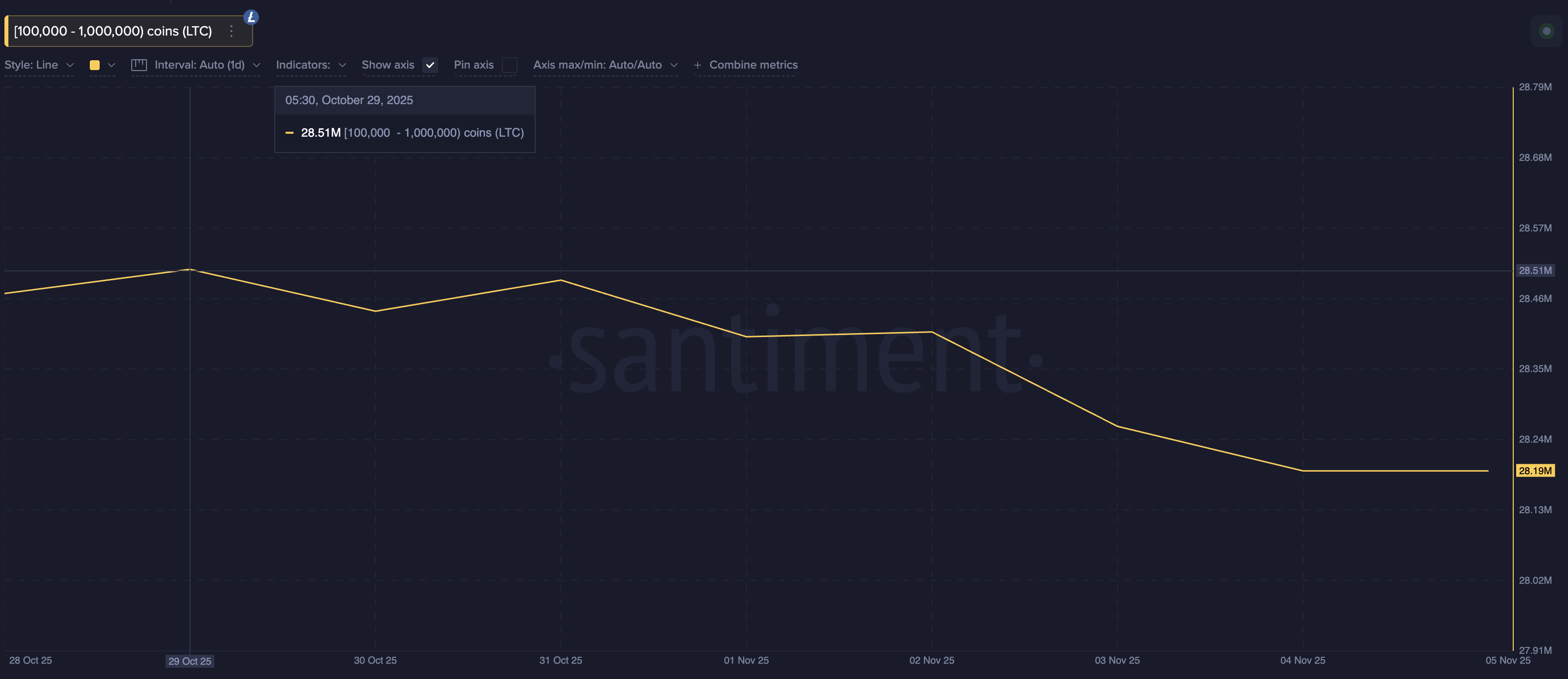

Large holders — addresses holding 100,000 to 1 million LTC — have also started reducing exposure since October 29. Their combined supply fell from 28.51 million to 28.19 million LTC, a drop of 0.32 million coins. At the current price, that equals roughly $28.8 million in tokens offloaded — a clear signal that bigger players are turning cautious.

Big LTC Holders Dumping: Santiment

Big LTC Holders Dumping: Santiment

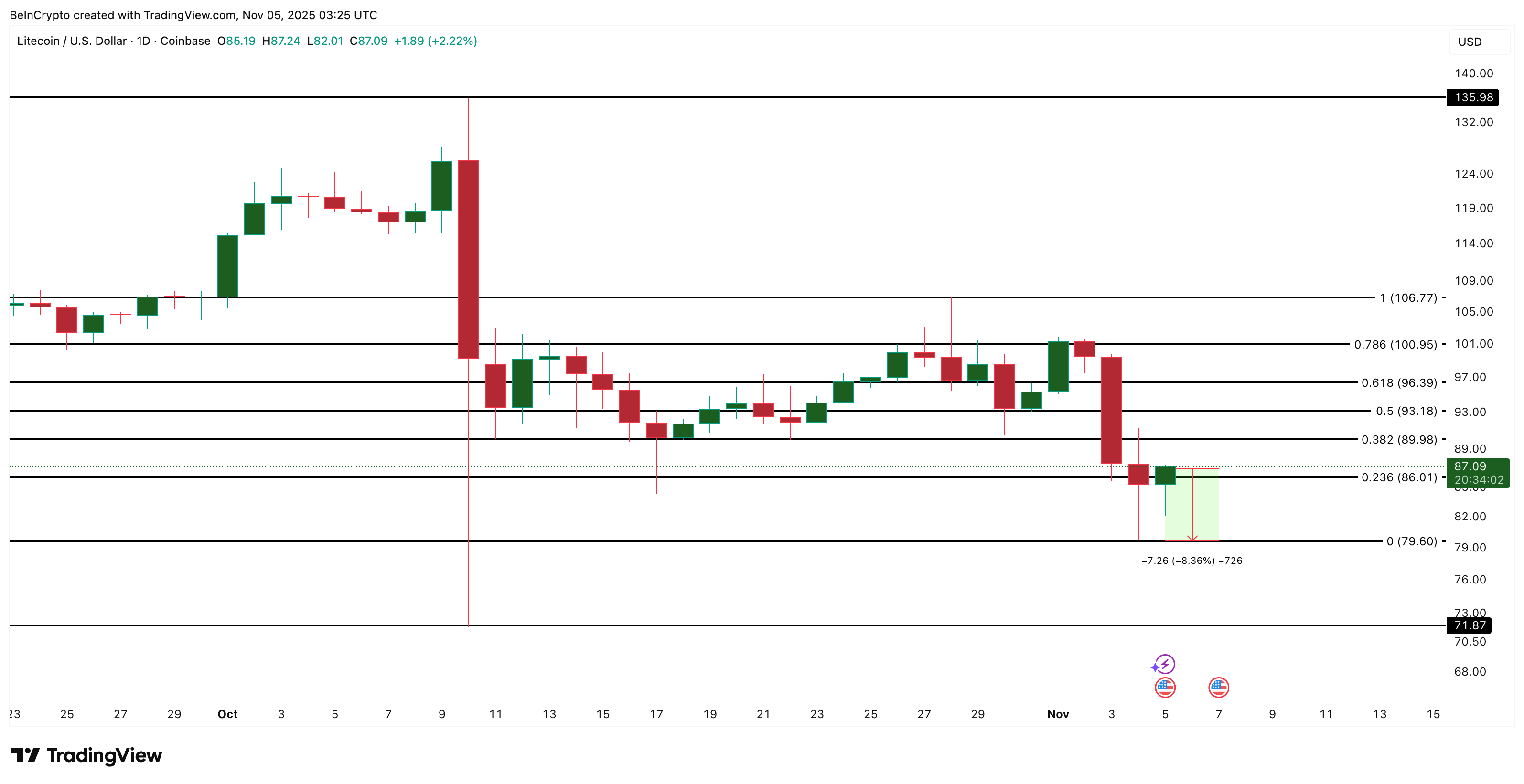

On the price chart, Litecoin trades near a strong support at $86. If that level breaks and Bitcoin weakens further, LTC could slide to $79, about 8.3% lower, and potentially even test $71 if bearish momentum builds.

LTC Price Analysis: TradingView

LTC Price Analysis: TradingView

However, if Bitcoin rebounds, Litecoin’s high correlation means it would likely bounce too. A move above $96 would invalidate the current bearish setup, while reclaiming $100 would confirm strength returning to both assets.