Will Short-Term Ethereum Holders Rescue ETH Price from Falling to $3,500?

Ethereum’s price remains under pressure, with the altcoin king struggling to find strong investor support. After weeks of sideways movement, ETH appears stuck in a consolidation phase as optimism fades.

The lack of recovery momentum has prompted concerns that Ethereum could soon retest lower levels if sentiment fails to improve.

Ethereum Holders Face Losses

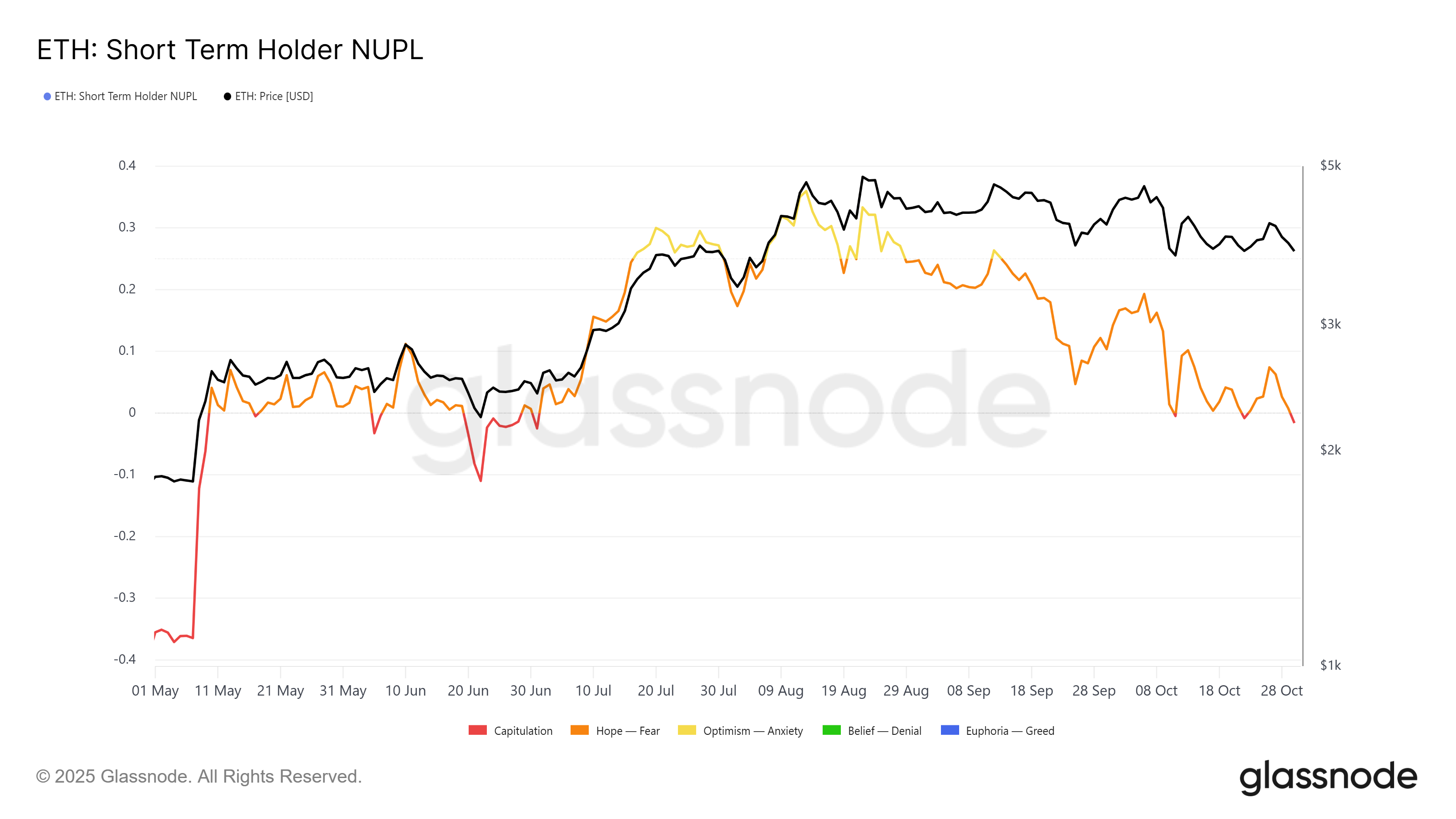

The Net Unrealized Profit/Loss (NUPL) metric is dipping into the capitulation zone, a range that historically precedes short-term rebounds for Ethereum. When investors enter capitulation, prices often reach oversold levels, creating conditions for a temporary relief rally.

Short-term holders, known for rapid reactions to price movements, tend to resist selling at a loss. This behavior could trigger a modest recovery as short-term holders aim to push prices higher before taking profits. Ethereum has experienced similar short-lived rallies twice this month under comparable conditions. If this pattern repeats, the network could witness a temporary price uptick before broader market trends regain influence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum STH NUPL. Source: Glassnode

Ethereum STH NUPL. Source: Glassnode

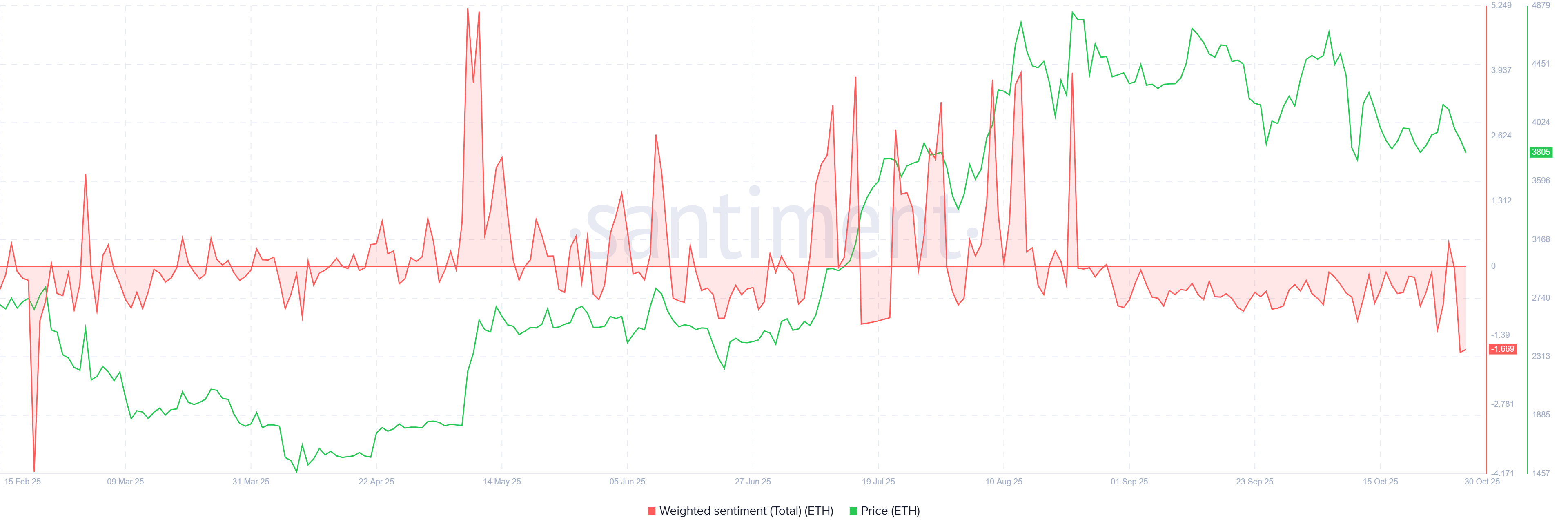

From a macro perspective, Ethereum’s weighted sentiment is declining sharply, signaling growing bearishness among investors. The indicator is at a nine-month low, marking its weakest reading since February. Such negative sentiment typically reflects exhaustion in buying activity and hesitation among traders to enter new long positions.

While this pessimism may only last a short period, prolonged bearish sentiment could increase selling pressure and undermine any near-term rebound. If sentiment does not improve soon, Ethereum could face greater difficulty maintaining critical support levels.

Ethereum Weighted Sentiment. Source: Santiment

Ethereum Weighted Sentiment. Source: Santiment

ETH Price Is Rangebound

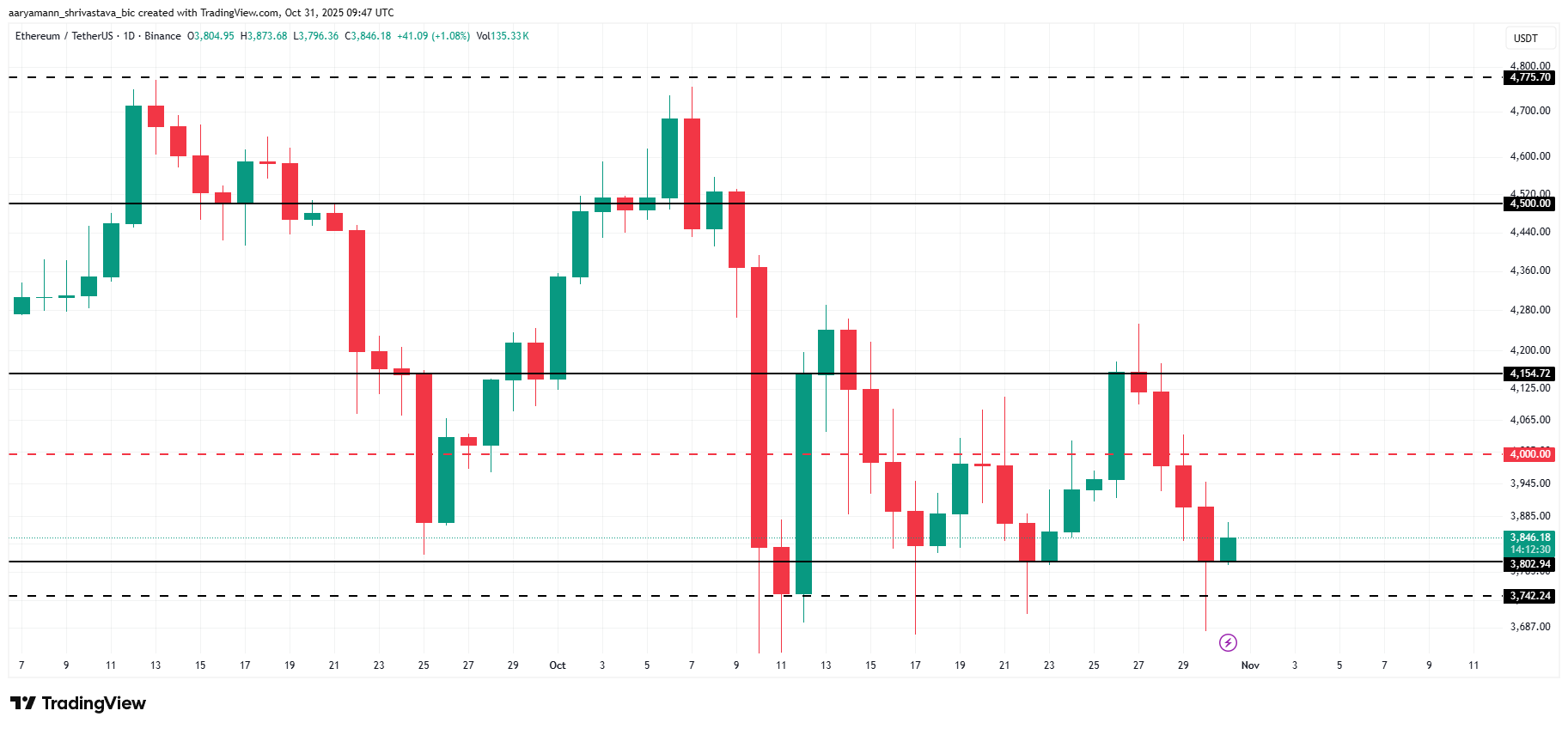

At the time of writing, Ethereum is trading at $3,846, holding just above the $3,802 support level. The altcoin king is likely to remain rangebound as market conditions show limited volatility.

Ethereum’s price currently fluctuates between $4,154 and $3,802. This consolidation range could persist in the coming sessions, with ETH possibly retesting resistance if short-term momentum returns.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingView

However, if bearish conditions intensify and Ethereum loses the $3,802 support, a further drop could follow. A breakdown below this level may send the price under $3,742 and toward $3,500, invalidating the bullish thesis and signaling deeper market weakness ahead.