Bitcoin Weekly Forecast: BTC slips below $110,000 as macroeconomic headwinds weigh on risk assets

- Bitcoin price hovers around $110,000 on Friday after correcting by nearly 5% so far this week.

- The Fed’s hawkish tone and cautious sentiment following the Trump–Xi meeting continue to dampen risk appetite.

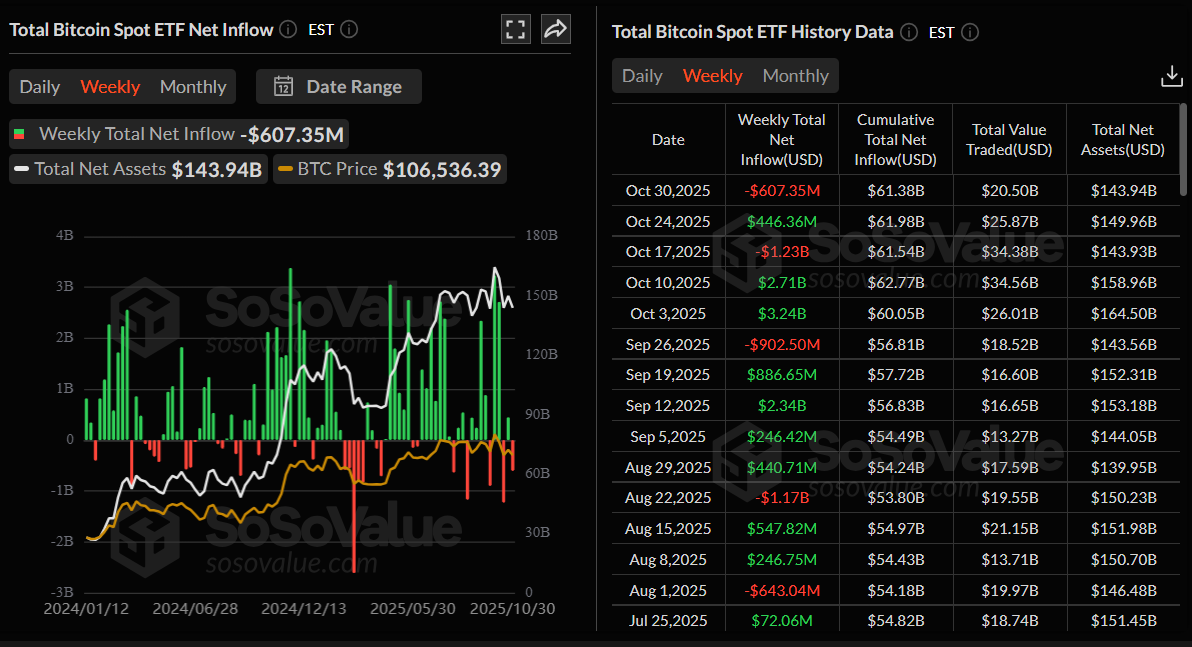

- US-listed spot Bitcoin ETFs saw $607.35 million in weekly outflows as of Thursday, signaling fading institutional confidence.

Bitcoin (BTC) extends its decline this week, slipping below $110,000 at the time of writing on Friday as macroeconomic headwinds continued to weigh on risk assets. The Federal Reserve’s (Fed) hawkish tone and a seemingly positive outcome from the meeting between US President Donald Trump and Chinese leader Xi Jinping have kept investors on edge. Meanwhile, weekly outflows of over $600 million from US-listed spot Bitcoin Exchange Traded Funds (ETFs) point to weakening institutional demand, which, if continued, could trigger a further correction toward the $102,000 mark.

Fed’s hawkish stance weighs on riskier assets

Bitcoin started the week on a negative note, facing resistance around a key zone on Monday and registering a four-day downward move, reaching a low of $106,304 on Thursday. This correction accelerated on Wednesday after Federal Reserve (Fed) Chair Jerome Powell pushed back against market expectations of another interest rate cut in December, despite delivering a widely anticipated 25 basis point (bps) cut at the October meeting. This hawkish stance by the Fed could strengthen the US Dollar (USD) and, in turn, weigh on cryptocurrencies, given their inverse correlation.

In addition to this bearish narrative for the cryptocurrency market, the US government shutdown has now entered its fourth week amid a deadlock in Congress on the Republican-backed funding bill, heightening economic uncertainty and dampening sentiment toward risk assets such as Bitcoin.

Bitcoin dips toward $106,300, wiping over $840 million in liquidations

Bitcoin's price correction this week triggered a wave of liquidations for BTC traders, totaling $843.26 million, of which $682.9 million were long positions, according to Coinglass' chart.

BTC Total Liquidations chart. Source: Coinglass

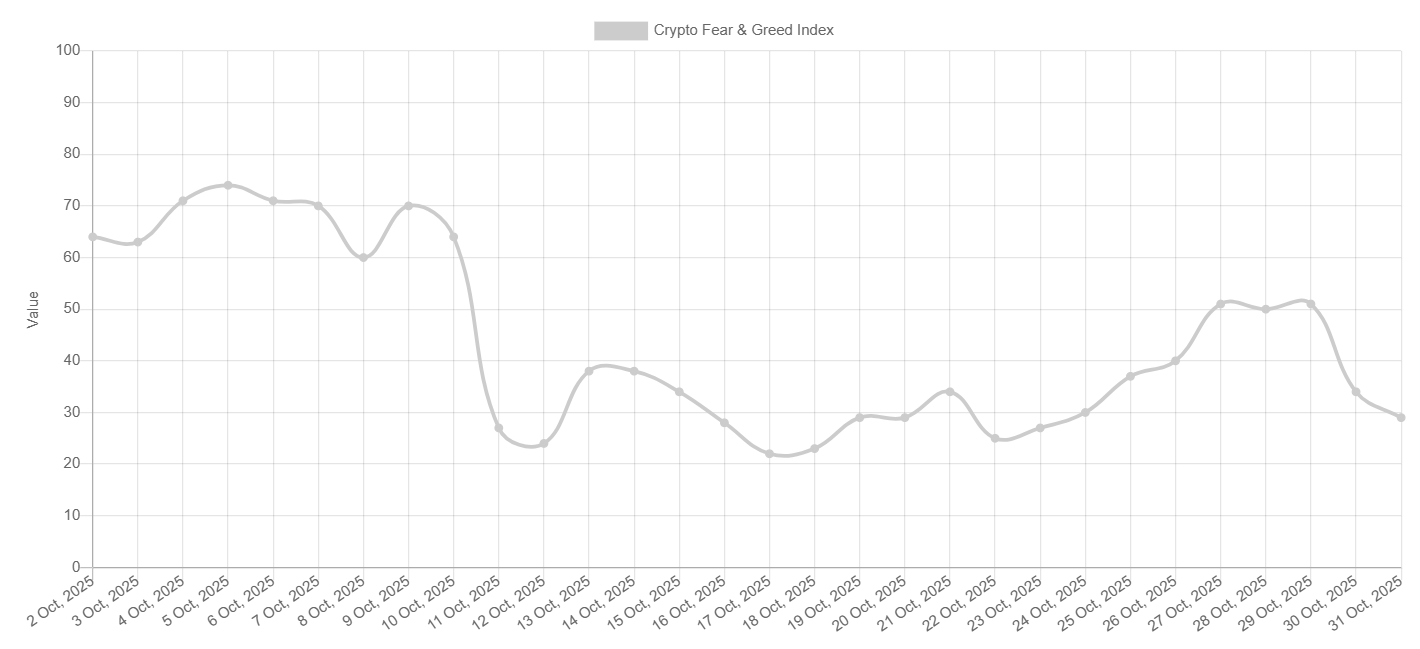

The Fear and Greed Index falls to 29 on Friday, nearing mid-October lows, indicating growing caution and a tilt toward fear among market participants.

Crypto Fear & Greed Index chart. Source: Alternative.me

US-China trade talks fail to provide support for BTC

The US-China trade narrative took a fresh turn on Thursday after US President Donald Trump announced that China would immediately resume soybean purchases and that all rare-earth issues had been resolved following his meeting with Chinese President Xi Jinping.

However, the positive outcome failed to lift market sentiment, as traders remain cautious amid broader economic uncertainty.

Weakness in spot Bitcoin ETFs flows

Bitcoin institutional demand shows early signs of weakness this week. SoSoValue data shows that spot Bitcoin ETFs have recorded a total outflow of $607.35 million as of Thursday, breaking the positive inflow seen in the previous week. If these outflows continue and intensify, BTC could extend its ongoing price correction as it suggests declining institutional confidence.

Total Bitcoin Spot ETF Net inflow weekly chart. Source: SoSoValue

Japan’s first yen-denominated stablecoin

JPYC Inc. announced the official launch of its yen-denominated stablecoin, JPYC, on Monday, along with the release of its dedicated issuance and redemption platform, JPYC EX.

This stablecoin is pegged 1:1 to the Japanese Yen (JPY) and fully backed by bank deposits and government bonds. Initial support includes issuance on the Avalanche (AVAX), Ethereum (ETH), and Polygon (POL) blockchains.

The launch of stablecoins in Japan supports a bullish outlook for the long term, as stablecoins often serve as gateways to cryptocurrencies, helping to drive broader acceptance and adoption.

Some signs of optimism

Despite ongoing correction and a bearish narrative for BTC, some signs of optimism emerged this week. Several spot altcoin ETFs have been launched, with Hedera (HBAR), Solana (SOL) and Litecoin (LTC) products starting to trade on Nasdaq.

On the corporate side, Strategy announced on Monday that it had added 390 BTC to its holdings and currently keeps a total of 640,808 BTC in reserves, valued at $47.44 billion. During the same period, US President Donald Trump's sons Eric and Donald Trump Jr.'s company, American Bitcoin, announced the acquisition of 1,414 BTC, worth approximately $163 million, bringing its total holdings to 3,865 BTC.

In addition, Bitcoin treasury company MetaPlanet announced on Tuesday a share repurchase program to repurchase 150 million common shares, valued at $495 million. Meanwhile, Strive, a Bitcoin treasury and asset management company, announced that it had acquired 72 BTC, bringing its total holdings to 5,958 BTC, reflecting consistent corporate demand and confidence in the largest cryptocurrency by market capitalization.

Technical outlook suggests revisiting $102,000 mark

Bitcoin price was rejected from the 78.6% Fibonacci retracement level (drawn from the April 7 low of $74,508 to the October 6 all-time high of $126,199) at $115,137 on Monday, and declined 5.44% by Thursday. At the time of writing on Friday, BTC hovers at around $110,000.

If BTC continues its correction and closes below the 61.8% Fibonacci retracement level at $106,453, it could extend the decline toward the October 10 low of $102,000.

The Relative Strength Index (RSI) on the daily chart reads 45, below the neutral level of 50, indicating that bearish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) lines are also converging, with decreasing green histogram bars signaling fading bullish momentum.

BTC/USDT daily chart

However, if BTC finds support around the 61.8% Fibonacci retracement level at $106,453, it could extend the recovery toward the 50-day EMA, currently at $112,905.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.