Pi Network Price Forecast: PI reverses from 50-day EMA despite AI models' test run

- Pi Network marks its fourth reversal from the 50-day EMA since May.

- Two large wallet investors withdrew 2.76 million PI, contributing to the CEX outflows of 3.48 million in the last 24 hours.

- Pi Network Ventures has officially announced an investment in OpenMind, with Pi Nodes operating image recognition AI models.

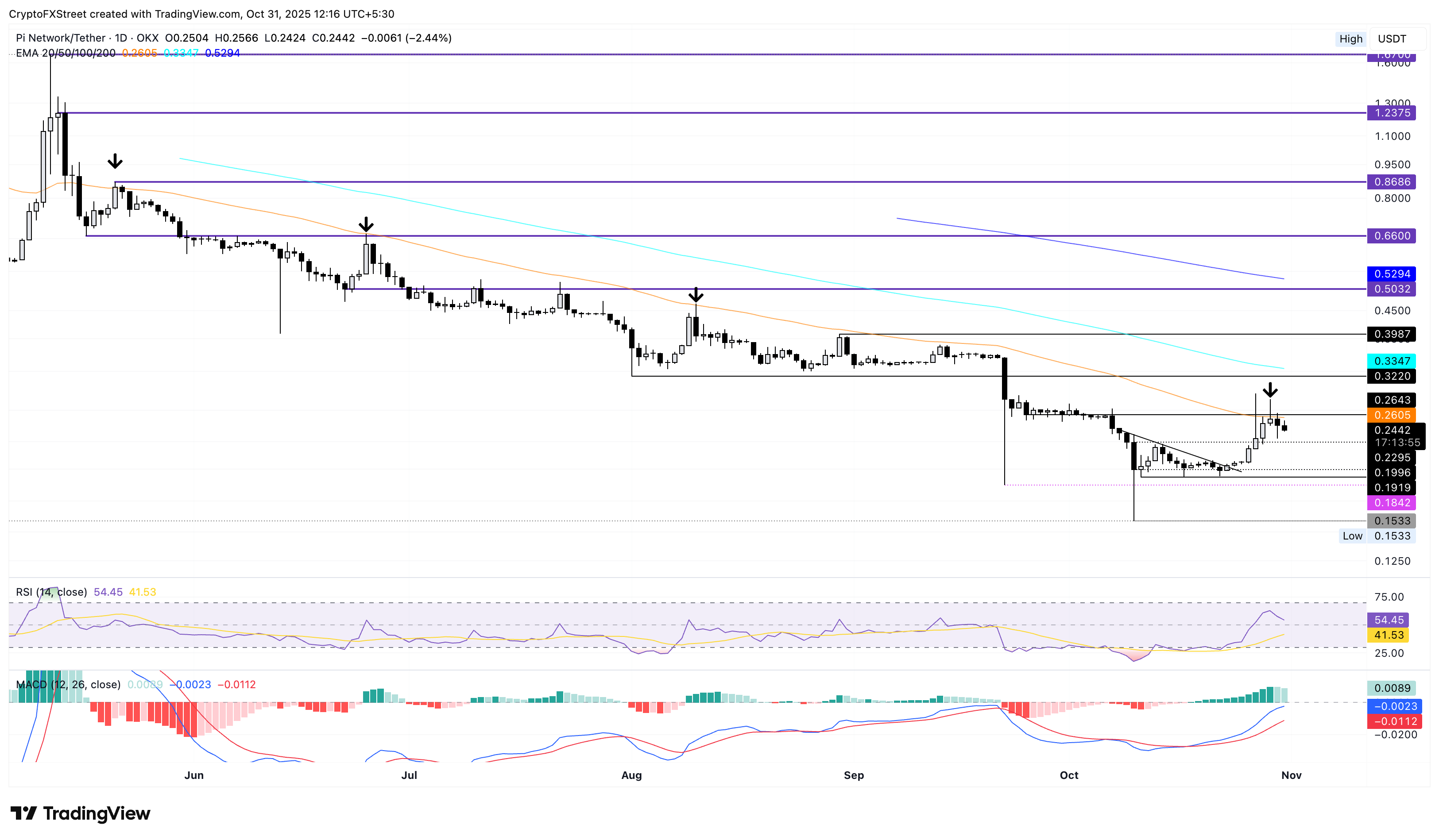

Pi Network (PI) price is down 2.5% at press time on Friday, extending the 3% loss from the previous day. The recovery from earlier this week failed to surpass the 50-day Exponential Moving Average (EMA) despite a rise in Centralized Exchanges (CEXs) outflows.

Furthermore, the announcement that Pi Network Ventures was investing in OpenMind and conducting AI test runs failed to lift sentiment.

Pi Network nodes run AI models' test runs

Pi Network Ventures, the $100 million investment arm that funds startups, officially announced on Thursday its investment in OpenMind, a company that develops operating systems and protocols for robots. The amount of capital invested has not been made public in the announcement.

On a more positive note, collaboration between Pi Network and OpenMind has successfully run image recognition AI models on Pi Node operators, consisting of 350,000 active nodes. This highlights the capabilities of Pi Nodes for decentralized AI training and computing tasks.

On-chain activity shows steady demand

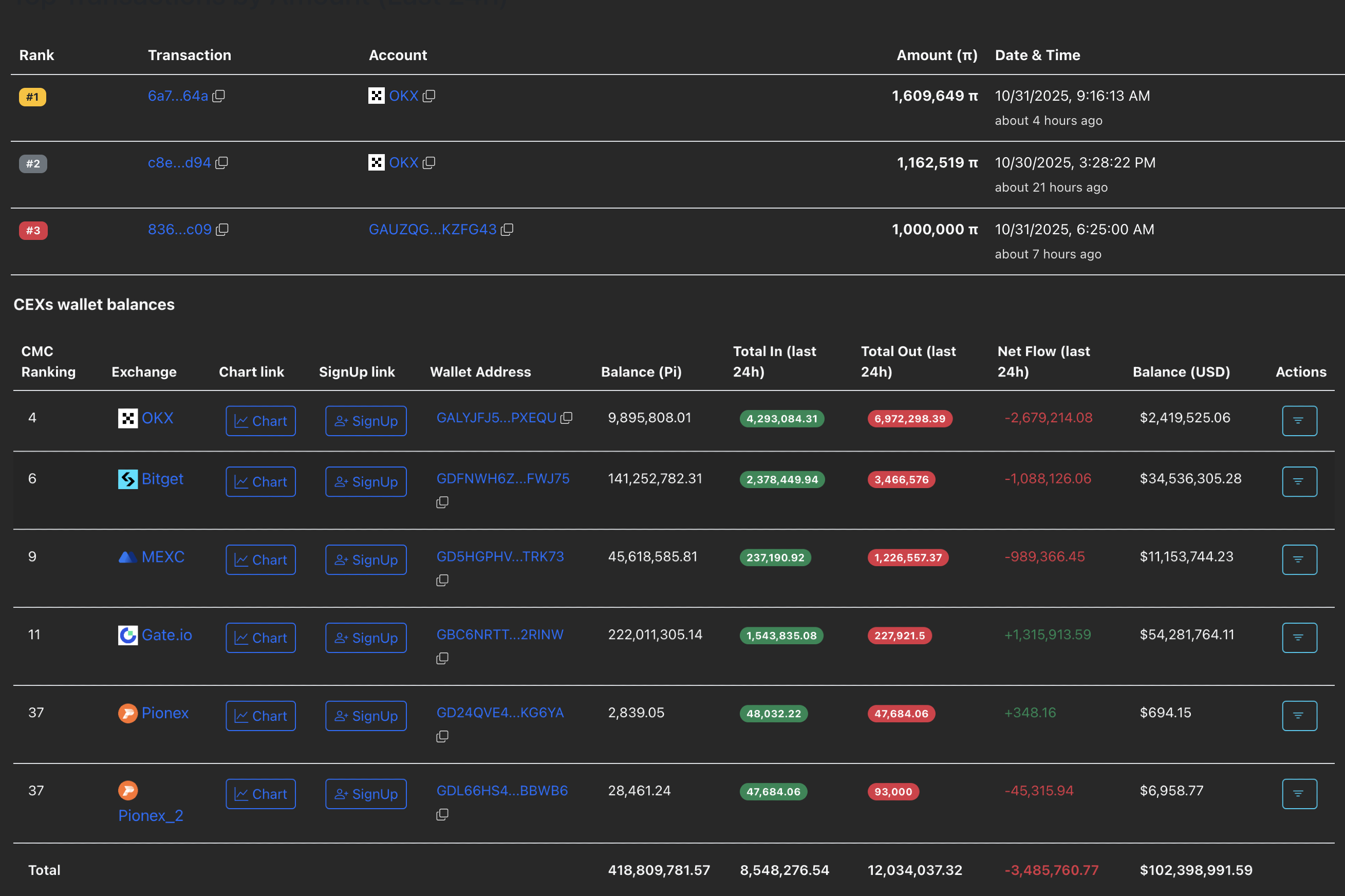

The amount of PI tokens available on Know Your Business (KYB) verified Centralized Exchanges (CEXs) originates from Know Your Customer (KYC) approved Pi Network users, who were permitted to transfer tokens to the mainnet. A decline in PI tokens available on these CEXs suggests that on-exchange users are acquiring the tokens, signaling a surge in demand.

PiScan data shows a net outflow of 3.48 million PI tokens from the CEXs’ wallet balances in the last 24 hours, indicating that on-exchange demand is increasing.

At the same time, two of the largest transactions on the Pi Network reveal that two large wallet investors, commonly referred to as whales, have withdrawn 2.76 million PI tokens from the OKX exchange over the last 24 hours. This reflects the confidence among whales.

Pi Network activity. Source: PiScan

Technical Outlook: Pi Network risks losing weekly gains

Pi Network trades below $0.2500 at press time on Friday, marking its second consecutive day of loss. The PI token's reversal from the 50-day EMA at $0.2605 aligns with a decline in buying pressure, as the Relative Strength Index (RSI) on the daily chart, currently at 54, traces downwards towards the neutral level of 50.

Pi Network’s fourth reversal from this average line, acting as a crucial dynamic resistance that has remained intact since May, risks erasing the gains made earlier this week. The immediate support for PI lies at the $0.2000 round figure and the $0.1919 level, marked by the October 11 low.

Corroborating the decline in bullish momentum, the Moving Average Convergence Divergence (MACD) hovers near the zero line, as green histogram bars above this line decline. If MACD reverses towards its signal line, resulting in a crossover, it would confirm a bearish shift in trend momentum.

PI/USDT daily price chart.

On the upside, a potential breakout of the 50-day EMA at $0.2605 could extend Pi Network’s recovery to $0.3220, marked by the August 1 low.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.