Aster price rises as DEX unveils Rocket Launch to support early-stage crypto projects

- Aster rebounds above $1.00, moving in tandem with the broader crypto market.

- Aster introduces Rocket Launch, a platform designed to boost liquidity and trading for early-stage crypto projects.

- Rocket Launch transforms token launches from one-time market events to sustained growth.

Aster edges higher, trading marginally above $1.00 at the time of writing on Thursday. The uptick in price reflects an overall positive sentiment in the cryptocurrency market, which has propelled Bitcoin (BTC) above $109,000 and Ethereum (ETH) above $3,800.

Aster Rocket Launch to boost liquidity, trading for new projects

Aster announced Rocket Launch on Thursday, a platform designed to provide support for new crypto projects by driving liquidity and trading activity. Rocket Launch aims to change how new projects are introduced in the market, ensuring a continuous process “from alpha discovery to trading activation and sustained growth,” according to the press release.

Market participants will also benefit by gaining access to emerging on-chain opportunities, in return earning rewards based on their share of the total trading volume.

“Projects gain visibility and trading activity; traders gain early access to on-chain opportunities and rewards; Aster strengthens its platform through high-potential listings and trading volume, while ASTER holders benefit from continuous buybacks and long-term value growth,” Aster stated.

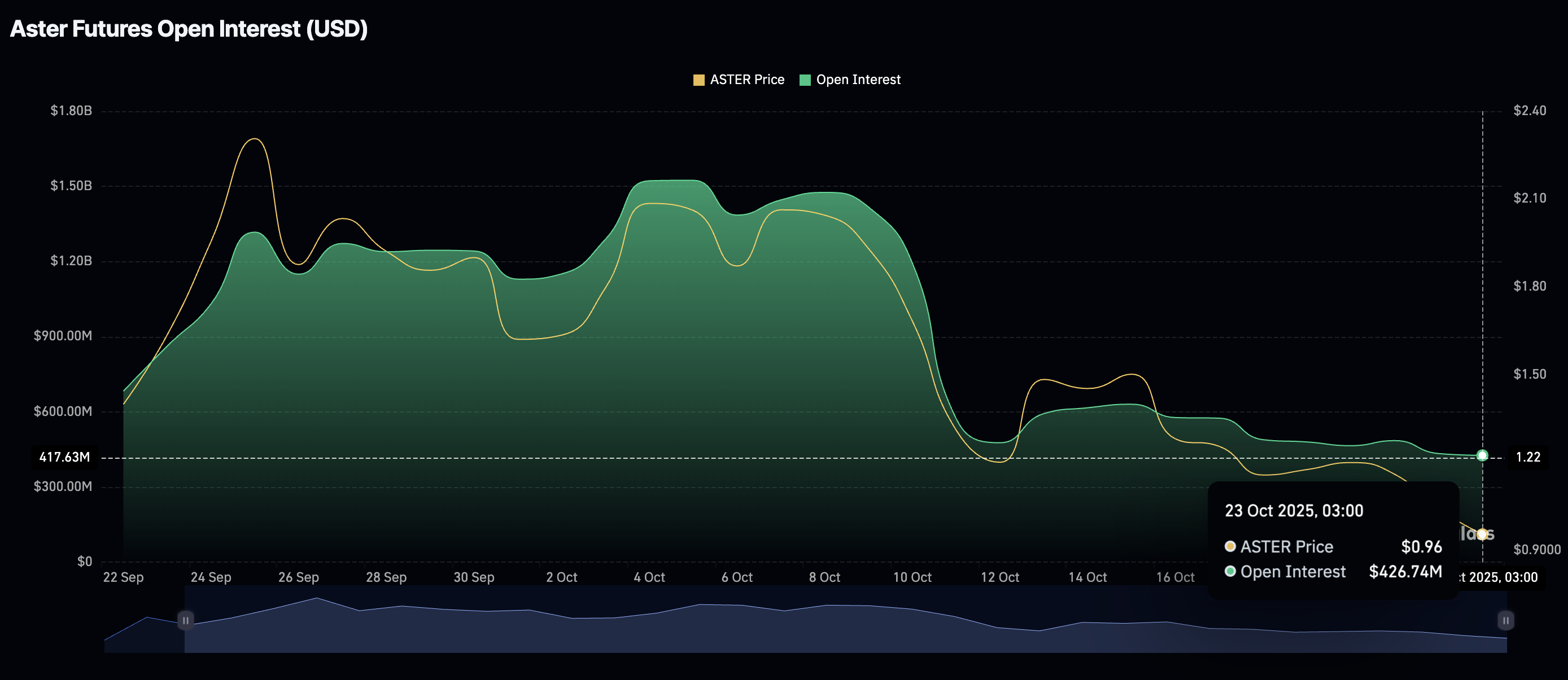

Despite Rocket Launch’s debut, interest in Aster remains significantly suppressed based on the futures Open Interest (OI), which averages $427 million at the time of writing from a record high of $1.52 billion in early October. Traders may want to see the OI, representing the notional value of outstanding futures contracts, steadily increase to ascertain Aster’s bullish potential.

Aster Futures Open Interest | Source: CoinGlass

Technical outlook: Aster bulls tighten their grip

Aster holds above the $1.00 key level three days after dropping to $0.92. The uptick follows an overall bullish wave in the crypto market and the token’s reaction to the launch of the Rocket Launch platform.

The recovery of the Relative Strength Index (RSI), which has stabilized at 38 at the time of writing, indicates that bullish momentum is increasing. Moreover, traders should watch out for a potential buy signal from the Moving Average Convergence Divergence (MACD) indicator on the daily chart, likely to occur when the blue line crosses above the red signal line.

ASTER/USDT 4-hour chart

Key milestones for Aster include a sustained break above a descending trend line in the same daily range, the 50-period Exponential Moving Average (EMA) at $1.17 and the 100-period EMA at $1.32 on the 4-hour chart to ascertain the short to medium-term technical outlook.

Still, traders should anticipate profit-taking around the $1.00 level, particularly if Aster starts showing weakness. If a reversal occurs, the demand area at $0.92 will be in line to absorb the selling pressure.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.