BNB Price Forecast: BNB hits record-high as Binance CEX holdings, BNB Chain grows

- BNB price hits a new all-time high, rising in a bullish parallel channel.

- BNB Chain gains traction amid discussions on the launch of prediction markets.

- Binance CEX total assets hit a record high of over $200 billion, indicating a growth in trading activity.

BNB, previously known as Binance coin, holds a steady uptrend above $1,100 at the time of writing on Friday, entering the price discovery mode. The rally is on the back of Binance’s record-high holdings and the BNB Chain, previously known as Binance Smart Chain (BSC), network growth. Both the technical outlook and derivatives data suggest further gains if the momentum sustains.

BNB Chain growth signals increased demand

BNB Chain users maintain a steady trend of digital assets deposits into the decentralized finance (DeFi) platform. DeFiLlama data shows that the Total Value Locked (TVL) on the BNB Chain has reached $8.163 billion, making it the fourth-largest DeFi chain by TVL. A rise in TVL correlates with increased user demand and trust.

Decentralized Exchanges (DEXs) are among the top performers, generating significant volume. The DEX volume over the past four days exceeds $3 billion, with PancakeSwap leading with $1.51 million in fees generated over the last 24 hours.

In parallel with the rising DeFi activity, the stablecoin market is expanding, signaling a growth in liquidity that is necessary for further expansion. Stablecoin supply on the BNB Chain has increased by over 6% in the last 24 hours, reaching $13.464 billion.

BNB Chain DeFi data. Source: DeFiLlama

A steady rise in BNB Chain’s DeFi metrics indicates growing user demand and market share, which could fuel the price of its native token, BNB.

Meanwhile, the BNB Chain is preparing to build prediction markets to compete with platforms like Polymarket, which maintains a 30-day trading volume of $1.5 billion. By tapping into the prediction market, BNB Chain could experience a further increase in demand for its services, resulting in increased revenue.

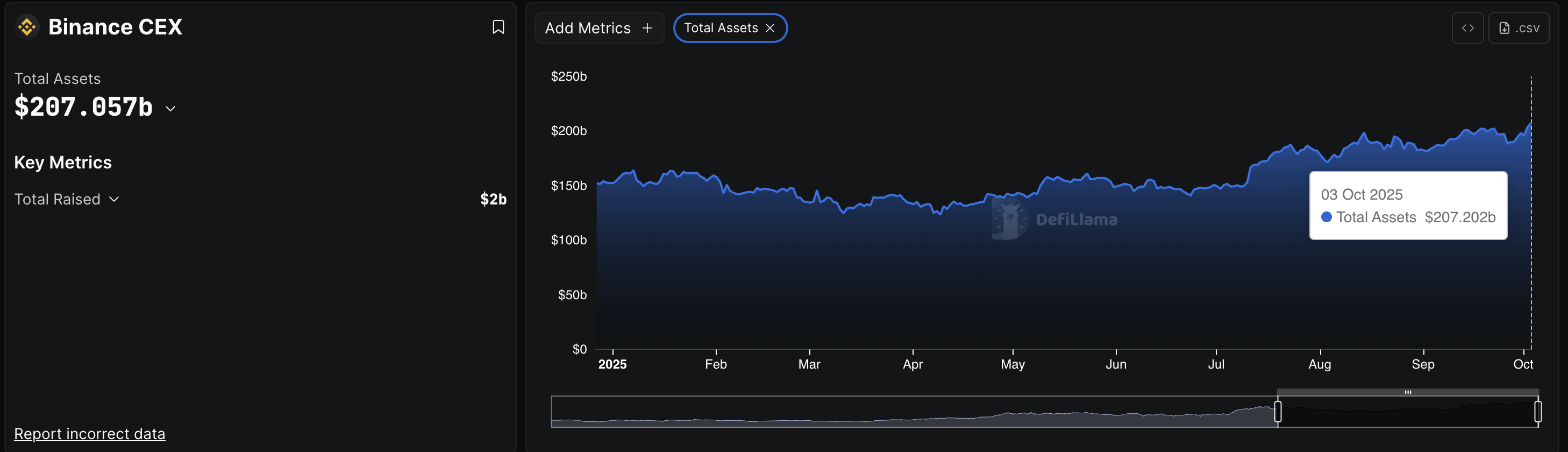

Additionally, the total assets deposited on the Binance Centralized Exchange (CEX) have reached a record high of $207.057 billion as of Friday. This signals a rise in broader cryptocurrency market activity, which could boost the use of the BNB token on the platform.

Binance CEX total assets. Source: DeFiLlama

Derivatives data show heightened optimism

The retail demand for the BNB token has significantly increased, aligning with the rise to record-high price levels. CoinGlass data shows the BNB Open Interest (OI) has risen by 12% in the last 24 hours, reaching $2.11 billion. An increase in OI refers to risk-on sentiment among traders, as traders are willing to hold or create more long positions.

Validating the demand surge, the OI-weighted funding rate, at 0.0123%, remains elevated, having previously been at 0.044% earlier in the day. High funding positive rates are considered a sign of strong intent among aggressively bullish traders anticipating further price growth.

Meanwhile, the $6.44 million in short liquidations over the last 24 hours outpaces the $307,880 in long liquidations, indicating a greater wipeout of bearish-aligned traders. If short liquidations continue to surge, the BNB rally could reach even higher price levels.

BNB derivatives data. Source: CoinGlass

BNB rebounds within a rising channel

BNB is gaining momentum within a rising channel pattern, entering the price discovery mode amid heightened bullish sentiments. Within the channel, BNB faces opposition from the R1 pivot level at $1,114.

The Moving Average Convergence Divergence (MACD) indicator displays an upward trend in average lines on the daily chart, indicating a rise in bullish momentum.

Still, the Relative Strength Index (RSI) at 70 remains lower than its previous peak of 80, indicating a decline in buying pressure and forming a bearish divergence. This warns of a potential reversal in BNB from the resistance pivot level at $1,114.

The short-term decline within the channel could retest the $1,000 psychological support to stabilize the uptrend.

BNB/USDT daily price chart.

If the upcoming prediction market release on BNB Chain rekindles demand among users and investors, BNB could test the upper resistance trendline near $1,150, followed by the R2 pivot level at $1,220.