Ethereum & Altcoins Capture 85% Of Futures Trading, Bitcoin Share Shrinks

Data shows Bitcoin has lost interest to Ethereum and altcoins recently as their combined futures volume has broken past the 85% mark.

Ethereum & Altcoins Have Seen Their Futures Volume Rise Recently

In a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the futures trading volume share of Ethereum and the altcoins. The futures trading volume here naturally refers to the amount that’s becoming involved in futures-related trades on the various derivatives exchanges.

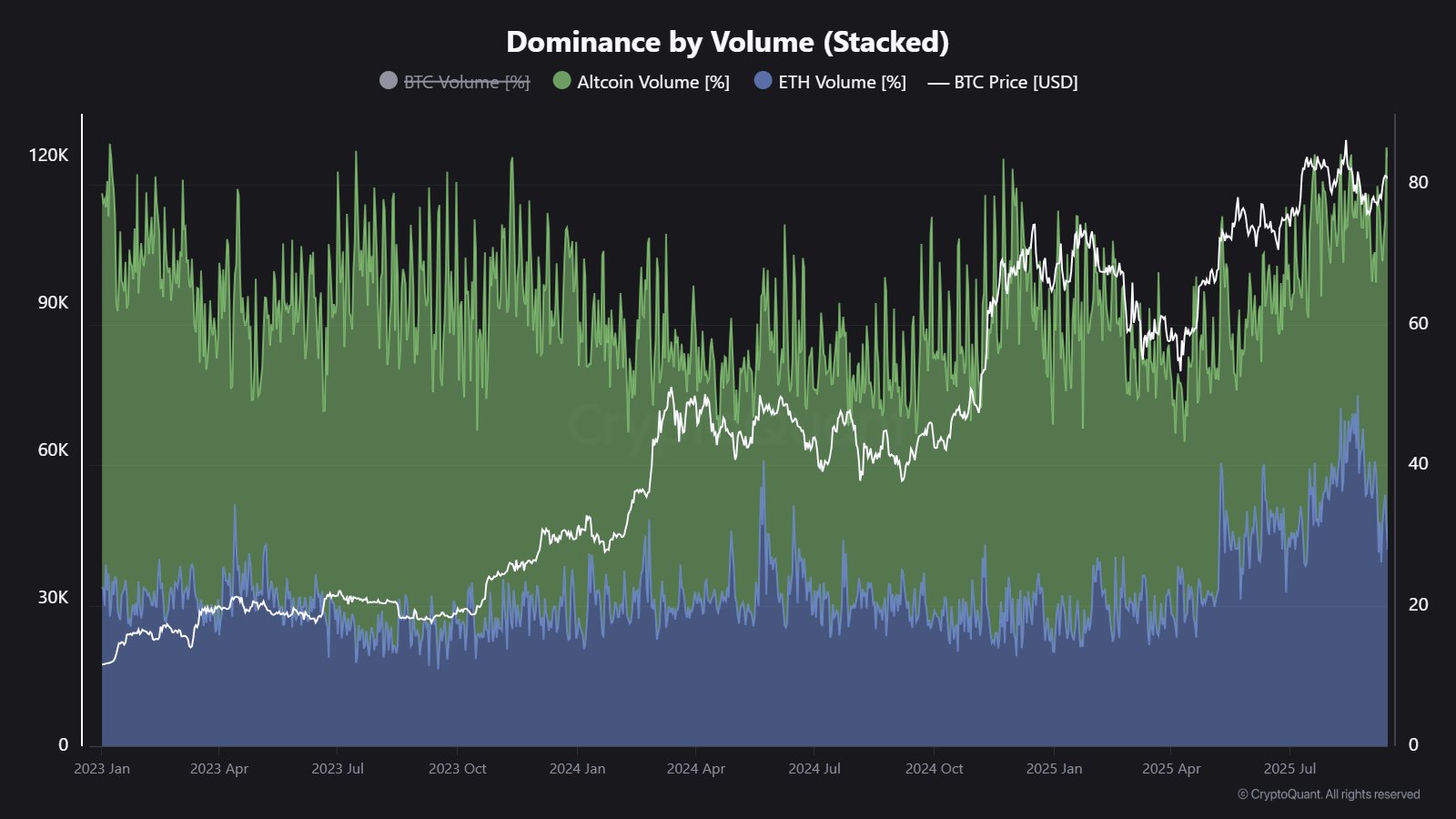

Below is the chart shared by Maartunn that shows the trend in the dominance in this metric for ETH and the alts over the last couple of years:

As is visible in the graph, the futures trading volume dominance has seen a sharp increase for the altcoins recently, implying that speculative interest in these coins has gone up.

The metric is still significantly down for Ethereum compared to its earlier high, but it has nonetheless also enjoyed an uptick at the same time as the altcoin growth.

Combined, ETH and the alts occupy around 85.2% of the total cryptocurrency futures trading volume following the increase. This means that the remaining portion, Bitcoin, has gone below 15% in dominance.

Historically, periods like these have been a bad omen for not just BTC, but the market as a whole. Examples of these are visible in the chart during both the late 2024 and Summer 2025 price tops.

Thus, considering that Ethereum and the altcoins are once again dominating futures trading activity, it’s possible that Bitcoin and other assets may be in for some volatility.

In some other news, on-chain analytics firm Santiment has shared in an X post an update on how the various projects in the digital asset sector rank up in terms of the Development Activity. This indicator measures the total amount of work that the developers of a given project are doing on its public GitHub repositories.

The metric makes its measurement in units of “events,” where one event is any action taken by the developer on the repository, like the push of a commit or creation of a fork.

Here is the table posted by Santiment that shows the ranking for cryptocurrency projects on the basis of their 30-day Development Activity:

As displayed above, Ethereum is only the 10th largest project in terms of 30-day Development Activity, despite its market cap being second only to Bitcoin. The project that’s seeing its developers work the hardest right now is Internet Computer (ICP), which has the metric sitting at a value nearly three times that of ETH’s.

ETH Price

Ethereum recovered above $4,750 earlier, but it seems the asset’s price has once again faced a pullback as it’s now back at $4,450.