Chainlink partners with Saudi Awwal Bank to advance blockchain finance in Saudi Arabia

- Chainlink announces a partnership with Saudi Awwal Bank to boost on-chain applications in Saudi Arabia.

- The applications will be built using Chainlink’s cross-chain integration and runtime environment features.

- Chainlink price fails to benefit from the partnership announcement.

Chainlink (LINK) has signed an agreement with one of Saudi Arabia’s largest banks, Saudi Awwal Bank (SAB), to boost on-chain finance in the country. While the announcement could contribute to boosting the use of Chainlink's blockchain, prices of the LINK token failed to react positively after the announcement, trading broadly steady on the day and losing more than 2% so far this week.

Saudi Arabia’s First Bank ventures into blockchain technology with Chainlink

The First Bank of Saudi Arabia, Saudi Awwal Bank, with over $100 billion in total assets, announced a partnership with Chainlink on Monday, marking the first step in its new on-chain finance applications. With this Innovation Co-operation Agreement, SAB developers will leverage Chainlink’s Cross-Chain Integration Protocol (CCIP) and Chainlink Runtime Environment (CRE).

The CRE will provide a modular platform for building applications and accessing multiple Application Programming Interfaces (APIs), while the CCIP will facilitate cross-chain transfers.

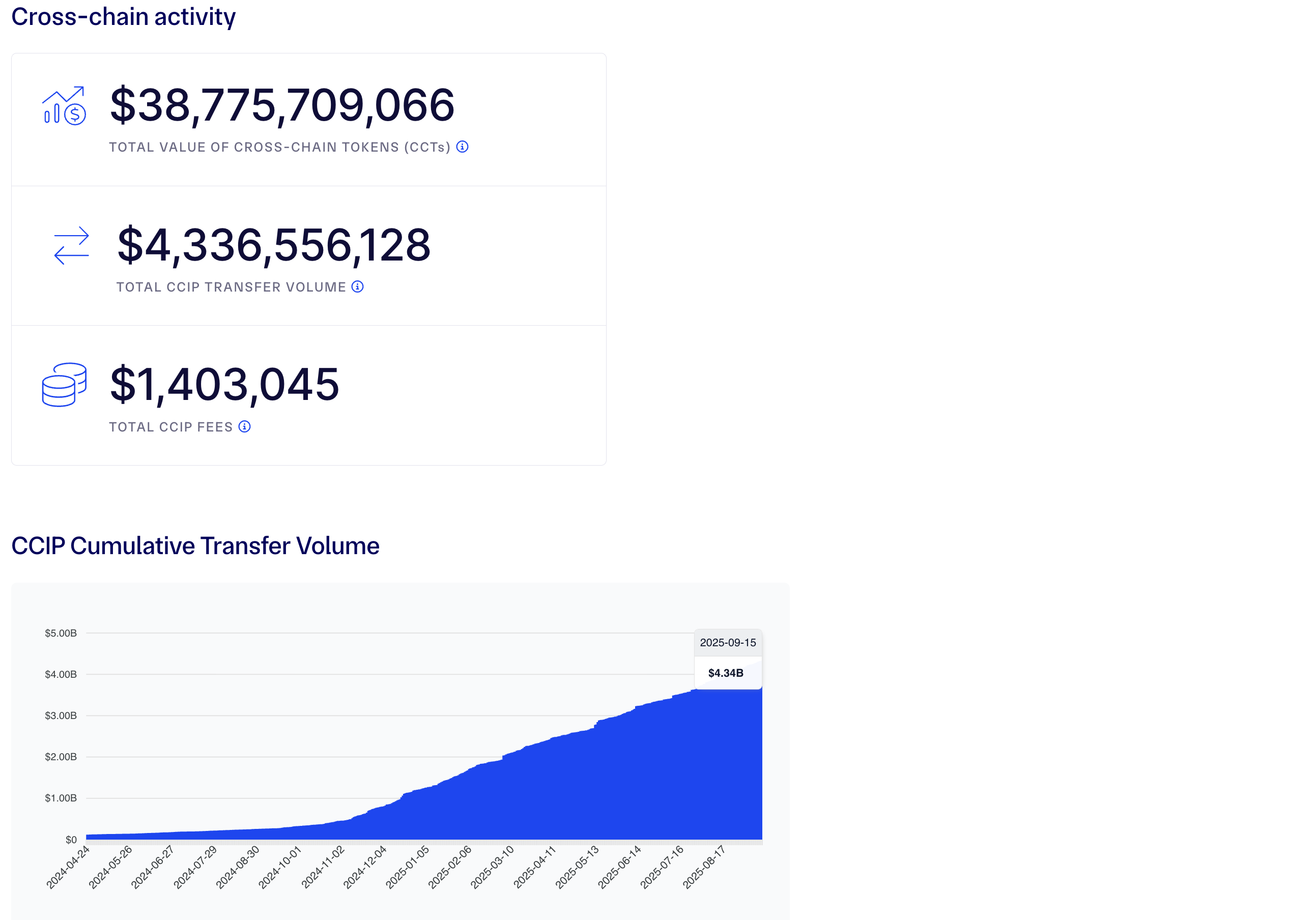

Chainlink’s official data shows that the CCIP is active on 60 different chains, holding a cumulative transfer volume of $4.34 billion, with the total value of cross-chain tokens surpassing $38.77 billion. Additionally, DeFiLlama ranks Chainlink as the largest decentralized oracle network based on Total Value Secured (TVS) of over $62 billion.

CCIP activity. Source: Chainlink

Doubling down on financial innovation, SAB also announced that it had signed a similar agreement with Wamid, a subsidiary of Saudi Tadawul Group, to begin experimentation on tokenizing of capital markets, which is valued at almost $2.32 trillion based on Tuesday’s Saudi Exchange report.

With the signed agreements, Saudi Arabia’s Crown Prince Mohammed bin Salman's Vision 2030 aims to reduce the country’s economic dependencies on Oil revenues.

Chainlink holds at crucial support as bullish momentum wanes

Chainlink trades above $23.00 at press time on Wednesday, holding above the 61.8% Fibonacci retracement, drawn from the December 13 high of $30.94 to the April 7 low of $10.10, which acts as a crucial support level at $22.98.

Following a Doji candle formation on Tuesday, LINK token price action teases a potential V-shaped reversal. A potential rise in the oracle token price could target the 78.6% Fibonacci retracement level at $26.48.

Indicators on the daily chart indicate a lack of momentum as the Relative Strength Index (RSI) hovers near the halfway line at 51. Additionally, the Moving Average Convergence Divergence (MACD) line remains steady after crossing below its signal line, reflecting a loss in bullish momentum.

LINK/USDT daily price chart.

On the downside, if Chainlink falls below $22.98, it could extend the decline to the 50% Fibonacci retracement level at $20.52.