Koreans Abandon Tesla for Crypto Bets: $657M Exodus Reshapes Markets

Korean retail investors are dramatically reshaping US equity markets. In August, they pulled a record $657 million from Tesla Inc. while simultaneously pouring over $12 billion into US-listed cryptocurrency companies this year.

This signals a fundamental shift in investment preferences among one of America’s most influential foreign retail bases, which is capturing Wall Street’s attention.

Tesla Loses Its Korean Crown

According to Bloomberg calculations of depository data, the unprecedented exodus from Tesla represents the most significant monthly outflow since early 2023. This marks a stark reversal for Korean investors, who once served as crucial amplifiers of the electric vehicle maker’s stock rallies.

Individual Korean traders, holding approximately $21.9 billion in Tesla shares—making it their top foreign equity holding—are increasingly questioning the company’s artificial intelligence narrative and growth prospects.

The selling pressure from Korean investors stems from mounting concerns over Tesla’s deteriorating fundamentals and leadership risks. Analysts point to intensified competition from Chinese rivals and declining electric vehicle sales attributed to “Musk risk” as key factors behind Tesla’s poor performance. Tesla’s stock volatility has been exacerbated by CEO Elon Musk’s conflicts with President Trump, contributing to repeated sharp declines.

Mirae Asset Securities researcher Park Yeon-ju noted that while Tesla previously offered strong medium-term prospects in autonomous driving and humanoid robotics despite short-term EV sales weakness, “the recent AI boom has intensified competition from China and Europe, reducing expected margins and market share.”

The selling pressure extended beyond Tesla’s common stock, with the double-leveraged Tesla ETF (TSLL) experiencing its largest monthly outflow since early 2024, losing $554 million in August alone. This comprehensive retreat from Tesla-related investments underscores the depth of Korean investors’ disillusionment with the company’s current trajectory and future prospects.

Aggressive Crypto Buying Captures Global Attention

While abandoning Tesla, Korean investors have embraced US-listed cryptocurrency companies with unprecedented aggression, purchasing over $12 billion worth of shares in crypto-related firms this year. Data released by 10x Research reveals the stunning scale of this activity: in August alone, Korean investors purchased $426 million worth of Bitmine Immersion Technologies Inc., $226 million worth of Circle stock, and $183 million worth of Coinbase shares.

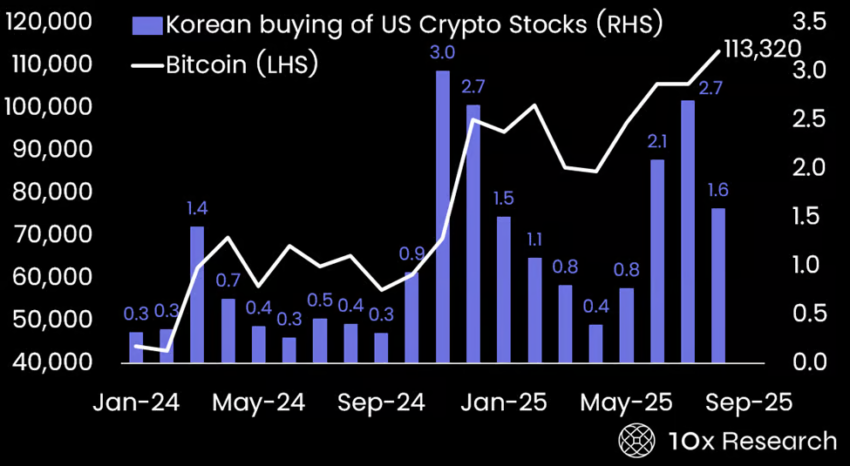

Bitcoin (LHS) vs. Monthly Buying of US crypto equities by Koreans (RHS, $bn) Source: 10x Research

Bitcoin (LHS) vs. Monthly Buying of US crypto equities by Koreans (RHS, $bn) Source: 10x Research

Beyond individual crypto companies, Korean investors also allocated $282 million to a 2x Ethereum ETF during the same period, demonstrating their sophisticated approach to gaining leveraged exposure to digital assets through traditional equity markets. This aggressive buying activity is reshaping global capital flows and garnering significant attention from Wall Street analysts closely monitoring Korean retail investor behavior.

The shift reflects broader cryptocurrency adoption patterns in South Korea, where approximately 20% of the population—roughly one in five citizens—now invests in digital assets, significantly exceeding global averages. Among younger demographics aged 20 to 50, cryptocurrency ownership rates climb even higher, reaching 25-27%, creating substantial demand for crypto-linked investment vehicles accessible through traditional brokerage accounts.

Regulatory Tailwinds Fuel Investment Surge

The timing of these massive investment flows coincides with favorable regulatory developments that are providing strong tailwinds for Korean capital allocation into cryptocurrency-related assets. South Korea is developing regulations for stablecoins, STOs, and crypto ETFs. Tax frameworks remain under discussion among policymakers. Unlike previous extreme caution, political circles and industry now agree on institutionalization needs.

Korean investors’ influence extends far beyond individual stock selection. They rank among the largest foreign investors in American equities overall. Their concentrated buying power can significantly impact individual stock performance, particularly in volatile sectors where their collective actions create noticeable market movements that ripple through global trading sessions.