CZ Backs DeFi Dominance As Japan Post Bank Unveils $1.3 Trillion Digital Currency Plan

Binance founder Changpeng Zhao (CZ) joined the BNB Chain this week as it marked its fifth anniversary in Tokyo.

Meanwhile, Japan Post Bank plans to activate its ¥190 trillion ($1.29 trillion) in deposits, issuing a digital currency for trading of blockchain-based financial products.

Binance’s CZ Says DeFi Will Outpace Centralized Trading Amid Japan’s Web3 Rise

In his fireside chat, Changpeng Zhao emphasized that BNB Chain’s success has been driven by its community rather than any single individual.

“The chain has a small tech team and is much more community-driven. I don’t do that much; I post tweets and encourage people to build. I’m a cheerleader,” he said.

With more than 4,000 decentralized applications now active, including PancakeSwap and Aster, BNB Chain has become one of the largest ecosystems in the industry.

CZ noted that stablecoin usage has nearly doubled this year. Meanwhile, real-world assets (RWAs) are beginning to take shape despite regulatory and liquidity challenges.

While he acknowledged that he holds many BNB tokens, which account for a significant portion of his worth, CZ stated that he sees decentralized finance (DeFi) overtaking centralized exchanges.

“DEX volumes are very likely to exceed CEX in the future. DeFi is the future. And normal trading should be privacy-preserving,” he said.

If starting from scratch today, CZ said he would focus on building an AI-powered trading agent and a privacy-preserving perpetual DEX. He also pointed to RWAs and stablecoins as areas of massive opportunity.

“Securities, treasuries, and commodities have huge potential. But regulation, KYC, and liquidity are major challenges,” he acknowledged.

Against this backdrop, the Binance executive highlighted BNB Chain’s investments into partnerships with issuers such as Securitize and Backed.

Japan, he argued, is well-positioned to play a leading role in this next chapter of Web3.

“I would love to see a dedicated BNB Chain team here, and more projects that bring together robotics, AI, and Web3,” CZ shared.

Japan Post Bank’s Digital Currency Push

While CZ looked at the future of global DeFi, Japan’s financial sector is preparing for a leap of its own.

Japan Post Bank announced it will issue the DCJPY digital currency in fiscal 2026. The move would enable depositors to instantly convert savings into digital money for trading blockchain-based assets.

Local media reports that the bank manages ¥190 trillion ($1.29 trillion) in deposits across 120 million accounts. By integrating blockchain rails into its core services, it hopes to revitalize dormant balances and attract younger customers.

DCJPY, developed by DeCurret DCP, will be pegged 1:1 to the yen and usable for purchasing security tokens and NFTs (non-fungible tokens).

The move could significantly improve trading efficiency by enabling instant settlement of tokenized securities. Japan Post Bank also envisions government subsidies and grants distributed via DCJPY, further embedding digital money into daily life.

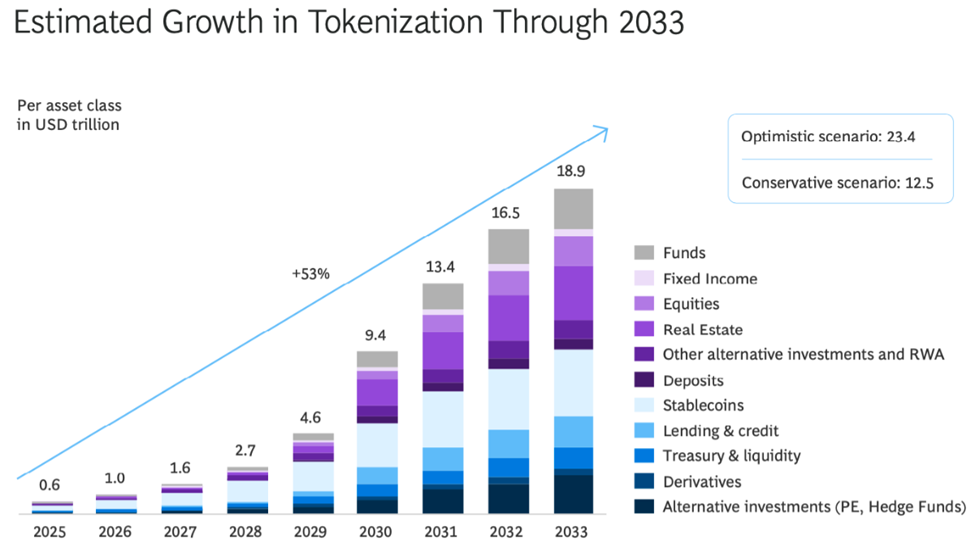

Meanwhile, the Boston Consulting Group and Ripple say the tokenized RWA market could expand from $600 billion in 2025 to $18.9 trillion by 2033.

Estimated Growth in Tokenization through 2033. Source: Ledger Insights

Estimated Growth in Tokenization through 2033. Source: Ledger Insights

Based on these reports, both CZ and Japan Post Bank aim to capture this opportunity.

From BNB Chain’s decentralized community to Japan’s state-backed digital currency, Tokyo is emerging as a hub where Web3 ideals and institutional innovation converge.