Binance Faces Allegations of Market Games as Solana Nears BNB

New allegations surfaced, claiming Binance is deliberately holding back Solana’s momentum to protect the BNB token, throwing the crypto market into controversy.

It adds to the list of times the largest exchange on trading volume metrics has been accused of using Wintermute market maker to influence prices.

Is Binance Secretly Holding Back Solana in Favor of BNB?

Analyst Marty Party sparked the debate on X (Twitter), alleging that Binance has been working with market maker Wintermute to prevent Solana’s market capitalization from surpassing BNB.

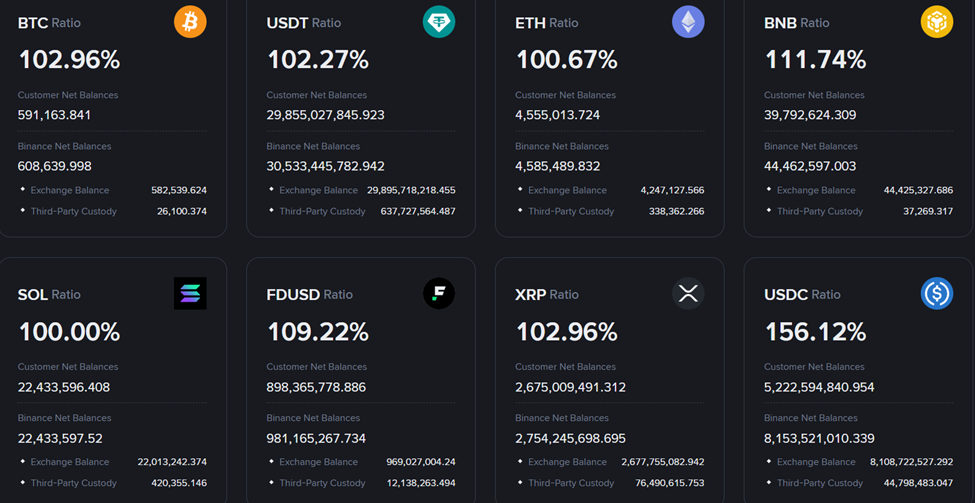

He shared what he called “receipts,” questioning how the Binance exchange could be sourcing SOL for trading activity when its proof of reserves (PoR) shows no Solana holdings beyond customer deposits.

As of the time of this writing, Solana was trading at $203 with a market cap of $109.7 billion, just behind BNB’s $865.97 price and $120.6 billion capitalization.

Indeed, Binance’s proof of reserves shows no Solana holdings beyond customer deposits of 22.433 million SOL tokens. The holdings comprise 22.013 million in exchange balance and 420.35 in third-party custody.

Binance proof of reserves. Source: Binance

Binance proof of reserves. Source: Binance

Meanwhile, this is not the first time Binance and Wintermute have been tied together in market controversy.

Five months ago, reports suggested Wintermute was involved in coordinated sell-offs that tanked smaller tokens such as ACT. Binance was also allegedly linked to the activity.

Similarly, seven months ago, Binance also faced scrutiny over $20 million worth of crypto transactions tied to Wintermute.

BeInCrypto reported that this sparked heated debates about opaque relationships between exchanges and market makers. BeInCrypto also explored the role of market makers beyond providing essential liquidity and preventing price volatility.

Critics argue that if Binance uses Wintermute to influence liquidity flows and suppress Solana, it would represent a direct conflict of interest.

More closely, it would undermine the credibility of both PoRs frameworks and the fairness of open markets.

Industry Voices Call for Action with Market at a Crossroads

The allegations have reignited questions about Binance’s dominance and the vulnerabilities of centralized exchange-driven markets.

“So the ‘new system’ is even worse than the old system? Why are any of us accepting a system this fragile … corrupt … and manipulatable? When will Binance be involuntarily shuttered? Arrest them. Prosecute them,” wrote Alan Knitowski, founder and former CEO of NASDAQ-listed companies Cisco Systems and Phunware Inc.

These remarks highlight growing frustration among traditional finance (TradFi) veterans entering crypto. Many of them believed blockchain markets would provide a more transparent alternative to legacy systems.

Instead, recurring accusations of manipulation and conflicts of interest may fuel skepticism.

The accusations come at a pivotal time for Solana, which has seen explosive adoption across DeFi, NFTs, and meme coins.

Its rise has positioned it as a potential challenger to Ethereum’s scaling dominance, and now, apparently, to Binance’s BNB token.

Whether the claims prove accurate, the controversy mirrors the fragile trust underpinning crypto markets.

On one hand, Solana’s community sees a network surging toward mainstream adoption. On the other hand, critics say entrenched players may be actively engineering ceilings to preserve their own dominance.

The tension leaves regulators, investors, and developers facing the same unresolved question: How much power should centralized exchanges still wield over market outcomes?