How the OKB Token Burn Strategy Created a 400% Rally

In 2025, token supply management strategies such as buybacks and burns have become increasingly important tools to enhance value and investor appeal. OKX, one of the leading cryptocurrency exchanges, demonstrated this through its OKB token burn plan.

The question is why this burn strategy enabled OKB to outperform other tokens in the past month. The following analysis highlights the core differences.

Key Differences in the OKB Token Burn

Data from CryptoBubble shows OKB recorded the highest growth among altcoins in the past month.

The token gained nearly 300%, surpassing other strong performers such as LINK, MNT, and AERO.

Altcoin Price Performance. Source: CryptoBubble.

Altcoin Price Performance. Source: CryptoBubble.

Unlike routine burns, the OKB burn was positioned as a near redefinition of tokenomics. OKX carried out its largest-ever burn, permanently removing 65,256,712 OKB—including previously repurchased and reserved tokens—reducing the fixed supply to 21 million.

This supply adjustment allowed the market to reprice the token’s capitalization. The timing proved critical, as it coincided with a positive period in August when analysts held high expectations for an altcoin season.

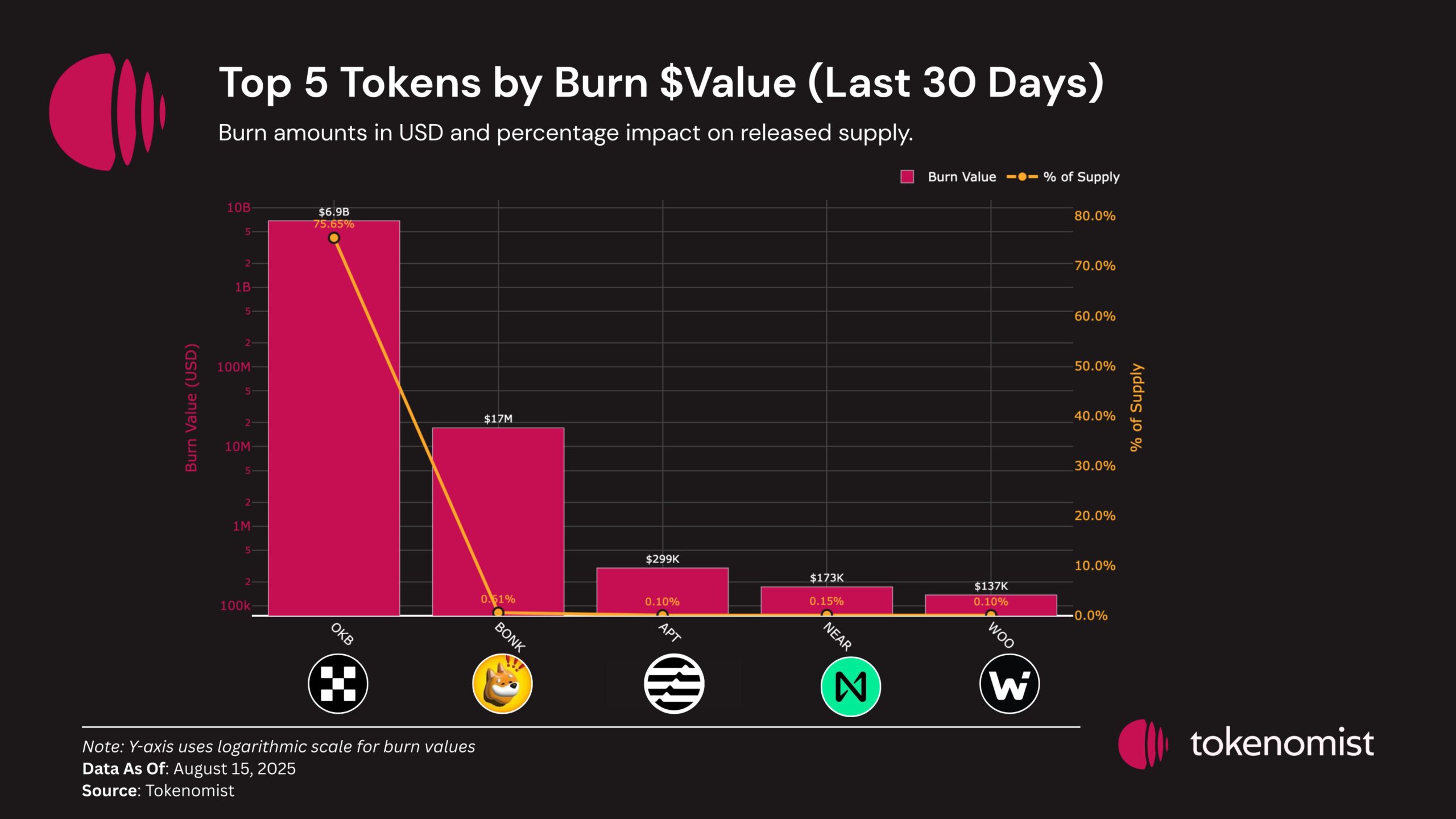

TOP 5 Tokens by Burn Value in August. Source: Tokenomist.

TOP 5 Tokens by Burn Value in August. Source: Tokenomist.

Following the burn, OKB’s supply is now fixed at 21 million. This figure mirrors Bitcoin’s maximum supply, creating a psychological link between OKB and the market’s benchmark asset. The move functions as a marketing factor, encouraging investors to compare OKB to Bitcoin when valuing it.

Other projects have adopted buyback-and-burn models, but without a fixed supply cap. For instance, Tron has burned 7.1 billion TRX since launch, including 820 million in 2025 alone, yet TRX does not have a maximum limit.

Smaller, periodic burns without a capped supply tend to dilute the impact over time. By contrast, OKX’s removal of 65.26 million OKB was decisive, introducing immediate deflationary pressure and driving a sharp price increase.

These structural differences helped OKB quadruple in value in August.

Will OKB Keep Rising?

An assessment of OKB’s potential requires looking beyond price movements to changes in market capitalization.

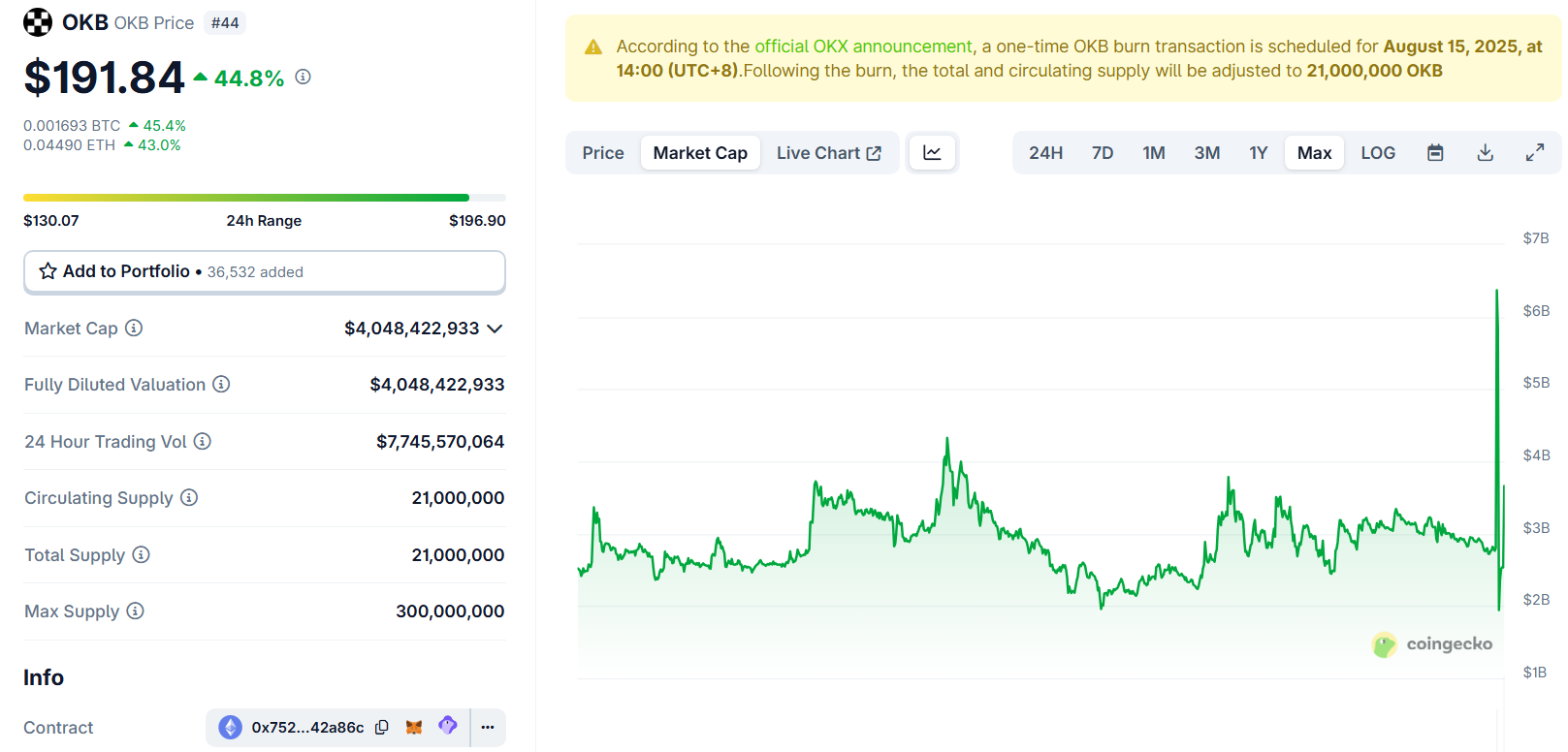

After the burn, data from CoinGecko indicates OKB’s current market capitalization equals its fully diluted valuation, at just over $4 billion.

OKB Market Cap. Source: CoinGecko.

OKB Market Cap. Source: CoinGecko.

Historically, capitalization fluctuated around $3–4 billion before and after the burn. This indicates that the price rally did not necessarily reflect a corresponding increase in total value.

“OKX cut total OKB supply from 300 million to 21 million. The price surged 3x, but history shows token burns don’t automatically create sustainable value or liquidity,” Bitcoin Suisse AG commented.

BNB’s long-term gains stemmed not only from burns but also from adoption within the Binance Chain ecosystem. Similarly, TRX maintained long-term growth due to rising demand for USDT transactions.

Therefore, expanding OKB’s applications will be crucial for maintaining growth in its market capitalization.

A key competitive advantage for OKB may lie in OKX’s ecosystem, particularly with X Layer. X Layer, a public zkEVM-based network developed in partnership with Polygon, launched in 2023. OKB remains the sole gas and native token for X Layer.