Altcoins to watch this week: AAVE, CRV, and ARB

- Aave price hovers around $321 on Wednesday after a nearly 10% rally in the previous session.

- Curve DAO price extends gains above $1, with bulls eyeing the $1.33 target.

- Arbitrum price nears its key resistance at $0.49, a decisive close above could trigger gains of over 20%.

Altcoins are gaining momentum this week, with Aave (AAVE), Curve DAO (CRV), and Arbitrum (ARB) standing out as top contenders for further gains due to a favourable technical setup. AAVE steadies near $321 after a strong rally, CRV pushes higher above $1 with eyes on $1.33, and ARB edges closer to a key resistance level that, if breached, could pave the way for gains of more than 20%.

Aave technical outlook suggests rally toward $400 as TVL hits record highs

Aave price found support around its 61.8% Fibonacci retracement level at $252.44 (drawn from the April 7 low of $114.05 to the July 18 high of $337.98) on August 3 and rallied nearly 30% in the next nine days until Tuesday.

This level roughly coincides with the ascending trendline (drawn by connecting multiple lows since early April), making it a key support zone. At the time of writing on Wednesday, it hovers around $321.

If AAVE continues its upward trend, it could rally toward its daily resistance at $367.11. A successful close above this level could extend gains toward the key psychological level $400.

The Relative Strength Index (RSI) reads 61, above its neutral level of 50 and pointing upward, indicating strong bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also showed a bullish crossover on Saturday, giving a buy signal.

AAVE/USDT daily chart

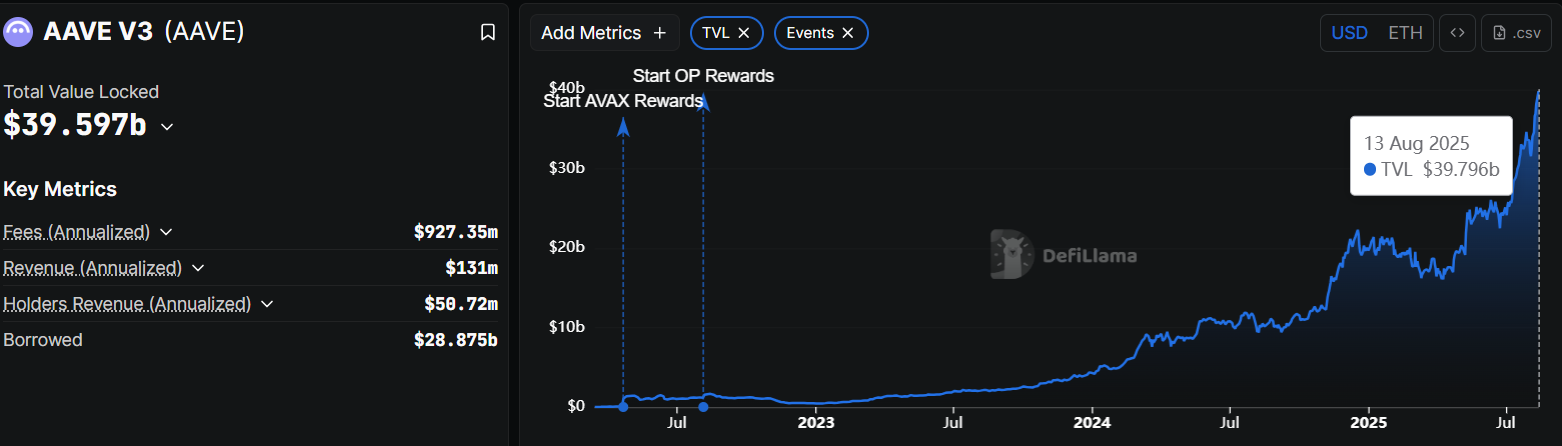

DefiLlama data shows that AAVE’s Total Value Locked (TVL) reached a new all-time high (ATH) of $39.79 billion on Wednesday. This rise in TVL suggests growing activity and interest within Aave’s ecosystem, suggesting that more users are depositing or utilizing assets within AAVE-based protocols.

AAVE TVL chart. Source: DefiLlama

If Aave faces a correction, it could extend the decline to find support around its 50-day Exponential Moving Average (EMA) at $284.59.

Curve DAO shows bullish technicals, rising Open Interest

Curve DAO price found support around its 50% price retracement level at $0.84 (drawn from the December 7 high of $1.33 to the March 11 low of $0.34) on August 3 and rose over 13% until Tuesday. At the time of writing on Wednesday, it trades above $1.03.

CRV could extend the rally toward its daily resistance at $1.09. A decisive close above this level would then shift the target to the December 7 high of $1.33.

The RSI reads above 61 and points upwards after bouncing above its neutral value of 50 on Monday, indicating that bullish momentum is gaining traction. The MACD lines are about to flip into a bullish crossover, and the falling red histogram bars suggest bearish momentum is fading.

CRV/USDT daily chart

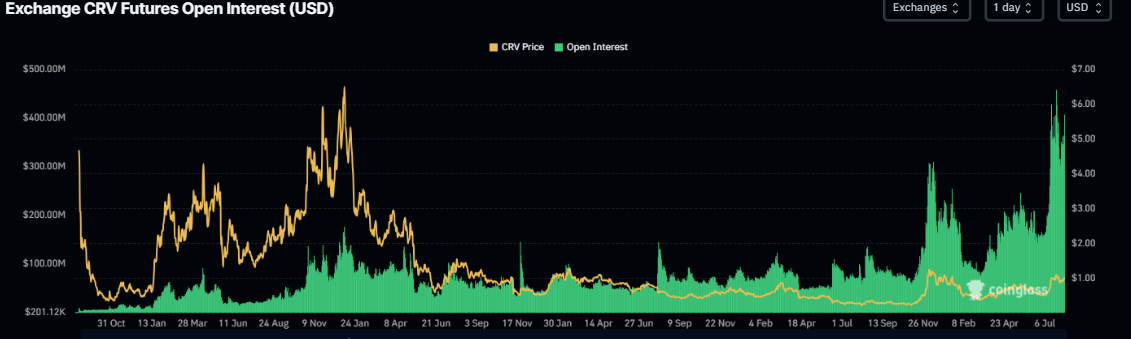

CoinGlass’s data indicates that the futures Open Interest (OI) in CRV at exchanges has risen to $406.99 million on Wednesday from $302.81 at the start of this month, closer to the record high of $458.55. Rising OI represents new or additional money entering the market and new buying, which could fuel the current CRV price rally.

CRV Open Interest chart. Source: CoinGlass

On the other hand, if CRV faces a pullback, it could extend the decline toward its 50-day EMA at $0.85.

Arbitrum’s technical outlook suggests 20% gains

Arbitum price rebounded after finding support around its ascending trendline (drawn by connecting multiple lows since mid-June) on August 3 and rallied 25% until Tuesday. At the time of writing on Wednesday, it approaches its daily resistance at $0.49.

If ARB breaks above its daily resistance at $0.49 on a daily basis, it could rally a further 20% toward its next daily resistance at $0.60.

Similar to Aave's case, ARB’s RSI and MACD also support the bullish thesis.

ARB/USDT daily chart

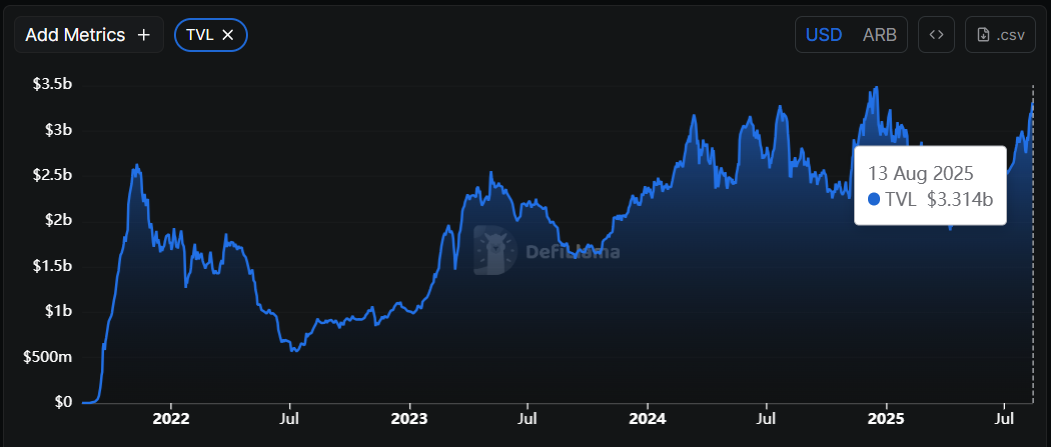

ARB’s TVL has been rising steadily since early August, reaching $3.31 billion on Wednesday and nearing its record high of $3.49 billion.

ARB TVL chart. Source: DefiLlama

If ARB faces a correction, it could extend the decline toward its 50-day EMA at $0.40.