Gold skyrockets to 4-week high amid geopolitical tensions, tariffs fears

- XAU/USD climbs as Russia-Ukraine conflict revs up and Trump revives tariff threats.

- Rising US-China trade tensions spark risk-off flight to Gold.

- Trump hikes steel tariffs to 50% starting June 4, adding to global market jitters.

- Fed’s Waller leaves door open for rate cuts; ISM Manufacturing PMI shows mixed signals ahead of NFP.

Gold prices rallied sharply on Monday, reaching their highest level in over four weeks, as geopolitical risks escalated over the Russia-Ukraine conflict. Renewed tensions on trade between the United States (US) and China prompted investors to buy the yellow metal throughout the day. At the time of writing, XAU/USD trades at $3,377, up by 2.70%.

Market sentiment shifted sour as news broke that Ukraine staged an aerial attack on Russia, which destroyed long-range bombers and other aircraft. Meanwhile, US President Donald Trump doubled down on tariffs over steel and aluminum imports to 50%, effective June 4, and rhetoric against China sent US global equities lower.

CNBC reported that Trump and China’s President Xi Jinping could speak this week, but not on Monday.

On the data front, the ISM Manufacturing PMI for May revealed that business activity deteriorated. Nevertheless, there were some improvements in the prices paid sub-component, which fell. Meanwhile, the employment index sub-component improved compared to the previous number, and it was received positively by market participants, who are eyeing Friday’s Nonfarm Payrolls figures.

Bullion prices are also up following Federal Reserve (Fed) Governor Christopher Waller's slightly dovish approach, saying that rate cuts remain possible later this year. However, he warned that policymakers are mainly focused on controlling inflation.

Gold daily market movers: Bullion rallies sharply as Greenback plummets

- Gold price surges as the US Dollar tanks. The US Dollar Index (DXY), which tracks the Greenback’s value against a basket of six currencies, tumbles 0.72% at 98.71.

- US Treasury bond yields are rising, with the US 10-year Treasury note yielding up almost six basis points to 4.458%. US real yields had followed suit and are also surging by six basis points to 2.118%.

- The ISM Manufacturing PMI rose by 48.5, down from April’s 48.7, hitting its lowest reading since November. The Prices Index remained in expansion territory, registering 69.4 percent, while the Employment Index stood in contractionary territory but improved from 46.5 to 46.8.

- The S&P Global Manufacturing PMI remained in expansionary territory, yet dipped in May from April’s 52.3 to 52.

- After the data release, the Atlanta Fed’s GDPNow preliminary reading of economic growth for Q2 2025 rose sharply from 3.8% to 4.6%.

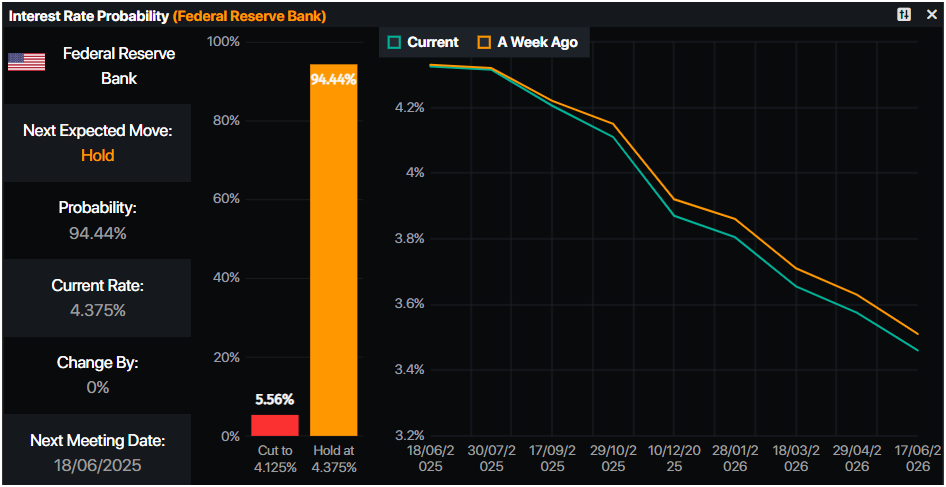

- Money markets suggest that traders are pricing in 51 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold surges past $3,350 with bulls targeting $3,400

Gold price is bullishly biased as buyers lifted the XAU/USD spot price above $3,370, eyeing a clear break of the $3,400 level. The Relative Strength Index (RSI) indicates that buyers are gaining momentum.

If Gold climbs above $3,400, the next resistance would be $3,438, the May 7 peak, ahead of the record high of $3,500.

For a bearish resumption, Gold must tumble below $3,300, so sellers could drag prices to $3,250. If cleared, the next stop would be the 50-day Simple Moving Average (SMA) at $3,228, followed by the April 3 high turned support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.