The Euro drops below 1.1400 following soft Eurozone CPI data.

The US Dollar appreciates further on strong US employment figures.

US Services PMI and ADP employment are in focus on Wednesday.

EUR/USD is moving lower for the second consecutive day on Wednesday, trading around 1.1380 at the time of writing. A positive surprise on Tuesday’s US job openings has boosted investors’ mood, contributing to easing concerns about the economic impact of tariffs.

The Euro, on the other hand, was hit by softer-than-expected Eurozone Consumer Prices Index (CPI) data release, which clears the path for the European Central Bank (ECB) to continue lowering interest rates in the coming months.

In the economic calendar on Wednesday, services activity data from Spain, France, and Germany precede the Eurozone final HCOB Services PMI reading.

Apart from that, the ECB kicks off a two-day monetary policy meeting, which is highly likely to conclude with a 25 basis points (bps) interest rate cut to be announced on Thursday. The main interest of the event will be on the ECB President Christine Lagarde’s ensuing press release to assess the chances of a pause in July.

In the US, a strong JOLTS Job Openings release boosted market sentiment and offset the downbeat Factory Orders figures. Investors' mood remains positive on Wednesday, and that is supporting the US Dollar.

Later in the American session, the US ISM Services PMI and ADP Employment Change figures will provide some guidance for the US Dollar, on a day when US trading partners are expected to submit their “best offers” to reach trade deals that, so far, remain elusive.

Euro PRICE Today

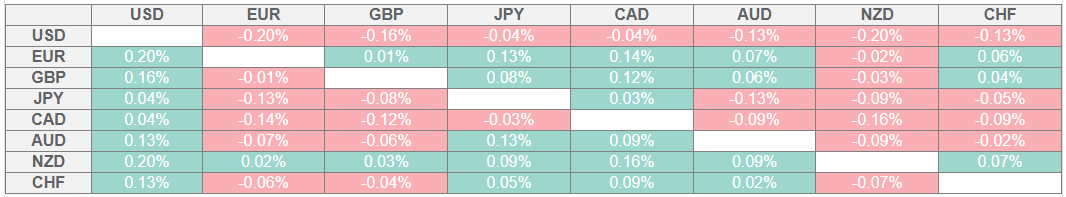

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Soft EU inflation figures weigh on the Euro

The Euro retreated from six-week highs after the Eurozone CPI showed that inflation fell below the ECB’s 2% target. Monthly inflation stalled in May, with the headline CPI rate down to a 1.9% year-over-year (YoY), against expectations of a 2% reading. Core inflation eased to 2.3% YoY, beyond the 2.5% expected.

In the US, JOLTS Job Openings, a relevant employment gauge for the Federal Reserve (Fed), increased to 7.39 million in April, against expectations of a slight decline to 7.1 million and from March’s 7.2 million reading.

April’s US Factory Orders resulted in a 3.7% contraction, which declined beyond the 3% expected, highlighting the negative impact of US President Trump’s trade policy on manufacturing activity.

In the Eurozone economic calendar, the main focus is May’s final HCOB Services PMI reading, which is expected to confirm that the sector’s activity contracted to 48.9 in May, following five consecutive months of growth.

During the US session, the focus will shift to the ADP Employment report, which will set the expectations for Friday’s all-important Nonfarm Payrolls release. The market anticipates an increase to 115,000 new payrolls in May, after April’s 62,000 reading.

Beyond that, the US ISM Services PMI is likely to show some acceleration in business activity in May. These figures are expected to feed investors’ appetite for risk, which, over the recent weeks, has favoured the USD rather than the Euro.

Technical analysis: EUR/USD corrects lower after rejection at 1.1455

EUR/USD hit six-week highs at 1.1450 on Monday but failed to consolidate at those levels and has returned to the mid-range of the 1.1300s.

The immediate trend remains positive, but technical indicators in 4-hour charts are approaching bearish territory, and the US Dollar Index is gaining momentum. Correlation studies suggest that further correction is on the cards for the index on Wednesday.

The 1.1365 level is holding bears for now, with the next support areas at 1.1310 and the May 20 and 29 lows in the 1.1210 area. On the upside, immediate resistance is at 1.1410 and Tuesday’s high at 1.1455.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.