Trump Raises Steel and Aluminum Tariffs, Escalating Global Trade Pressures

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

On June 3rd, US President Donald Trump signed an executive order raising the tariffs on imported steel and aluminum from 25% to 50%. The new tariffs took effect on June 4th. In response to this, Trump said that this was out of the need to protect national security.

The White House responded that raising the previously implemented tariff levels would provide greater support for these industries and reduce or eliminate the threat posed by imported steel and aluminum products and their derivatives to the national security of the United States.

The United States is negotiating reciprocal tariffs with multiple trading partners ahead of the July 9 deadline, a move that has exacerbated trade tensions.

The European Union said that it strongly regretted Trump's increase in import tariffs on steel and aluminium, saying that the move undermined the planned trade negotiations. As the deadline for Trump to impose a 50% tariff on EU imports approaches (early July), trade negotiations between the United States and the European Union have once again come into focus.

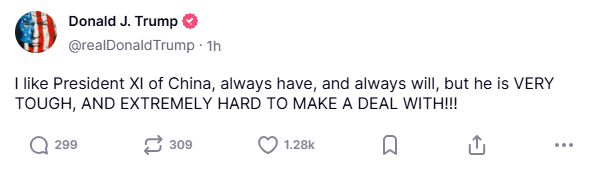

Meanwhile, there is huge uncertainty in the trade talks between the United States and China. In the early hours of Wednesday morning in Washington time, Trump posted on his Truth Social account that it was "EXTREMELY HARD TO MAKE A DEAL" with Chinese President Xi Jinping.

White House officials said Trump and Xi Jinping are expected to talk directly later this week. But Beijing has not yet confirmed the call plan.

Trump's remarks seemed like a preventive injection to the market. Since the 90-day trade truce agreement reached in Geneva on May 12th, the friction between the United States and China has not ceased.

The United States has recently banned the export of key jet engine components to China, restricted China's access to chip design software, and imposed new restrictions on Huawei's chip supply. Furthermore, the United States also announced the plan to revoke student visas for Chinese students, further intensifying the tensions in bilateral relations.

U.S. Treasury Secretary Scott Bassent said in an interview last week that the trade negotiations between the United States and China "have somewhat stalled".

The OECD warned on Tuesday that Trump's trade war is causing the global economy to slow down, and the economic growth rate is currently at its lowest level since the outbreak of the COVID-19 pandemic.

The OECD has lowered its forecast for most G20 economies and warned that easing trade tensions is key to promoting investment and maintaining price stability. Alvaro Pereira, the chief economist of the OECD, said that countries need to lower trade barriers.

Read more

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.