Mexican Peso holds ground ahead of Banxico, Fed Powell’s remarks

- Mexican Peso holds firm ahead of expected Banxico 50 bps interest rate cut.

- US economic data and Fed Powell's speech may trigger volatility and shape near-term USD/MXN momentum on Thursday.

- USD/MXN remains under pressure after decisively breaking below a consolidation range.

The Mexican Peso (MXN) holds steady against the US Dollar (USD) on Thursday as markets brace for a pivotal session driven by monetary policy developments in both Mexico and the United States.

At the time of writing, USD/MXN is trading 0.22% lower in the near 19.35, with attention centered on Bank of Mexico (Banxico) interest rate decision – where a 50 basis-point (bps) cut is widely expected –, as well as a slew of US economic data and a speech from Federal Reserve (Fed) Chair Jerome Powell, all of which are poised to guide near-term price direction.

US-Mexico policy divergence drives exchange rate dynamics

The policy divergence between Banxico and the Fed is a central factor in USD/MXN price action. Banxico is expected to cut rates for the seventh consecutive meeting, lowering the benchmark to 8.5% from 9.0% in response to easing inflation and economic headwinds. By contrast, the Fed has maintained interest rates unchanged this year, signaling a prolonged restrictive stance to anchor inflation at its 2% target.

Thursday’s US economic data, including Initial Jobless Claims, the Producer Price Index (PPI), and Retail Sales figures for April, will provide vital insight into the health of the US economy and could further shape Fed policy expectations. Powell’s speech will be closely watched for any change in tone or policy direction, with markets highly sensitive to shifts in guidance.

Mexican Peso daily digest: Banxico in focus

- Banxico rate cuts: The Bank of Mexico has cut interest rates at six consecutive meetings since August. A 50 bps cut on Thursday would mark a cumulative 250 bps (2.50%) of easing over seven meetings.

- Fed stance: In contrast, the Fed has reduced rates three times in the same period, lowering its benchmark rate to the 4.50%-4.25% range from 5.50%-5.25%. Since then, the Fed has maintained a data-dependent, hawkish bias.

- Market sensitivity to surprises: Stronger-than-expected US data would likely reinforce expectations of extended restrictive monetary policy, boosting the US Dollar. Weaker data may revive speculation around earlier Fed rate cuts, weighing on the Greenback.

- Trade tensions with the US: Rising US-Mexico trade tensions threaten Mexico’s export-reliant economy, where over 80% of exports go to the US. Tariffs on goods such as steel and aluminium could disrupt supply chains, dampen investor sentiment, and weigh on growth.

- Tariff policy developments: The US has imposed 25% tariffs on certain Mexican imports not covered by the USMCA, citing security and drug enforcement concerns, adding further uncertainty to bilateral trade relations.

USMCA review proposal: According to Reuters, Mexico’s Economy Minister has proposed an early review of the USMCA, ahead of the 2026 timeline, to reassure investors and preserve the framework underpinning over $1.5 trillion in annual North American trade.

USD/MXN Technical Analysis: Bearish breakdown extends below key support

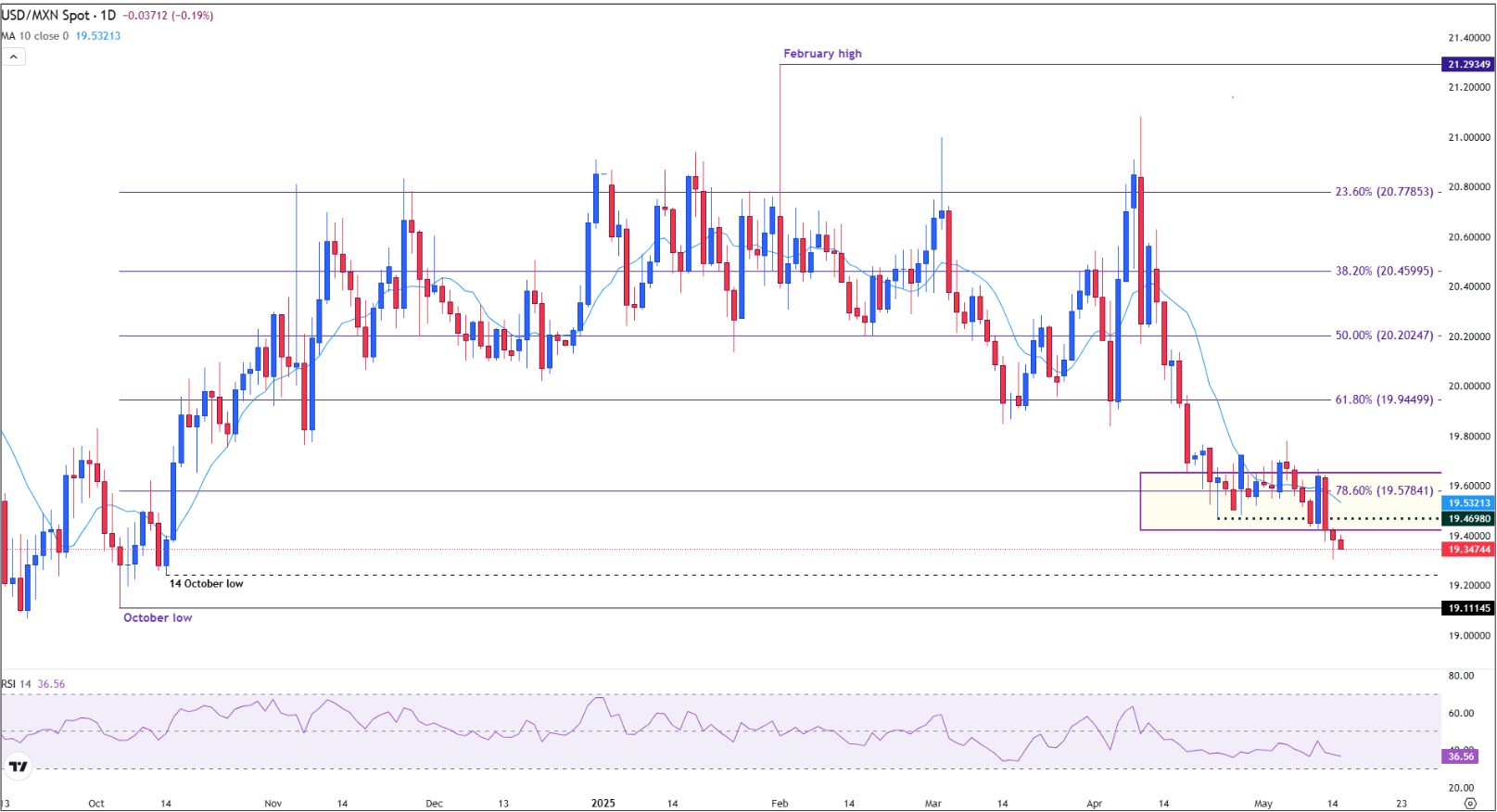

USD/MXN remains under pressure, extending its decline below the 78.6% Fibonacci retracement of the October to February rally at 19.57. The pair is currently trading around 19.37, having decisively broken below key psychological support, now turned resistance, at 19.40, reinforcing the prevailing bearish momentum.

The consolidation range highlighted in the purple box in the chart below has been breached to the downside, confirming the continuation of the broader downtrend. This technical breakdown aligns with persistent bearish sentiment.

The next key support lies near the October low at 19.11, a critical level that could serve as a medium-term downside target if bearish pressure continues. A break below this level would open the door to further losses, potentially exposing the psychological 19.00 handle.

On the upside, initial resistance is seen at 19.40, followed by the 78.6% Fibonacci level at 19.57. A sustained move above this zone could signal a shift in momentum, bringing the psychological 19.60 area back into focus.

The 10-day Simple Moving Average (SMA), currently at 19.53, continues to act as dynamic resistance, capping any upside attempts. Meanwhile, the Relative Strength Index (RSI) stands at 37.14, indicating the pair is approaching oversold conditions, though there remains room for additional downside before a corrective rebound becomes technically compelling.

USD/MXN Daily chart

Economic Indicator

Fed's Chair Powell speech

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

Read more.Next release: Thu May 15, 2025 12:40

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve