GBP/USD slips below 1.3800 as Warsh nomination, hot PPI boosts USD

- GBP/USD falls as Trump names Kevin Warsh Fed Chair nominee, triggering a rebound in the Dollar.

- US PPI surprises higher, backing the Fed’s decision to hold rates amid persistent inflation pressures.

- Focus turns to next week’s BoE meeting and guidance on the future policy path.

The Pound Sterling retreats on Friday, remaining below 1.3800 after the Trump administration revealed that Kevin Warsh to lead the Federal Reserve. Additionally, a red-hot inflation report on the producer front boosted the Greenback’s appeal.

Sterling weakens as Kevin Warsh’s Fed nomination, strong PPI reinforces a firmer Dollar tone

The GBP/USD trades at 1.3720. down 0.6% at the time of writing. Trump announced via Truth Social that he is nominating Warsh to be the Chairman of the Fed. Since the breaking news emerged, the buck has recovered some ground according to the US Dollar Index (DXY).

The DXY which measures the performance of the buck’s value against six currencies, is up 0.50% at 96.64.

The US Bureau of Labor Statistics revealed that the Producer Price Index (PPI) for December rose by 3% YoY unchanged from November but exceeded forecasts for a 2.7% drop. Core PPI, which excludes food and energy prices, expanded even higher by 3.3% YoY, missing estimates for a dip to 2.9%, above the prior month 3% increase.

The data supports the Fed’s decision to hold rates on Wednesday. The Fed Chair Jerome Powell expressed that the labor market has stabilized but that inflation remains too high.

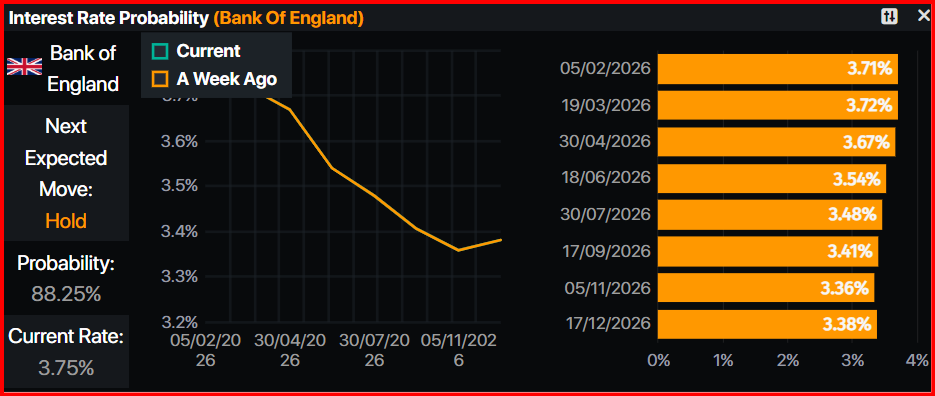

A scarce economic docket in the UK kept traders focused on dynamics linked to the US Dollar. Nevertheless, investors focus is on next week’s Bank of England (BoE) monetary policy meeting in which the Bank Rates is expected to remain in hold.

Data from Prime Market Terminal, suggests that the BoE would ease policy by 37 basis points, towards the end of the year.

Aside from this, traders’ eyes are on the vote-split and the update for economic projections, which could pave the way for the future of interest rates.

Next week, the UK economic docket will feature speeches by BoE policymakers, the central bank’s monetary policy decision. In the US, the ISM Manufacturing and Services Purchasing Managers Indices (PMI), speeches by Fed officials, jobs data and the University of Michigan Consumer Confidence.

GBP/USD Price Forecast: Technical outlook

The GBP/USD is still biased upward even though it retreats to new three-day lows. Momentum as depicted by the Relative Strength Index (RSI) shows that sellers are stepping in, but unless they push the pair below January 6 high turned support at 1.3567, further upside is seen.

If GBP/USD drops below the January 6 peak, this clears the way to challenge 1.3500. A breach of the latter will expose the 50-day SMA at 1.3433.

On the upside, the GBP/USD must remain above 1.3700. The next key resistance levels are 1.3800, followed by the yearly peak at 1.3869.

Pound Sterling Price This Month

The table below shows the percentage change of British Pound (GBP) against listed major currencies this month. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.18% | -1.75% | -1.25% | -1.20% | -4.79% | -4.46% | -2.85% | |

| EUR | 1.18% | -0.64% | 0.06% | 0.05% | -3.30% | -3.25% | -1.62% | |

| GBP | 1.75% | 0.64% | 0.68% | 0.70% | -2.68% | -2.63% | -0.99% | |

| JPY | 1.25% | -0.06% | -0.68% | -0.02% | -3.48% | -3.69% | -1.49% | |

| CAD | 1.20% | -0.05% | -0.70% | 0.02% | -3.45% | -3.67% | -1.67% | |

| AUD | 4.79% | 3.30% | 2.68% | 3.48% | 3.45% | 0.05% | 1.73% | |

| NZD | 4.46% | 3.25% | 2.63% | 3.69% | 3.67% | -0.05% | 1.67% | |

| CHF | 2.85% | 1.62% | 0.99% | 1.49% | 1.67% | -1.73% | -1.67% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).