GBP/USD pares gains as markets weigh rate cut bets

- GBP/USD gave up most of its gains from late last week.

- Cable continues to grind it out near key moving averages.

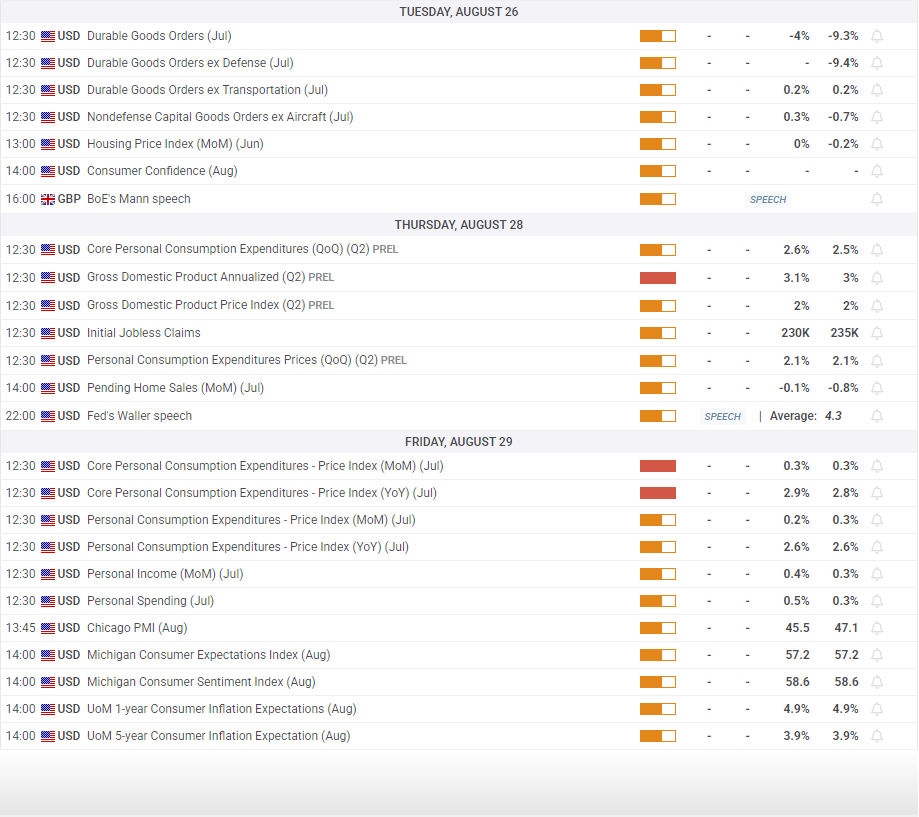

- Markets are hunkering down for a long wait to key US inflation figures later this week.

GBP/USD backslid on Monday, falling back into the 1.3450 region after global markets reconsidered their rate cut frenzy sparked by perceptions of a dovish Federal Reserve (Fed) Chair Jerome Powell late last week. Powell’s appearance at the Jackson Hole Economic Symposium fanned the flames of interest rate cut expectations heading into the weekend, but now the latest batch of key US Personal Consumption Expenditure Price Index (PCE) inflation data looms large ahead of investors this week.

It’s a fairly sedate showing on the economic data docket for Cable traders on the UK side; London markets were shuttered for an extended weekend, making Tuesday the first day that GBP domestics will be back on the books since Friday. The data docket is dominated by a decent spread of US economic figures, culminating in the latest PCE inflation print slated for Friday.

Rate cuts? Jobs say yes, inflation says....

Softening labor figures have certainly done their job to stoke rate cut hopes recently. A sharp downside revision to the latest quarter’s hiring numbers tilted both Fed policymakers and market participants into expectations of forthcoming interest rate cuts. However, the ever-present specter of tariff-led inflation continues to be the quiet thorn in the side of traders. The latest batch of PCE inflation, due on Friday, is expected to show yet another slight uptick in annualized PCE inflation. As the favored inflation metric for the Fed’s decision-making, rising PCE inflation will make it difficult for the Fed to dole out rate trims at a pace markets will be satisfied with.

GBP/USD price forecast

A fresh round of Greenback bidding halted a one-day advance on the GBP/USD pair, dragging intraday price action back into familiar consolidation near the 50-day Exponential Moving Average. Cable bids have struggled to push away from the 1.3450 region in either direction as of late. Despite an ongoing bullish trend from early August’s lows around 1.3150, topside momentum has stalled out ever since bidders flubbed the 1.3600 handle.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.