FTSE 100 up, midcaps uncertain today; shares mixed at market open

Source Investing

Investing.com – U.K. equities started mixed on Thursday, with losses in Beverages, Automobiles & Parts and Oil & Gas; gains in Industrial Engineering, General Industrials and Construction & Building Materials sectors.

At the market open in London, the FTSE 100 Index climbed 0.14%. The FTSE 250 Index and the FTSE 350 Index were down. The FTSE 250 dropped 0.07% at market open, while the FTSE 350 was down by 0.01%.

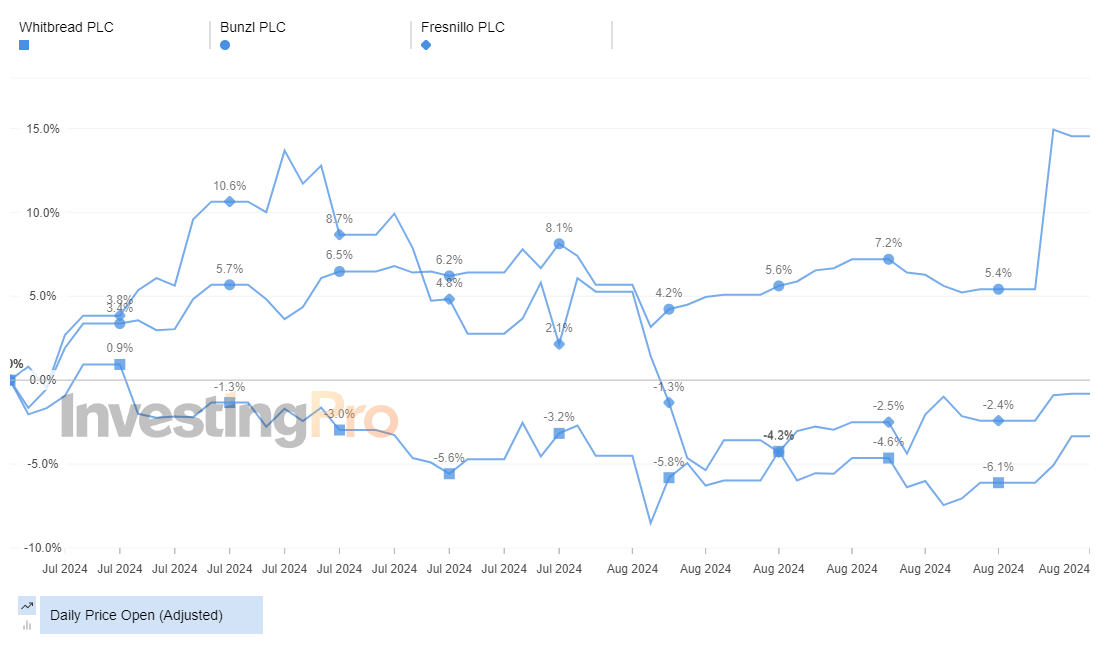

Top Gainers:

- Whitbread (LON:WTB): Rose 1.73% or 49.0 points to 2,881.0.

- Bunzl (LON:BNZL): Increased 1.21% or 42.0 points to 3,504.0.

- Fresnillo (LON:FRES): Climbed 1.08% or 5.90 points to 552.40.

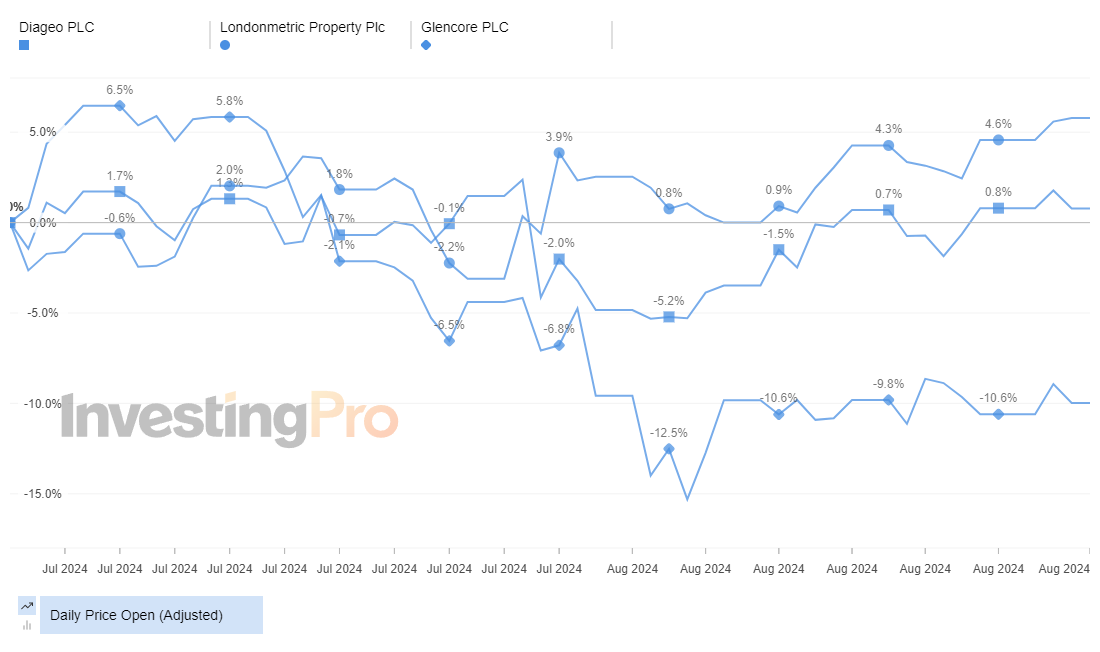

Top Losers:

- Diageo (LON:DGE): Declined 1.39% or 35.0 points to 2,484.5.

- LondonMetric (LON:LMPL) Property: Fell 1.39% or 2.87 points to 203.13.

- Glencore (LON:GLEN): Dropped 0.88% or 3.55 points to 401.00.

In Commodities Trading:

- Gold Futures for December delivery climbed 12.75 points to 2,550.55 a troy ounce.

- Crude Oil for October delivery increased 0.06 points to 74.58 a barrel.

- November Brent Oil Contract rose 0.12% or 0.09 points to 77.67 a barrel.

Currency Markets:

- GBP/USD stays over 1.32 line.

- EUR/GBP is at 0.8415 with a daily range of 0.8413-0.8435.

- The US Dollar Index Futures was down at 100.920.

Main Economic Events:

Today's main economic event in the United Kingdom is the car registration data.

Disclaimer: For information purposes only. Past performance is not indicative of future results.

Recommended Articles

Natural Gas sinks to pivotal level as China’s demand slumpsNatural Gas price (XNG/USD) edges lower and sinks to $2.56 on Monday, extending its losing streak for the fifth day in a row. The move comes on the back of China cutting its Liquified Natural Gas (LNG) imports after prices rose above $3.0 in June. It

Natural Gas price (XNG/USD) edges lower and sinks to $2.56 on Monday, extending its losing streak for the fifth day in a row. The move comes on the back of China cutting its Liquified Natural Gas (LNG) imports after prices rose above $3.0 in June. It

Egrag Crypto, a well-known crypto analyst on the social media platform X, recently shared an optimistic price prediction for XRP. According to the analyst, technical analysis of the XRP price on the

As the Bitcoin market continues to mature, its 2025 outlook appears highly favourable, driven by institutional adoption and regulatory developments.

Crypto whales are making bold moves heading into May 2025, and three tokens are standing out: Ethereum (ETH), Artificial Superintelligence Alliance (FET), and Onyxcoin (XCN).

Gold Price Forecast: XAU/USD attracts some sellers below $3,250 on firmer US DollarThe Gold price (XAU/USD) extends the decline to around $3,245 during the early Asian session on Thursday. The precious metal edges lower to near a two-week low amid easing US-China trade tensions and stronger US Dollar (USD) demand.

The Gold price (XAU/USD) extends the decline to around $3,245 during the early Asian session on Thursday. The precious metal edges lower to near a two-week low amid easing US-China trade tensions and stronger US Dollar (USD) demand.