Here Are Analysts' Takes on the ECB Rate Decision

- Markets in 2026: Will gold, Bitcoin, and the U.S. dollar make history again? — These are how leading institutions think

- Bitcoin Price Surges To $90,000. U.S. Arrests Venezuela's President, Triggers Bull Frenzy

- After Upheaval in the World’s Largest Oil Reserve Holder, Who Will Emerge as the Biggest Winner in Venezuela’s Oil Market?

- U.S. to freeze and take control of Venezuela's Bitcoin holdings after Maduro capture

- Ethereum Price Forecast: Accumulation addresses post record inflows in December despite high selling pressure

- Silver Price Forecast: XAG/USD bulls look to build on momentum beyond $79.00

Insights - Eurozone inflation is steadily falling, with September's rate at 1.8%, down from 2.2% in August, and below the ECB's 2% target for the first time in three years.

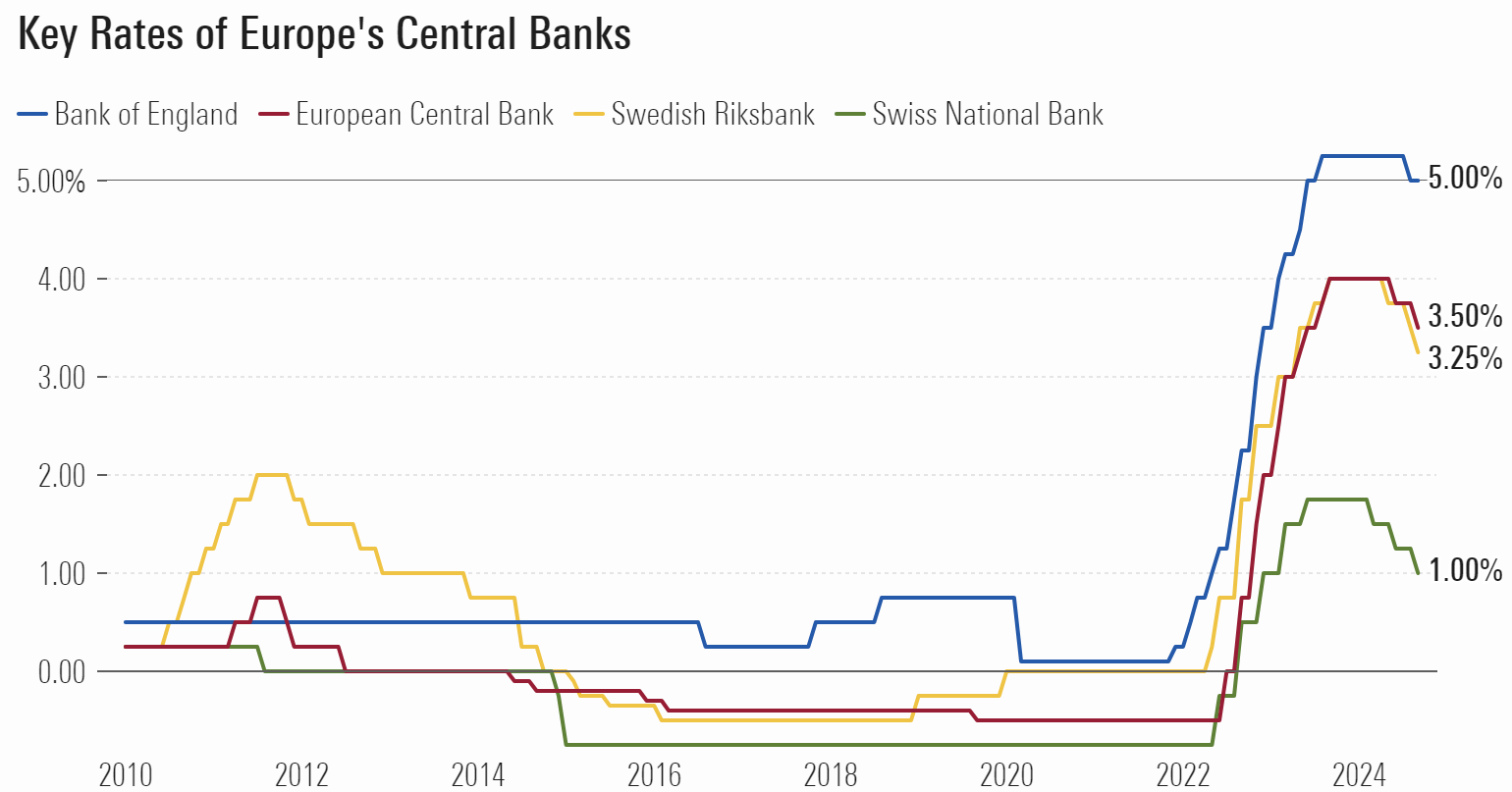

Other major European central banks have begun cutting rates, most notably the Swiss National Bank, which led the way in March, followed by further cuts in June and September.

Source: MorningStar

The ECB is expected to announce further rate cuts this Thursday. Deutsche Bank has revised its outlook, stating that declining inflation and weak economic activity mean the ECB should act in October rather than waiting until December.

"With policy rates still arguably above neutral and restrictive even with a 25bp policy rate cut in October, there is little risk in accelerating the next rate cut. A cut in October would better balance the risks to the path of inflation in 2025-2026 while leaving the Governing Council will all options open to it in December when a full reassessment of the inflation forecast will be available," says Deutsche Bank.

Bastian Freitag, head of fixed income Germany at Rothschild, also expects rapid interest rate cuts. "The decline in headline inflation is not only due to falling energy prices, but also to a slowdown in core inflation," Freitag says.

Jack Allen-Reynolds, Deputy Chief Eurozone Economist at Capital Economics, stated that tight monetary policy, along with structural issues like declining German industrial competitiveness, is hindering growth. He expects the ECB to cut rates this week and continue doing so at upcoming meetings until the deposit rate reaches 2.5%.

Bank of France Governor Francois Villeroy de Galhau described an October rate cut as “very likely” and said such a step “won’t be the last.”

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.