Who are the Forex Market Participants?

Before we look into the entities involved in the forex market, let’s look at forex market structure to better understand how each participant falls into the picture.

Forex Market Structure

Unlike the centralized markets such as the New York Stock Exchange (NYSE) which can be very monopolistic in the sense that only one entity controls the price.

A centralized market is where all orders routed to one central exchange. The quoted prices that investors see are made available by one exchange.

The forex market is a decentralized market where the currency quotes will vary between each broker and other entities.

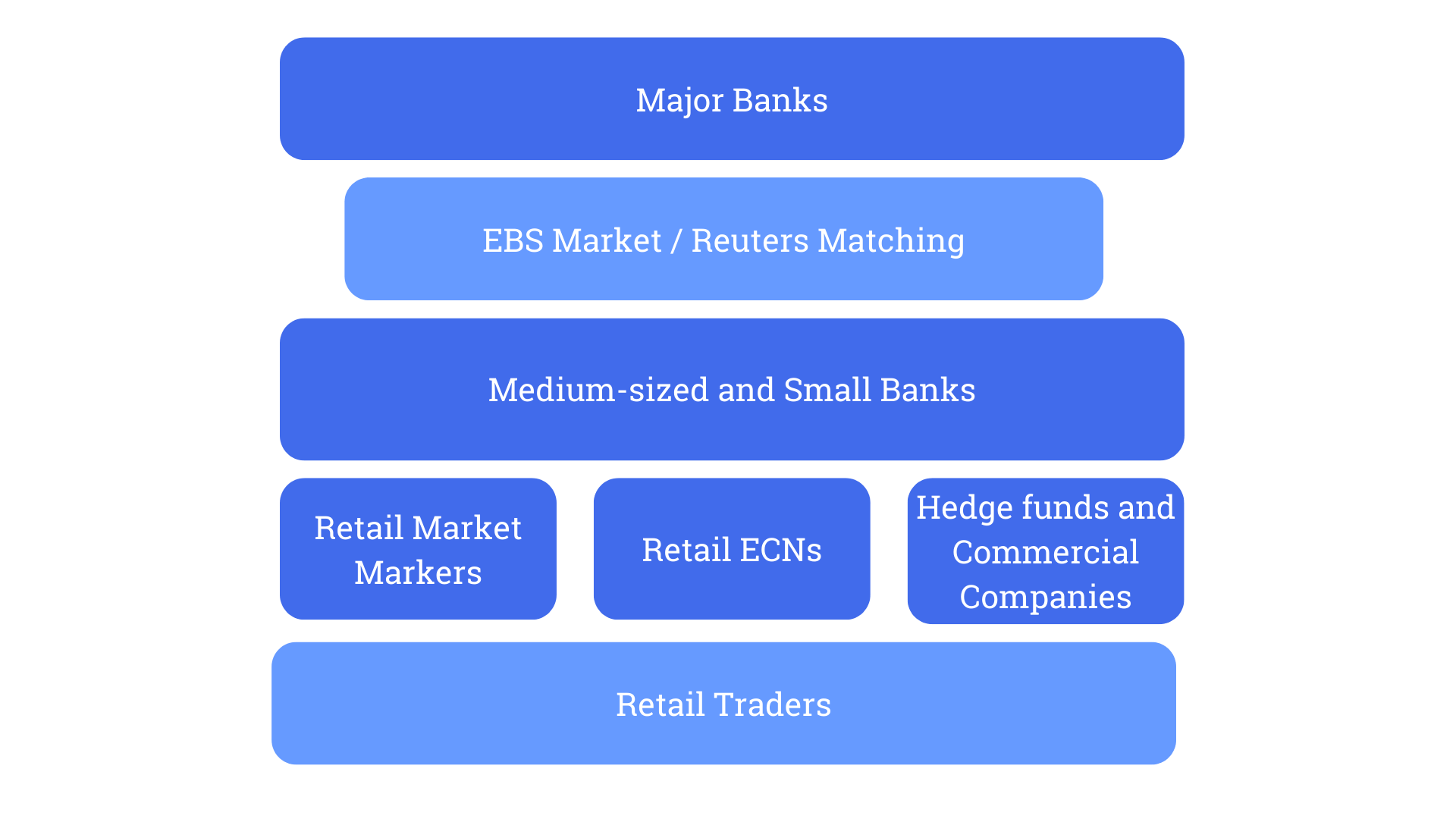

It may seem very messy and chaotic, but it can be organized into a ladder to better understand the structure of the forex market.

At the very top of the forex market structure is the interbank market. Comprised of the largest banks in the world, the participants of this market trade directly with each other (“bilaterally”) or through voice or electronic brokers (such as EBS Market and Reuters Matching). The competition between the two companies, EBS and Reuters, is similar to Coke and Pepsi.

While both companies offer most currency pairs, some currency pairs are more liquid on one than the other. For the EBS platform, EUR/USD, USD/JPY, EUR/JPY, EUR/CHF, and USD/CHF are more liquid. Meanwhile, for the Reuters platform, GBP/USD, EUR/GBP, USD/CAD, AUD/USD, and NZD/USD are more liquid.

All the banks that are part of the interbank market can see the rates that each other is offering, but this doesn’t necessarily mean that anyone can make deals at those prices. The rates will be largely dependent on the established credit relationship between the trading parties. Similar to applying for a loan at your local bank. The better your credit standing and reputation with them, the better the interest rates and the larger loan you can get.

Next on the ladder are the hedge funds, corporations, retail market makers, and retail ECNs. Since these institutions do not have tight credit relationships with the participants of the interbank market, they have to do their transactions via commercial banks. Which means that their rates are slightly higher and more expensive than those who are part of the interbank market.

At the bottom of the ladder are non-professional traders known as retail traders. In the past, it used to be very challenging for retail investors to participate in the forex market. Nowadays with the advent of internet, electronic trading and retail brokers, it lowered the barrier of entry significantly for retail trading.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.