Forex Today: Tariff uncertainty weighs on mood as attention turns to FOMC Minutes

Here is what you need to know on Wednesday, July 9:

Investors adopt a cautious stance mid-week while navigating through the latest headlines surrounding the United States' trade policy. Later in the American session, the Federal Reserve (Fed) will publish the minutes of the June policy meeting and the US Treasury will hold a 10-year note auction.

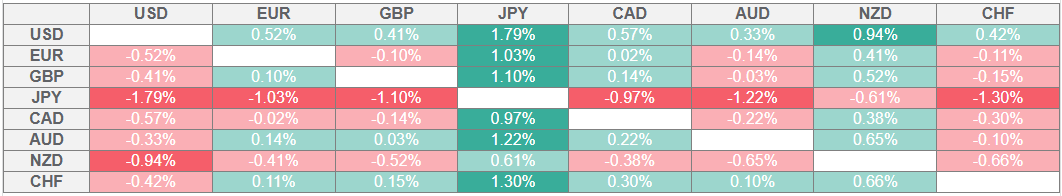

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

During the American trading hours on Tuesday, US Commerce Secretary Howard Lutnick noted that another 15 to 20 tariff letters are expected to be announced in the next two days. Meanwhile, US President Donald Trump said that the BRICS members will be subject to 10% tariff rate and added that they will be introducing tariffs on pharmaceuticals and semiconductors soon. Finally, he noted that there is likely to be a 50% tariff on copper. On this matter, Lutnick explained that copper tariffs will likely be put in place toward the end of July or in August.

After posting small gains on Tuesday, the US Dollar (USD) Index holds steady at around 97.50 in the European session on Wednesday. In the meantime, US stock index futures trade flat after Wall Street's main indexes closed mixed on Tuesday.

In the Asian session on Wednesday, the Reserve Bank of New Zealand (RBNZ) announced that it left the policy rate unchanged at 3.25%, as widely expected. "If medium-term inflation pressures continue to ease as projected, the Committee expects to lower the official cash rate further," the RBNZ said in its policy statement. NZD/USD showed no immediate reaction to the RBNZ policy decision and was last seen trading flat at around 0.6000.

Following a drop in the Asian session, AUD/USD regained its traction and turned positive on the day near 0.6550. The data from China showed earlier in the day that the Consumer Price Index (CPI) declined by 0.1% on a monthly basis in June.

After posting marginal gains on Tuesday, EUR/USD struggles to gather directional momentum early Wednesday and moves sideways slightly above 1.1700. Several European Central Bank (ECB) policymakers are scheduled to deliver speeches later in the day.

GBP/USD stabilizes at around 1.3600 in the European morning on Wednesday after touching a two-week low below 1.3530 on Tuesday.

Gold came under heavy bearish pressure in the second half of the day on Tuesday and lost about 1%. XAU/USD stays on the back foot and trades near $3,290.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.