Here is what you need to know on Wednesday, June 11:

The trading action in financial markets remains choppy early Wednesday as investors' search for the next catalyst continues. In the second half of the day, the US Bureau of Labor Statistics will publish the Consumer Price Index (CPI) data for May and the US Treasury will hold a 10-year note auction.

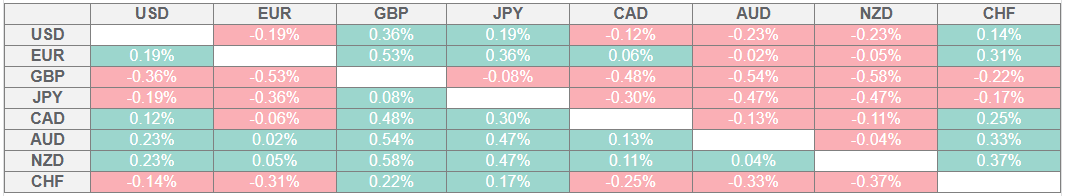

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The US Dollar (USD) held its ground on Tuesday, with the USD Index ending the day marginally higher. Following a two-day talk, the United States (US) and China have decided to ease export curbs, including the ones on rare earths, and agreed on a framework to keep the tariff truce alive. Wall Street's main indexes registered modest gains following this development. In the meantime, Bloomberg reported late Tuesday that a federal appeals court has ruled that US President Donald Trump’s broad tariffs can remain in effect while legal appeals continue, Early Wednesday, the USD Index stays in positive territory above 99.00 and US stock index futures lose about 0.2%.

Annual inflation in the US, as measured by the change in the CPI, is forecast to rise to 2.5% in May from 2.3% in April. In the same period, the core CPI is seen rising 2.9%.

EUR/USD extends its sideways grind at around 1.1400 in the European morning on Wednesday after closing virtually unchanged on Tuesday.

GBP/USD closed in negative territory on Tuesday as the disappointing labor market data weighed on Pound Sterling. The pair stays on the back foot and trades below 1.3500 in the early European session on Wednesday. The UK's Office for National Statistics will publish monthly Industrial Production, Manufacturing Production and Gross Domestic Product data for April on Thursday.

USD/JPY registered small gains on Tuesday and erased Monday's losses. The pair edges higher on Wednesday and trades above 145.00. The data from Japan showed in the Asian session that the Producer Price Index (PPI) rose 3.2% on a yearly basis in May. This print followed the 4.1% increase reported in April and came in below the market expectation of 3.5%.

After failing to make a decisive move in either direction on Monday and Tuesday, Gold stretches higher and trades in positive territory at around $3,340 in the European session on Wednesday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.