AUD/JPY treads water above 94.50 due to signs of BoJ delaying rate hikes

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

AUD/JPY receives support as the BoJ is expected to delay interest rate hikes.

BoJ’s Takata mentioned the need for an accommodative monetary policy as the central bank’s price target hasn't been fully achieved.

Australia’s trade surplus came in at 2,238M MoM in May, significantly below the expected 5,091M.

AUD/JPY holds its positions for the second successive session, trading around 94.60 during the European hours on Thursday. The currency cross gains ground as the Japanese Yen (JPY) faces challenges, driven by the Bank of Japan (BoJ) adopting caution on interest rate hikes. This increases the expectations of delaying interest rate hikes.

The BoJ Board Member Hajime Takata noted on Thursday that Japan is nearing achieving the BoJ's price target but hasn't fully achieved it yet, so it needs to maintain an accommodative monetary policy. “Hard to predict exactly when BoJ's price target will be completely achieved until US tariff impact becomes clearer,” Takata added.

BoJ board member Kazuyuki Masu noted on Tuesday that the central bank should not rush into raising interest rates, given various economic risks. Moreover, BoJ Governor Kazuo Ueda highlighted that any rate hikes in the future will be decided by gauging economic data, including wage growth and expectations. Ueda also mentioned that headline inflation has remained above 2% for nearly three years, and underlying inflation has remained below target.

Additionally, the Japanese Yen faces challenges due to the lack of a final tariff deal between the United States (US) and Japan. US President Donald Trump said on Tuesday that he is considering adding additional 30% or 35% tariffs on Japan and not extending the self-imposed July 9 deadline on the currently-suspended reciprocal tariffs. Trump expressed his doubt about reaching a deal with Japan.

The upside of the AUD/JPY cross could be limited as the Australian Dollar (AUD) struggles following the release of key economic data on Thursday. Australia’s trade surplus narrowed to 2,238M month-over-month in May, against 5,091M expected and 4,859M (revised from 5,431M) in April. Exports fell by 2.7% MoM, while Imports increased by 3.8% MoM.

However, the S&P Global Australia Composite Purchasing Managers’ Index (PMI) rose to 51.6 in June, from the 50.5 reported in May. The reading has marked a ninth successive month of growth and the fastest pace since March. Meanwhile, Services PMI rose to 51.8 from 50.6 prior, indicating the fastest pace of expansion since May 2024.

Australian Dollar PRICE Today

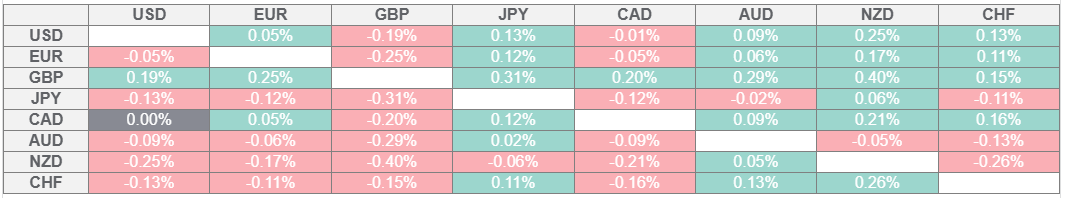

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.