US Dollar Index treads water above 98.00 ahead of Nonfarm Payrolls

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

The US Dollar Index moves little as traders adopt caution ahead of US Nonfarm Payrolls.

The US Nonfarm Payrolls are expected to rise by about 75,000 in August, while the Unemployment Rate is projected at 4.3%.

The CME FedWatch Tool shows markets pricing in over a 99% probability of a 25-basis-point Fed rate cut in September.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, is trading around 98.10 during the early European hours on Friday after recovering recent gains from the previous session.

Traders are awaiting further labor market data on Friday that could shape the US Federal Reserve’s (Fed) policy decision in September. Economists project US Nonfarm Payrolls to add about 75,000 jobs in August, while the Unemployment Rate is seen at 4.3%. Any softer data would boost the odds of a Federal Reserve rate cut in September.

The Greenback faces challenges amid rising odds of a US Federal Reserve (Fed) interest rate cut in September, driven by softer-than-expected United States (US) job data. Markets are pricing in more than 99% of a 25-basis-point (bps) rate cut by the Fed at the September policy meeting, up from 87% a week ago, according to the CME FedWatch tool

The US Initial Jobless Claims rose to 237K for the week ending August 30, against the previous reading of 229K. This figure came in above the market consensus of 230K. Meanwhile, ADP Employment Change showed that employment rose by 54,000 in August, which came in below the expectation of 65K. This reading followed a 106K (revised from 104K) increase recorded in July.

Federal Reserve Bank of Chicago President Austan Goolsbee said early Friday that the US labor market might be deteriorating, adding that there is a bit of wait-and-see because of uncertainty. On Thursday, New York Fed President John Williams warned that although he expects Fed interest rates to continue declining at a slow pace, the US central bank has to carefully balance supporting the jobs market with interest rate cuts.

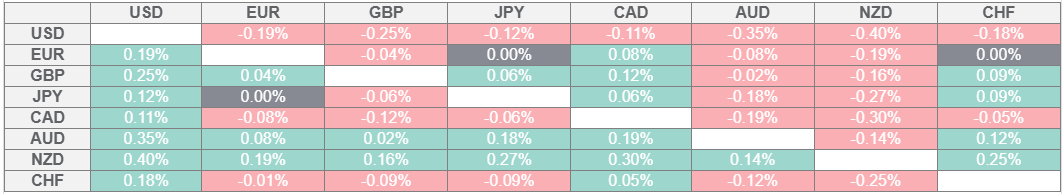

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.