US Dollar Index hovers around 100.00, nine-week highs ahead of Nonfarm Payrolls

- Silver Price Forecast: XAG/USD surges to record high above $56 amid bullish momentum

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- U.S. PCE and 'Mini Jobs' Data in Focus as Salesforce (CRM) and Snowflake (SNOW) Report Earnings 【The week ahead】

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

US Dollar Index maintains its position near a nine-week high of 100.14, marked on Friday.

The US Dollar advanced after the PCE report indicated that the Fed may delay rate cuts until at least October.

President Trump imposed new tariffs ranging from 10% to 41%, set to go into effect on August 1.

The US Dollar Index (DXY), which measures the value of the US Dollar (USD) against six major currencies, remains stronger for the seventh successive day and is trading around 100.00 during the Asian hours on Friday.

The Greenback surged as the US Personal Consumption Expenditure (PCE) Price Index report suggested that price pressures would increase in the second half of 2025 and delay the US Federal Reserve’s (Fed) interest rate cuts until at least October. Traders await the United States (US) Nonfarm Payrolls (NFP), due later in the North American session, which is expected to hold in positive territory in July.

However, the market sentiment remained cautious after US President Donald Trump imposed higher tariff rates on US trading partners set to go into effect on August 1. On Thursday, Trump signed an executive order imposing tariffs ranging from 10% to 41% on US imports from dozens of countries and foreign locations, including Canada, India, and Taiwan, that failed to reach trade deals deadline, per Reuters.

The US Bureau of Economic Analysis reported on Thursday that Core US Personal Consumption Expenditure Price Index (PCE) inflation ticked higher in June, rising 0.3% MoM as many market participants had expected. On an annualized basis, PCE inflation accelerated to 2.6% YoY, outrunning the expected hold at 2.5%.

The US Department of Labour (DOL) released Initial Jobless Claims, the number of US citizens submitting new applications for unemployment insurance, which rose to 218K for the week ending July 26. The latest print fell short of initial estimates (224K), while last week’s prints stood at 217K.

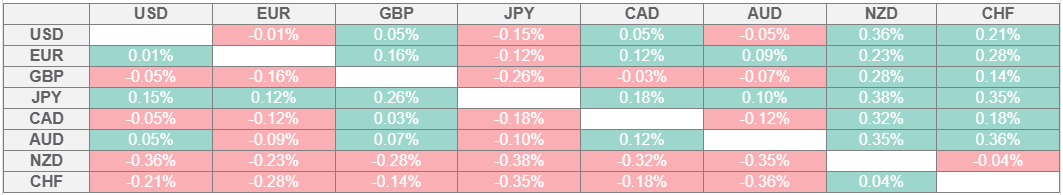

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.